Forming a Limited Liability Company (LLC) in the United States might be the best option for Dubai-based entrepreneurs and business owners trying to broaden their horizons.

Access to a large consumer market, brand credibility, and an overall positive business environment are just some of the many reasons the U.S. is a desirable place for setting up a business.

The cherry on top is that you don’t even have to be a resident or citizen of the U.S.!

In this article, we’ll provide detailed guidance on how to start an LLC in the USA from Dubai.

Reasons To Start A U.S. LLC Based In Dubai

It’s essential to note how beneficial forming a U.S. LLC is for businessmen in Dubai:

- Increased trust from international clients. A U.S. identity increases credibility on a global scale.

- Access to major platforms such as Stripe, PayPal, Amazon, and U.S. banks that require a business registered in the U.S.

- An enormous market of American consumers increases revenue streams.

- Personal assets are protected against business debts, lawsuits, or any financial troubles due to limited liability protection.

- Potentially no U.S. taxes if structured properly. Pass-through taxation offers considerable tax benefits.

Step 1: Choose the LLC Formation State Strategy

The first step is deciding the most favorable state for registering your LLC. Every US state has its own set of regulations, expenses, and even protocols when it comes to privacy.

Given that you are a non-resident forming an LLC from Dubai, it is highly unlikely you will be operating physically in any US state. Therefore, you can select any state that is a non-resident, business-friendly.

Best Options For Entrepreneurs From Dubai:

Delaware: known to have the best business laws with few requirements, no income tax outside the state, and minimal restrictions, it is a Wilmington, Delaware-based entrepreneur’s dream.

Wyoming: great for digital entrepreneurs as privacy is strictly observed, with low filing costs and maintenance fees, it provides them with all.

New Mexico: has no annual reporting requirements while granting ownership anonymously at an affordable rate.

Step 2: Select a Unique, Legal, and Brandable Business Name

Every US state verifies if your LLC operates under a name that is distinguishable from the existing entities within the same territory. As such, your chosen name should include the following core components:

- Include “LLC”, “L.L.C.,” or “Limited Liability Company”

- Avoid restricted words (like “Bank,” “Insurance,” or “Corporation”)

- Avoid misleading or deceptive terms

- Be available in your chosen state (check via the Secretary of State website)

Working with a formation service makes name validation quick and stress-free.

Step 3: You need to appoint a Registered Agent based in the US.

Every Limited Liability Company, LLC operating within the US is required to have a registered agent up which is a person or business entity based in the same state where the LLC is formed and can receive legal and official communication on your behalf.

- An agent’s responsibilities include the following:

- They must have a physical address within the state of formation and not a P.O. box

- They are required to be open during business hours and are required to accept tax returns, legal documents, and other official documents from the government

EasyFiling offers professional registered agent services for all fifty states.

Step 4: File the Articles of Organization

At this step, you should complete your company structure by adding the company name and registered agent to eliminate the initial step in the process.

The following information needs to be included in this document:

- The official name of the LLC

- The address of the Executive branch

- In some states, the purpose of conducting business can also be included

- The name and address of the registered agent

- name and address of the manager or the members operating

Filings can be completed personally through the official easyfiling website or trusted partners.

