Planning to start a business in one of the most potential countries in the world, the United States? Well, no matter whether you are an Indian citizen or a non-US resident from anywhere across the world, Easyfiling will help you get your business registered in the US from your home country.

This guide article will help you find out the steps to form a US LLC from India. Read the complete article and register your US LLC from India with Easyfiling.

Let us guide you through step by step.

1. Choose Your State of Formation

After making up your mind to get started with US LLC, the first step is to choose the state among all the 50 states of the United States of America.

This might be the tricky and confusing part of an overall process. However, we have found you the best and most business-friendly state saving you time going through all the states.

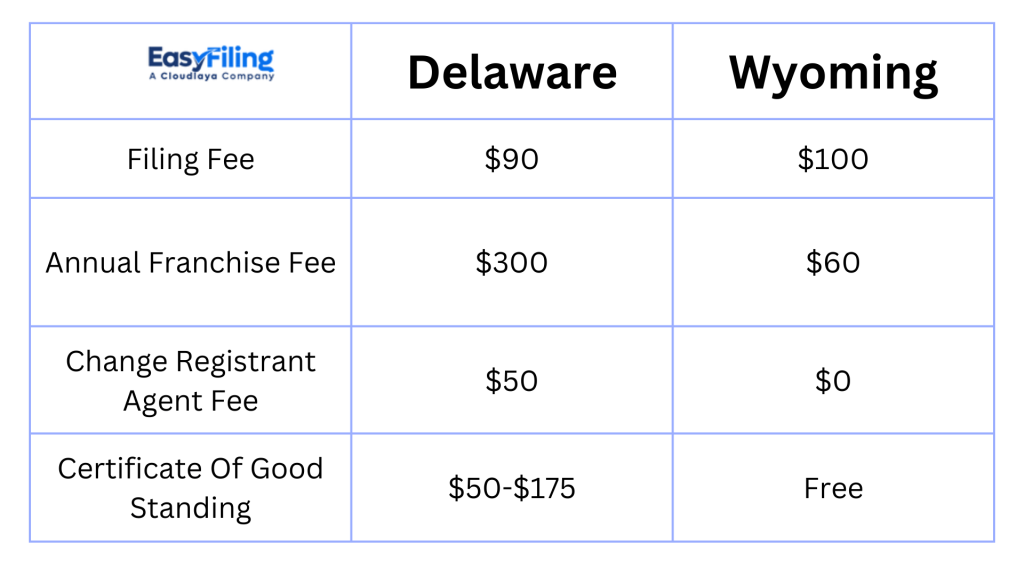

Like most business owners from India and other countries, we recommend you form a US LLC in either Delaware or Wyoming states.

Why Delaware?

- Known for its business-friendly laws and well-established Chancery Court

- Offers strong legal protections for business owners and investors

- Transparent and predictable legal environment

- Higher annual fees and franchise taxes

- Ideal for large corporations with complex structures

Why Wyoming?

- Lower formation and maintenance costs

- No state income tax and low annual fees

- Enhanced privacy protections with minimal disclosure requirements

- Less established legal system compared to Delaware

- Suitable for small to medium-sized businesses seeking affordability and privacy

2. Name Your LLC

Well, after having a state to start your LLC, now you shall choose a business name which should not be a hard part if you have a name in your mind.

However, as per the guidelines of the Secretary of State:

- Your LLC name must include the word “LLC” (Limited Liability Company, company, limited)

- Not to include words that represent government agencies such as the State Department, FBI, etc.

- Do not include anything that falsely implies your business.

- Do not mislead the public with terms that do not match your business purpose.

Tips for naming an LLC

- Search the business name on your selected state’s website

- Make sure the domain name is available

- Avoid names that are similar to other well-recognized companies

3. Appoint a Registered Agent

Well, the next step is to get a registered agent as every Secretary of State requires you to have a registered agent.

A registered agent is an individual or a company designated to process legal documents on behalf of a business entity. A registered agent is a third-party agent who ensures your legal documents are registered with the state and federal government.

