I am pretty sure that you have already got some ideas regarding the best state in which to form an LLC for your business. Among 50 states in the United States, Wyoming is one of the best states where millions of young entrepreneurs and business owners start an LLC every year.

So, what are the processes and steps to start an LLC in Wyoming? If this is the question revolving around your head then you have come to the right place as your question is about to be answered.

However, before jumping right into the steps,

Why Start an LLC in Wyoming?

Wyoming as mentioned, is one of the best states to start your LLC, the state provides multiple benefits for your business which other states hardly provide.

Here are the lists of advantages you get after starting your LLC in Wyoming:

1. Asset Protection Laws

Having your LLC formed in Wyoming protects you or other LLC members from being targeted for defaulted loans from other LLC members. Neither, the creditors can seize or acquire any assets.

Similarly, Wyoming LLC provides another benefit of having lifetime proxy laws that allow you to nominate another individual to be a proxy. Other states charge the proxies to be renewed every six to seven years.

2. Low Cost

Starting an LLC in Wyoming helps you by saving lots of money as it provides you with the least maintenance costs in other states. You can also incorporate your business with no minimum fund.

Wyoming charges the lowest fee among the states with around $50 minimum to $200 per every million of assets. Even the low-budget start-up business owner can easily start an LLC in Wyoming.

3. No State Income Tax

One of the most appealing advantages after you start an LLC in Wyoming is that you do not have to pay business taxes at the corporate level. However, you will still have to pay federal taxes and property taxes.

Likewise, in Wyoming, you don’t have to pay any inventory tax, gross receipts tax, franchise tax, excise tax, or per-capita tax. Although you shall pay property taxes, Wyoming seeks the lowest tax in the country.

4. No Citizenship Requirements

Another benefit you get after you start an LLC in Wyoming is that you do not have to be a US citizen or even a resident of Wyoming state. Now, if you are a US citizen it might be helpful as your LLC might require foreign investors, managers, or members involved.

How to start an LLC in Wyoming

1. Name Your Delaware LLC

Naming your LLC is the initial step in the formation process. Additionally, when naming your LLC, various factors must be taken into consideration.

- The LLC name should be unique

- At the end of your LLC Name, you must include, “Limited Liability Company” or “LLC” in short.

- If the name includes any non-English words, you need to translate with your filing.

- The LLC name shall not contain any state names

- The LLC name should be available

2. Hire a Registered Agent

After selecting a name for your LLC, the subsequent step involves engaging the services of a professional registered agent. This agent, whether an individual or business entity, is responsible for processing legal documents on behalf of your LLC.

The registered agent you choose must be a Wyoming resident with a physical street address within the state.

3. File Articles of Organization

Upon obtaining a registered agent, the subsequent step involves filing a Certificate of Formation, also referred to as the “Articles of Organization.” This certificate is crucial for ensuring that the state possesses all necessary information pertaining to your company.

The articles of organization include:

- The name of your LLC

- The name of your registered agent and address

- The name and signature of the person filling the form

If you already own an LLC in another state and are considering registering it in Wyoming, you will need to submit an Articles of Organization for a Foreign Limited Liability Company.

4. Create an LLC Operating Agreement

An operating agreement is a legally binding document that details the specific rules and privileges of each member. It also safeguards personal assets from business liabilities by establishing the LLC as a distinct entity separate from individual possessions.

An operating agreement includes:

- Classes of interest

- Management

- Fiduciary duties

- Profits and distributions

- Transfer of Interest

- Raising money and adding members

- Dissolution

5. Obtain an EIN (Employer Identification Number)

If your limited liability company has multiple members, you must apply for an Employer Identification Number (EIN), also called a Federal Tax ID number. This unique 9-digit number, issued by the IRS (Internal Revenue Service), is necessary for tax obligations and various key business functions like hiring staff, setting up a business bank account, and applying for a business loan.

How to apply for an EIN?

- Apply online through the IRS website where you need to fill up an Internet EIN application (Only Support If you have SSN or ITIN )

- Apply by Fax filling up the Form SS-4. A Fax will be sent back with the EIN within four business days.

- Apply by Mail filling up the Form SS-4. The processing time via mail will take around four weeks.