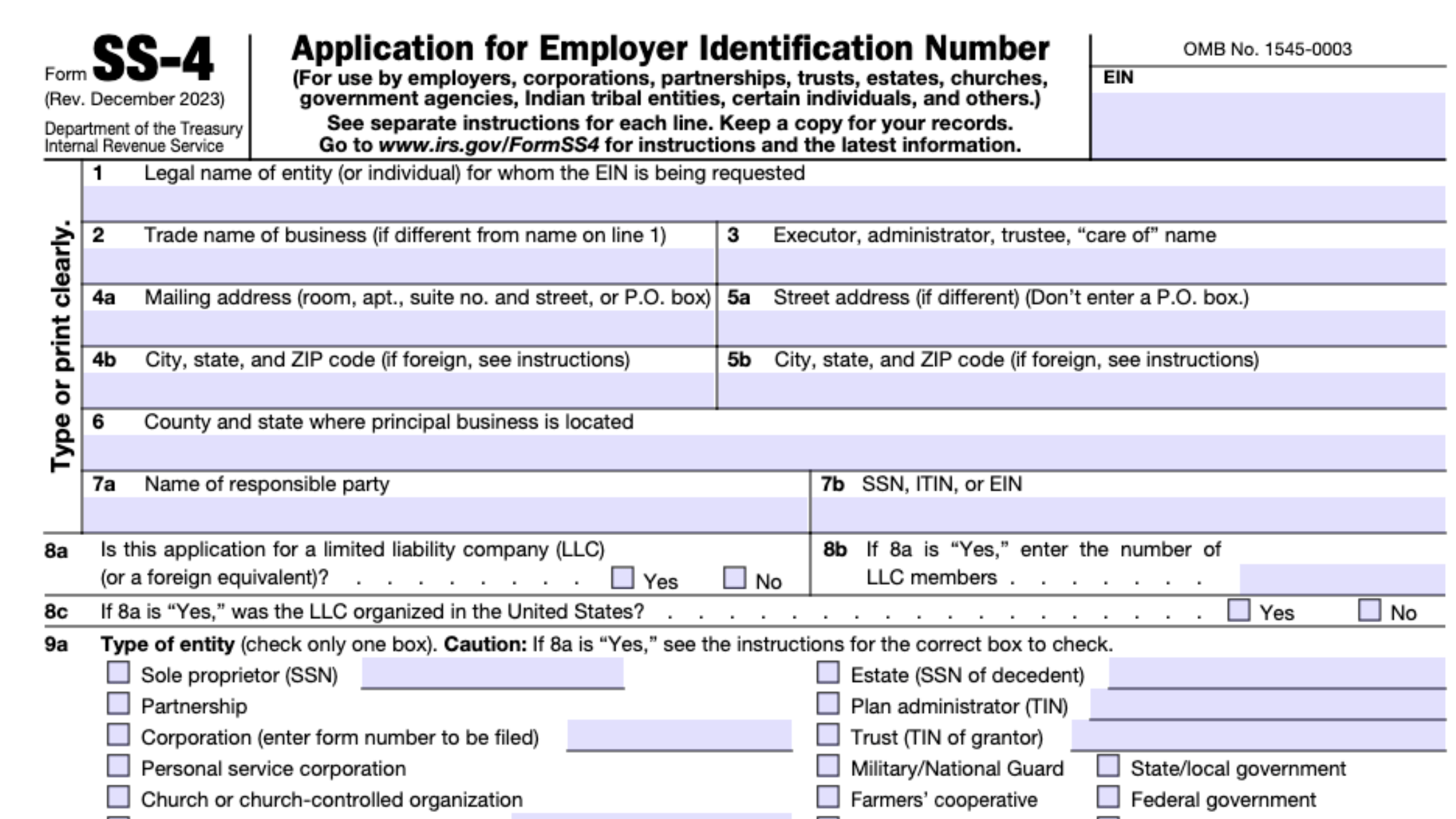

Step 5: Apply for an EIN

Your EIN (or Federal Tax ID for some people) is a requirement to:

- Open a U.S. business bank account

- File taxes, pay them, and hire employees

- Apply for business licenses

- Sign up for Stripe, PayPal, Amazon Seller accounts, and other online services

As a foreign applicant from Dubai, you can apply for an EIN with no Social Security Number (SSN) by submitting IRS Form SS-4 via fax or mail. You can also hire EasyFiling to obtain your EIN much faster.

Step 6: Create a Legally Binding LLC Operating Agreement

“Operating Agreement” carries the most practical legal meaning for your LLC, as it acts as a founding document. For multi-member LLCs, it proves highly beneficial and is highly recommended for single-member LLCs as well.

It outlines:

- Ownership of a percentage of the company

- Voting rights and responsibilities

- Profit and loss distribution

- Rules for adding/removing members

- Procedures for dissolution

Opening a business bank account requires this document in a lot of places. EasyFiling can make a customizable Operating Agreement for you.

