With the growth of young entrepreneurs and businesses, the formation of LLCs has risen to the sky. Similarly, as Delaware is one of the best states to start an LLC, every entrepreneur is looking the solutions on how to start an LLC in Delaware.

So, if you are one of them, you have come to the right place. After reading this article, you will know all the steps required to start an LLC in Delaware.

Before jumping right into the steps,

Why start an LLC in Delaware?

Delaware as mentioned, is one of the best states to start your LLC, the state provides multiple benefits for your business which other states hardly provide.

Here are the lists of advantages you get after starting your LLC in Delaware:

1. Custom LLC Business Structure and Rules

LLC Business Structure and Rules can be customized as per the needs and preferences of an LLC. The structure and company rules are contained in a contract called the LLC Operating Agreement which is customized by the members of the LLC.

Drafting the business structure and rules is probably the biggest benefit of having an LLC in Delaware.

2. Tax Benefits

Another big reason why most businessmen are eager to start their LLCs in Delaware is due to the tax benefits. With your LLC in Delaware, you don’t have to worry about income tax. However, LLCs have to pay $300 annually for the Delaware LLC franchise tax.

Likewise, you shall be free of sales tax and other intangible income taxes.

3. Protection of Asset against creditors

Having your LLC in Delaware gets your assets protected against creditors. It means that although a member of your LLC has a judgment filed against them, the creditor cannot acquire the asset of the LLC.

4. Low Annual Fees with Simple Maintenance

With Delaware LLC, you can save a lot of money as the state annual fee costs relatively less than other states. Delaware requires an annual Franchise Tax of $300. Similarly, maintenance is easy and simple in Delaware state. Additionally, as per the state law, you shall have a Registered Agent’s service who shall also be paid annually.

5. Privacy

Another big advantage of having your LLC in Delaware is that you get to have privacy as you are not required to disclose any information about the owner of an LLC to the Delaware state. Not every state of the US provides this level of privacy which has become the most likely reason to start an LLC in Delaware.

How to Start an LLC in Delaware?

1. Name Your Delaware LLC

Naming your LLC is the first step in forming an LLC. Also while naming your LLC there are several points that you have to consider.

- The LLC name should be unique

- At the end of your LLC Name, you must include, “Limited Liability Company” or “LLC” in short.

- If the name includes any non-English words, you need to translate with your filing.

- The LLC name shall not contain any state names

- The LLC name should be available

2. Designate a Registered Agent

After naming your LLC, the next step is to hire a professional registered agent who is an individual or business entity and provides services to process the legal documents on your LLC’s behalf.

Also, while hiring a registered agent, the agent should be a Delaware resident who has a physical street address in the state.

3. File Certificate of Formation (Articles of Organization)

After getting a registered agent, the next step is to file a certificate of formation which is commonly known as “articles of organization”. With this certificate, the state will recognize the essential information about your company.

The certificate of formation includes:

- The name of your LLC

- The name of your registered agent and address

- The name and signature of the person filling the form

If you already have an LLC in a different state and planning to register your LLC in Delaware, you have to file a certificate of registration of a foreign limited liability company.

4. Draft an Operating Agreement

An operating agreement is a legally enforceable contract where the specific laws and rights of each member are outlined. The agreement also protects the personal assets from company liabilities defining the LLC as a separate business entity from personal belongings.

An operating agreement includes:

- Classes of interest

- Management

- Fiduciary duties

- Profits and distributions

- Transfer of Interest

- Raising money and adding members

- Dissolution

5. Obtain an Employer Identification Number (EIN)

If your LLC has more than one member then you would be required to obtain an EIN (Employer Identification Number) also known as a Federal Tax ID number. EIN number is provided by the IRS (Internal Revenue Service) which is a 9-digit number used for tax purposes and other essential business activities like hiring employees, opening a business bank account, getting a business loan, etc.

How to apply for an EIN?

- Apply online through the IRS website where you need to fill up an Internet EIN application (Only Support If you have SSN or ITIN )

- Apply by Fax filling up the Form SS-4. A Fax will be sent back with the EIN within four business days.

- Apply by Mail filling up the Form SS-4. The processing time via mail will take around four weeks.