- Apply by Telephone, international applicants can make a call on 267-941-1099 from (6 am to 11 pm).

How Much Does it Cost to Start an LLC in Wyoming?

Wyoming stands out as one of the most economical states in the U.S. for establishing LLCs, although the fees are structured in multiple tiers.

1. Filing Fee

Wyoming LLC seeks $102 for the filing fee covering the processing of your LLC formation documents. One more advantage is that there is no expedite filing cost in Wyoming. So, with $102 you can complete the process of filing your LLC.

2. Hiring a Registered Agent

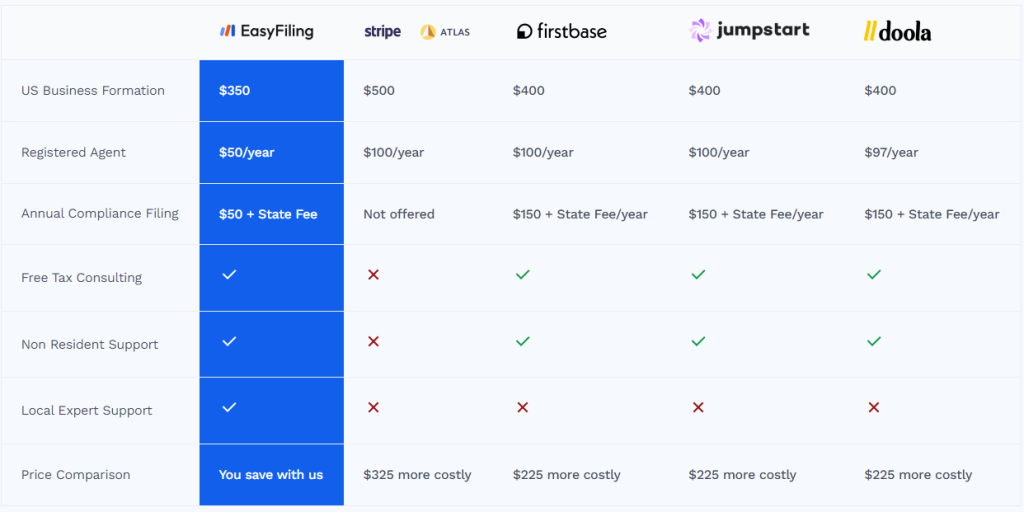

In Wyoming, all LLCs are required to have a registered agent to manage legal filings and tax matters. By using Easyfiling’s services, you can secure a registered agent for just $75 annually.

3. Franchise Tax

Establishing an LLC in Wyoming necessitates a yearly franchise tax fee of only $60, due on June 1st annually. You must pay the tax within 2 months of the company anniversary. Late payments will result in a penalty of $200 plus 1.5% per month.

Connecting with EasyFiling can assist in meeting the deadline and preventing additional charges.

Get the most cost-reliable support with EasyFiling

Conclusion

By following the outlined steps, you can successfully establish an LLC in Wyoming. If you have any questions or encounter difficulties, EasyFiling is available to provide assistance and simplify the process for a seamless and stress-free formation of your Wyoming LLC.

Also read:

How to Start an LLC in Delaware | Step-by-Step Guide

Frequently Asked Questions (FAQs)

Can I Convert My Existing Business to a Wyoming LLC?

Yes, you can convert your existing business to a Wyoming LLC. The process typically involves filing a conversion or domestication document with the Wyoming Secretary of State. You’ll need to meet Wyoming’s requirements for LLC formation and pay any associated fees. It’s also advisable to consult with a legal professional to ensure compliance with both your current state’s laws and Wyoming’s regulations.

Can I Form a Wyoming LLC if I Don’t Live in Wyoming?

Yes, you can form a Wyoming LLC even if you don’t live in Wyoming. Wyoming allows non-residents to establish and operate an LLC within the state. You’ll need to appoint a registered agent with a physical address in Wyoming to receive legal documents on behalf of your LLC.

How long does it take to form an LLC in Wyoming?

Forming an LLC in Wyoming typically takes about 2-3 business days for online filings and 5-7 business days for mail filings. Expedited processing is available for an additional fee.