Incorporation in Delaware is quite popular because of its excellent corporate laws as well as its flexible business structures. Formed Delaware entities, however, have one annual obligation: the payment of the Delaware Annual Franchise Tax. This tax is a levy on corporations and limited liability companies (LLCs), authorizing them to do business in the state.

The guide provides a detailed description of the method of calculating the Delaware Annual Franchise Tax, its payment, and its consequences for the taxpayer. You will find this information useful whether it is your first time setting up a business or you are already managing an entity.

For Corporations (Including C Corporations)

Filing Deadline

Each year, all Delaware corporations, including C Corporations, are required to pay an annual franchise tax that is due on the first of March every year. This deadline ensures that they do not suffer any penalty since it serves to preserve the required levels of corporation compliance with state requirements. This date should be marked on their calendars for company administrators and all necessary documents should be prepared even before the deadline passes.

Who Needs to Submit Filings and Payments?

Every Delaware-incorporated for-profit corporation, regardless of its status of engaging in business or just registered there, is obligated to both file and pay an annual franchise tax. This obligation does not depend on where the business is carried out and even where the business derives earnings. Delaware is very popular as a state of incorporation given its favorable corporate laws and so this is an annual obligation for all.

Calculation Methods

Authorized Shares Method

- This is the default method availed by the states for purposes of computing the franchise tax for corporations.

- It relies on the number of shares the corporation is allowed to issue:

- 1 to 5,000 shares: $175

- 5,001 to 10,000 shares: $250

- Per each additional 10,000 shares or portion thereof: add $85

- Maximum annual tax: $200,000

- This method is disadvantageous especially to companies with huge amounts of authorized shares since this will greatly. influence their tax liability.

Assumed Par Value Capital Method

- This is an alternative that may be applied in case it has a lower tax liability than the Authorized Shares Method.

- The tax rate is based on the assumption that each $400 represents a par value capital of $1 million or part of it:

- The lowest tax is: $400

- The largest tax is $200,000 on all corporations other than Large Corporate Filers.

- This method can make a difference to corporations that have a large number of shares authorized but with lower-than-expected capital par value, hence low tax liability.

Large Corporate Filer

- These are Corporations that have been classified under Large Corporate Filers and have their annual franchise tax value set at $250,000.

- The corporation qualifies as a Large Corporate Filer if it has a class or series of stock registered in a national securities exchange and meets certain specified revenue and asset requirements, which show substantial size and volume of economic activity of the corporation.

Payment and filing charges.

In addition to the total franchise tax, a fee of $50 is also charged for filing. Payments can be done online through an automated clearing house or major credit cards which provide ease in fulfilling this specific requirement.

Estimated Payments

Those corporations having a franchise tax liability of $5000 and above ought to make estimated payments in an active manner observing the following due dates:

- Due on June first – 40 percent

- Due on September first – 20 percent

- Due on December first – 20 percent

- And the final portion till March 1st.

Penalties for Non-Compliance

In the event of failure to submit an effective report, a penalty of $200 is imposed. This stress upon compliance helps clients avoid this strain.

Such payment conditions also render issuances of the Secretary of State of the USA to cease providing a Certificate of Good Standing for any corporation that still has unpaid taxes making it difficult for the corporation to operate legally.

Any corporation that files a report to a taxable jurisdiction and does not comply with the franchise tax payables for over a year shall automatically have its charters canceled meaning they cease to exist as a legal corporation.

For LLCs (Limited Liability Company)

Due Date

Annually, the franchise tax is payable on or before June 1st for Delaware LLCs. This is a more favorable deadline for the LLC because now they can delay as much as possible for them to be able to coordinate and arrange how they will pay for tax obligations.

Filing and Payment

As for payments, they’re made directly to the state of Delaware. The procedure is very simple, and it can be done either online or by postal service. One is a credit card using PayPal which is quite popular another is via ACH debit which is also inclusive of payments made on the area website.

Alternatively, you may make payments through a check which should be addressed to “Delaware Secretary of State” which should be forwarded to the tax notice provided address. This option is still open for those who have not adopted modern payment means.

Fees and Penalties

The taxation of LLCs in Delaware based on the state law and set provisions stipulates that the applicable franchise tax is a flat annual rate of $300. There are certain charges for late payments as there is a late fee of $200 and a penalty of 1.5 percent will be charged for every month the payment is not made which is a clear indication that there is a need to comply.

Additional Information

Using a Registered Agent or Filing Service

To navigate through the various requirements of Registered agents’ specifics and thorough filing respectively, it would help for both Corporations and LLCs to consider a combination of the above two options. This is not obligatory as the activity can be done over the internet, however, some firms may find it useful and a bit of peace of mind.

Consequences of Non-Payment

The deadline has passed, and your business is at risk of administrative dissolution if taxes and penalties remain unpaid for a considerable duration. This consequence indicates the importance of adhering to complying with state tax obligations to protect one’s business reputation and strength.