- Apply by Telephone, international applicants can make a call on 267-941-1099 from (6 am to 11 pm).

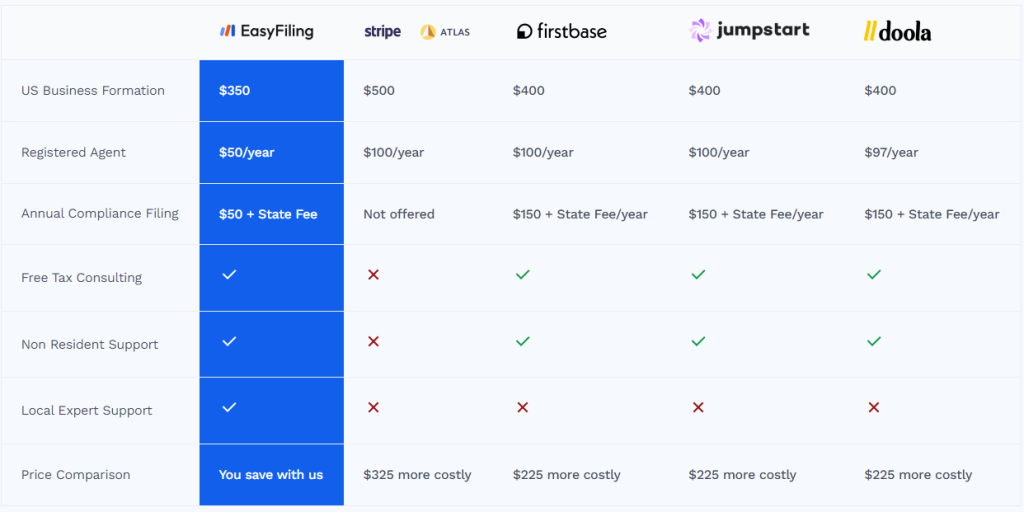

Cost of Forming an LLC in Delaware

Delaware is one of the most cost-effective LLC-forming states in the United States. However, the costing fees break down into several layers.

1. Filing Fee

Delaware seeks $90 for the filing fee which covers the processing of your LLC formation documents. This is a one-time payment while filing your LLC. Delaware has also the expedite filing as below:

Same Day Service

Fee: $200 additional

Processing Time: Same business day if received by 2:00 PM EST.

24-Hour Service

Fee: $100 additional

Processing Time: Within 24 hours of receipt.

2. Hiring a Registered Agent

As per Delaware state law, every LLC requires a registered agent who carries out the process of filing the legal documents and tax on behalf of your LLC. With the collaboration with Easyfiling, the fee for hiring a registered agent is only $75 per year.

3. Franchise Tax

Lastly, forming an LLC in Delaware requires an annual Franchise tax payment of $300. The payment is expected to be paid on the 1st of June of every year. Also, the late payment will be penalized with an additional $200 and an additional 1.5% per month.

Connecting with EasyFiling saves you from crossing the deadline and getting penalized with extra fees.

Get the most cost-reliable support with EasyFiling

Conclusion

Following the above steps shall provide you with an LLC in Delaware. Also, if any confusion, you can always seek support from EasyFiling to streamline the process and have a smooth and hassle-free formation of the LLC in Delaware.

Also read:

How to Start an LLC in Wyoming | Step-by-Step Guide

Frequently Asked Questions (FAQs)

Can I start an LLC in Delaware if I don’t live there?

Yes, you can start an LLC in Delaware even if you don’t live in the state. However, you must designate a registered agent with a physical address in Delaware.

What are the ongoing requirements for a Delaware LLC?

Annual Franchise Tax: File and pay the annual franchise tax by June 1st.

Maintain a Registered Agent: Your LLC must continuously maintain a registered agent in Delaware.

How long does it take to form an LLC in Delaware?

Forming an LLC in Delaware typically takes about 1-2 weeks if you file electronically. However, the process can be expedited for an additional fee, allowing you to complete it in as little as 24 hours.

Can I start a series LLC in Delaware?

Yes, you can start a series LLC in Delaware. Delaware law allows for the formation of series LLCs, which can provide liability protection and operational flexibility for different business ventures under a single LLC umbrella.