Entrepreneurs and enterprises in the United States can pick from a number of different legal structures when establishing a company. Delaware and Wyoming are two common alternatives. These states have earned a reputation as places where businesses may thrive thanks to the unique opportunities they provide.

In this post, we’ll examine the pros and cons of incorporating your US company in either Delaware or Wyoming and help you make an informed decision.

You should incorporate a limited liability company (LLC) in the state where you live, your employees work, or your business is physically located. Why?

Simply put, you need to register in the jurisdiction where you live or conduct business. If you don’t have a physical location in the United States, however, you can incorporate your LLC in any state. Furthermore, Delaware and Wyoming are unique among the 50 states because of the following:

Three key factors make Delaware and Wyoming attractive for businesses:

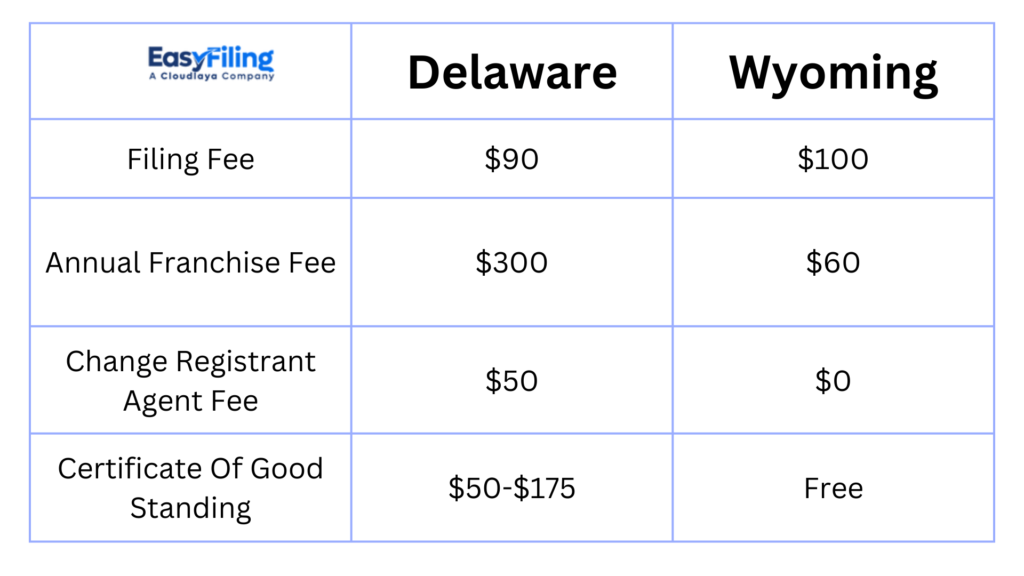

- Robust legal infrastructure: Both Delaware and Wyoming have very favorable legal frameworks for enterprises. Their legal systems and infrastructures are well-established, allowing for streamlined commercial processes.

- No state income taxes: It is possible to avoid paying state income taxes in certain states if your company does not have any operations there. This distinguishes them from states that impose income taxes on businesses regardless of whether or not they have any activities within the state.

- Efficient and competitive processing: States like Delaware and Wyoming compete with one another to bring in new business. They work hard to make it easy for firms to settle in their states. Therefore, they have simplified the law and the procedure for incorporating a firm, making it easier and cheaper to start a company.

What are the advantages of incorporating an LLC in Delaware?

Let’s break them down and talk about them separately. Delaware’s legal system is widely regarded as one of the most business-friendly worldwide. Because of its effectiveness, Delaware law has been used as a template by many other countries.

In addition, disputes are resolved expeditiously in Delaware’s Chancery Court because they are decided by qualified judges rather than juries. Sixty-six percent of Fortune 500 corporations are headquartered in Delaware because of this. It’s possible that a startup company wouldn’t see the need for such stringent regulations.

What benefits come with forming an LLC in Wyoming?

Wyoming, which is renowned for its low taxes and little government intrusion, is on the opposing side. Wyoming is a favorite option for entrepreneurs because of its simple and affordable LLC formation process.

The state provides excellent chances for non-residents by not requiring LLC members to be citizens or residents of the United States. I chose Wyoming because of its favorable tax laws and adaptable business regulations.

The state allows anonymous ownership, which offers some privacy, and has no business income tax or franchise tax.

Expert Insights: Wyoming limited liability companies (LLCs) are a good choice for non-residents and single owners who want to run modest online or e-commerce firms without the need to raise venture funding. Compared to Delaware, Wyoming has cheaper initial and ongoing administrative costs and fewer paperwork requirements.

We at EasyFiling know it might be difficult to settle on a state for your limited liability company. That’s why we’re here: to make sure you have a smooth experience with everything. Whether you decide to incorporate in Delaware or Wyoming, our team of specialists will walk you through the process and make sure it goes as smoothly and quickly as possible.

Visit EasyFiling.us or give us a call today, and let us assist you in making the best choice for your non-resident LLC formation. EasyFiling simplifies the path to your business success.