All the upcoming business owners and future entrepreneurs who are planning to start a business in the United States might be aware of the form SS-4 which is essential for a business to represent as a unique business identifying number.

What is Form SS-4?

Form SS-4 is generally used to obtain an Employer Identification Number (EIN) from the IRS. EIN is a nine-digit number provided by the IRS to employers, sole proprietors, corporations, estates trusts, and other entities for tax filing.

If you are a business owner with employees or a sole proprietor with no employees, you have to apply for an EIN for which you need to file an form SS-4.

Purpose of Form SS-4

The major purpose of filing form SS-4 is to apply for an EIN also used as a Social Security Number for business. EIN is used in several business activities like opening a business bank account and paying employment taxes to the government.

Here are a few more reasons to get an EIN:

1. Starting a Business

While starting a business, EIN is required to form a business structure such as a corporation or a partnership. With EIN, businesses have a unique identity and can pay taxes.

2. Hiring Employees

If you are a business owner and want to hire employees then, the IRS requires you to have an EIN for the employment taxes.

3. Opening a Business Bank Account

Another reason to have an EIN is to open a business bank account as traditional banks and online financial institutions require an EIN to open your account.

4. Identity Protection

Having an EIN offers a layer of identity protection for your business no matter the size of your business. EIN keeps your social security number private and hides your personal information in a safe place.

5. Business Taxes

With EIN it is easier to file federal and state taxes. Those who don’t have EIN have to pay through their banking systems. Having an EIN and business bank account benefits tax payments as well.

6. Establish Credit

With EIN, you can also apply for a credit card for your company which can boost your financial investment to the business.

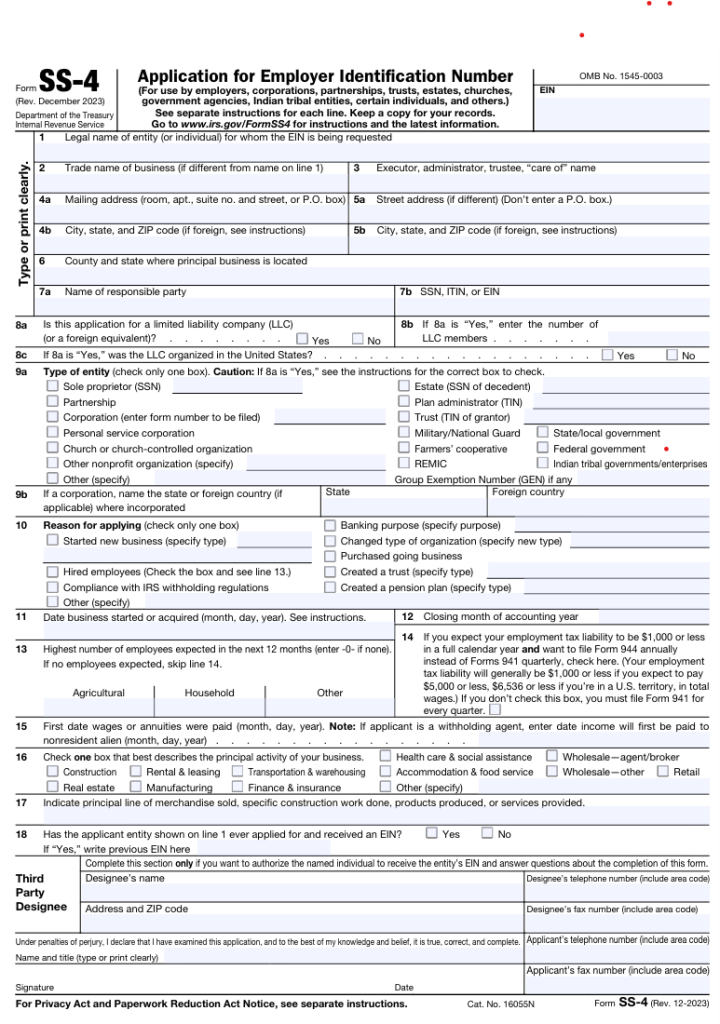

Information Required in Form SS-4

Internal Revenue Service (IRS) requires detailed information regarding your business while filing the SS-4 form. Here are the key elements that you must not miss during filing the form.

- Legal Name and Trade Name

- Executor, Administrator, Trustee Name

- Mailing Address

- County and State where the principal business is located

- Reason for Application

- Third Party Designee

- EIN or Individual tax identification number

- Date of business started or was acquired

- Closing month of the accounting year

- Highest number of expected employees in the next 12 months

- Your business is a corporation, partnership, or LLC.

How to file a Form SS-4

Filing the SS-4 form can be processed via multiple mediums.

- Via IRS website

- Via Fax by filing the SS-4 Form. The fax processing takes around four business days.

- Via Mail by filing SS-4 Form. The mail processing takes around four weeks.

- Via Telephone, international applications can make a call on 267-941-1099 from (6 am to 11 pm).

Also, if you want any kind of support while filing an SS-4 form for obtaining EIN, you can always connect with EasyFiling for your smooth process.

Who needs the Form SS-4?

The SS-4 form is mainly needed by individuals or entities to obtain an Employer Identification Number (EIN) from the IRS.

Well, here are the lists of who may need the SS-4 form:

- Individuals starting a business on their own

- Business partnerships or companies forming a new entity

- Non-profit organizations seeking tax-exempt status

- Trusts or estates in need of an EIN

Frequently Asked Questions (FAQs)

Can I file the SS-4 form online?

Yes, you can file an SS-4 form online via the IRS website. The process is simple and quick where you have to fill an EIN form. Also, applying online gets you an Employer Identification Number (EIN) immediately after completing the SS-4 form.

Is there a filing fee for the SS-4 form?

No, filing the SS-4 form is completely free of cost. You can simply access the form on the IRS website, fill out the form, and obtain the EIN.

How to get a copy of SS-4 online?

After completing the SS-4 form online, you can simply request the form on the IRS website without physically visiting the location.

If you want the copy by fax, you can request that the IRS provide the information they seek for faxing the completed form.