Filing the Annual Report

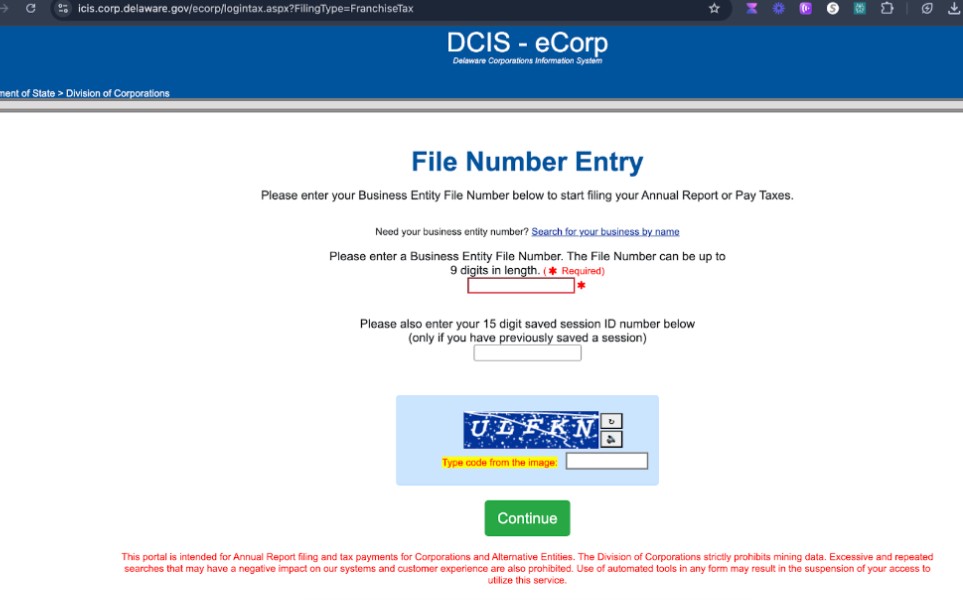

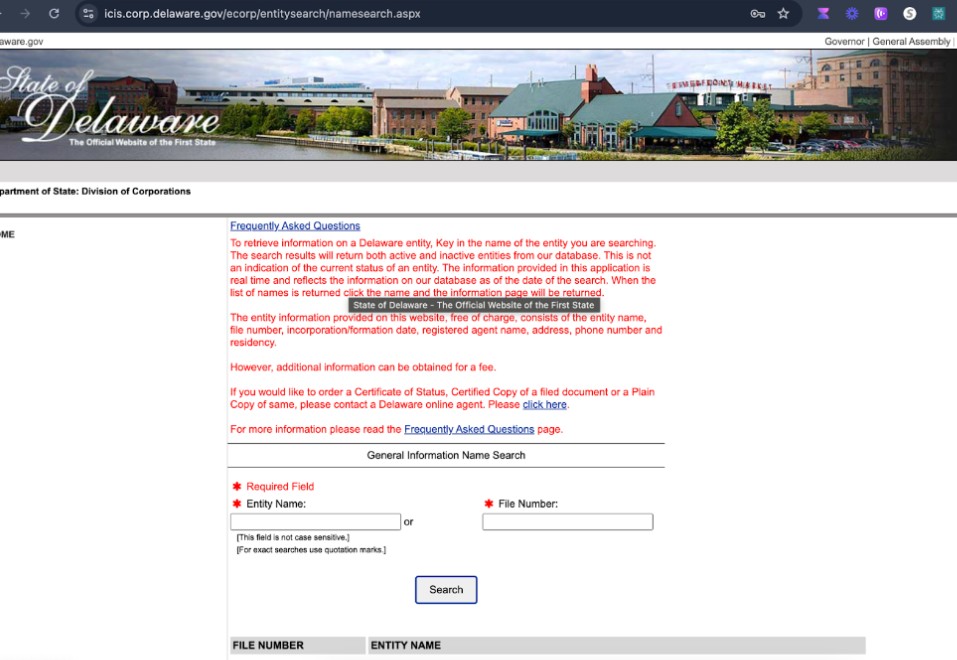

The Annual Franchise Tax Report must be filed online through the Delaware Division of Corporations website at click Here

Enter your Business Entity File Number, which can be found by performing a business name search on the Delaware Secretary of State entity https://icis.corp.delaware.gov/ecorp/entitysearch/namesearch.aspx.

Conclusion

Avoiding any penalties and adverse situations is possible only if Delaware Annual Franchise Tax is paid as it is one of the vital factors in keeping your business’s entity in good standing. These steps must be followed as well as the particulars applicable to your kind of business to avoid any sanctions that may result from non-compliance. End these processes here, as you have the option of getting help from EasyFiling services to eliminate the struggles that come with franchise tax filings.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now