Step 7: Open a U.S. Business Bank Account

Accepting payments from U.S. clients, along with utilizing a broader range of important financial instruments, becomes easier with a U.S. business bank account. It also enhanced trust and legitimacy.

Options available for non-resident account holders comprise:

- Mercury: Tailored to founders and international entrepreneurs, done completely online.

- Brex: Great for tech businesses, equipped with expense management tools.

- Wise (formerly TransferWise): Allows users to maintain multi-currency accounts as well as receive USD.

Prerequisites:

- Articles of Organization

- EIN confirmation letter

- Operating Agreement

- Passport and proof of address in Dubai

Step 8: Complying with Legal and Tax Filing Requirements

Your responsibilities do not stop after forming your LLC. To remain in compliance, you’ll need to adhere to the following requirements each year to avoid incurring penalties or dissolution:

- Annual reports (most states will require this)

- Franchise Taxes (varies by state)

- IRS submissions, which include filing Form 5472 for single-member foreign-owned LLCs

- Appropriate financial recordkeeping and bookkeeping

- Registered Agent renewals. You must renew annually.

Non-compliance can lead to fines, losing standing, or even having your LLC terminated.

How EasyFiling Lets Dubai Entrepreneurs Instantly and Cost-Effectively Set Up a U.S. LLC

We specialize in forming and managing a U.S. LLC from Dubai. EasyFiling, Your.

✅ Your registered agent with a business address in the USA

✅ Complete LLC formation service throughout America

✅ Mailbox & mail forwarding service (optional)

✅ EIN application processed without an SSN

✅ U.S. bank account assistance (Mercury, Brex, Wise)

✅ Postage stamp 5472 filing and compliance management service

✅ Easy and reasonable packages for new enterprises and small firms

Even Without a Social Security Number or Address in the United States, EasyFiling Enables You to Launch Your Company Online from Your Home in Dubai.

Conclusion

It’s now easier than it has ever been to start a U.S. LLC from Dubai, especially to help with opening an overseas branch. As long as the business services provider, EasyFiling in this case, is up to par, the whole procedure can be remote, seamless, and legal.

Any entrepreneur ready to step onto a global scale now has the tools at their fingertips, from tech startups to consulting firms and eCommerce brands, to expand internationally by setting up their very own U.S. LLC.

Are you contemplating how to start your U.S. LLC from Dubai effortlessly?

Stop worrying and hand everything over to EasyFiling. They do it all, from the paperwork to the EIN, compliance, and more.

👉 Get started today with EasyFiling to set up your LLC.

Frequently Asked Questions (FAQs)

1. Can a Dubai resident without a visa or citizenship set up a U.S. LLC?

Of course, there’s no restriction preventing non-residents from starting a U.S. LLC. Dubai founders can own and manage an LLC located in the U.S. without traveling there. EasyFiling takes care of every detail, so traveling is optional.

2. Is a US Address Required to Register an LLC or Open a Bank Account?

You don’t need a personal address in the US, but legally, every LLC must have a Registered Agent with a US address. EasyFiling takes care of this for you. We also provide guidance for banking with international-friendly partners such as Mercury and Brex, who work with foreign founders.

3. How Long Does it Take to Form a US LLC from Dubai?

Forming an LLC usually takes 3 to 7 business days with EasyFiling, depending on the state. Obtaining an EIN from the IRS may add a few days. If needed, we have options for faster turnaround times.

4. Do I Need to Pay US Taxes While Running a Business From Dubai?

You wouldn’t incur any US income tax if your LLC does not have US source revenue, doesn’t have a physical presence, or employees based in the US. However, certain forms need to be filed, such as Form 5472 for those who have a single-member, foreign-owned LLC. EasyFiling helps you stay compliant with IRS regulations.

5. What is needed to begin an LLC from Dubai in the United States?

When registering an LLC with EasyFiling, you will usually need:

- A current passport (to confirm identity)

- A proposed name for your business

- An address located in Dubai (for correspondence related to the owner)

- You do not need a Social Security Number to apply for an EIN, we do it on your behalf.

We assist you in every part of the filing process and take care of all forms so you can concentrate on growing your company.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now