As you are a non-US resident, having a registered agent will represent you and your business in the US. Also, if you have friends or family members living in the US state, they can be your registered agent as well.

However, having a professional registered agent keeps you out of trouble and gets your job done easily.

4. File Articles of Organization

To get your LLC reviewed and confirmed, you need to file the Article of Organization to the Secretary of State.

The Articles of Organization represent:

- The Name of your LLC

- Name and address of your registered agent

- Statement of Acceptance by your registered agent

- Purpose of your organization

- Statement of limited liability company

After filing the article, you can submit it on the state’s website. You will receive the filing receipt after a couple of weeks.

Delaware

- Delaware’s state website

- Filing Fee: $90

Wyoming

- Wyoming’s state website

- Filing Fee: $100

5. Create an Operating Agreement

Operating Agreement is a document where you shall set the rules for an LLC. The document is only created after your LLC is approved by the secretary of state.

No matter whether you are a single founder, it is always recommended to create an operating agreement. Although not all the US states demand operating agreements, having the document is a good practice.

Here are things that are included in the operating agreement for the non-US resident:

- Purpose of the LLC

- Membership and Ownership

- Management Structure

- Meetings and Voting

- Distribution of Profits and Losses

- Tax Matters

- Transfer of Membership Interests

- Dissolution and Termination

- Miscellaneous Provisions

6. Obtain an EIN

Obtaining an EIN is an essential part of your LLC formation no matter from which country you are. Firstly, you need to apply for an EIN (Employer Identification Number) which is also known as Federal Tax Identification Number.

How to apply for an EIN?

- Apply online through the IRS website where you need to fill up an Internet EIN application (Only Support If you have SSN or ITIN )

- Apply by Fax filling up the Form SS-4. A Fax will be sent back with the EIN within four business days.

- Apply by Mail filling up the Form SS-4. The processing time via mail will take around four weeks.

- Apply by Telephone, international applicants can make a call on 267-941-1099 from (6 am to 11 pm).

Why do you need EIN?

- To retain an employee or hire one

- To create accounts on PayPal US, Stripe US, and other platforms.

- Identity protection

- Separation of personal and business finances

- Applying for credit and opening business accounts

- Protection of assets from business losses

7. Open a US Business Bank Account

After receiving your EIN, it is now time to open a US business bank account to start making payments, paying taxes and depositing your earnings.

You can also open a US bank account without visiting the US and Visa. How to Open a US Bank Account Without Visiting the US and Visa, read this article to get your US bank account today.

8. LLC Costs

LLC Costs across the United States vary. However, if you plan to form a US LLC either in Delaware or Wyoming, here are the cost differences you will get with Easyfiling.

9: Managing Compliances

Stay informed about state and federal compliance requirements. If you choose to file through a professional service provider such as EasyFiling, we will send you regular reminders about upcoming compliance deadlines. You have two key compliance requirements:

- State Compliance: Renewal of Registered Agent service and filing annual compliance reports with the state.

- Federal Compliance: You are required to submit your tax return to the IRS every year after the end of the fiscal closing month in December.

Conclusion

Follow the steps above or if you need help forming a US company from India or any other country, contact Easyfiling today and have your dream company registered in your dream country.

Frequently Asked Questions (FAQs)

Do I need a US address to form an LLC?

While you don’t need a US address yourself, you will need a registered agent with a physical address in the state where you form the LLC.

How long does it take to form an LLC in the US?

The timeline varies by state. It can take anywhere from a few days to a few weeks for the state to process and approve your LLC formation documents.

What are the costs involved in forming a US LLC?

Costs can vary by state, but generally include:

- State filing fee for the Articles of Organization ($50-$500)

- Registered agent fees ($90-$300 annually)

- Additional fees for services like obtaining an EIN, filing initial reports, etc.

Can I operate my US LLC from India?

Yes, you can operate your US LLC from India. Modern communication tools and outsourcing options make it feasible to manage business operations from overseas.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now