In today’s digital era, online payments are integral to both big and small businesses. The Stripe payment platform has transformed how companies receive money, making it easier to accept payments. With more competitors on the market, there are now various alternatives to Stripe that offer additional functionality.

This article will examine the top 7 best alternatives to Stripe in 2024 by providing a comprehensive overview of their main features, pricing models, and target audience. This guide is ideal for anyone who wants a payment processing solution that matches their requirements, whether an experienced entrepreneur or just starting in e-commerce.

Here are the lists of the Top 7 best stripe alternatives in 2024:

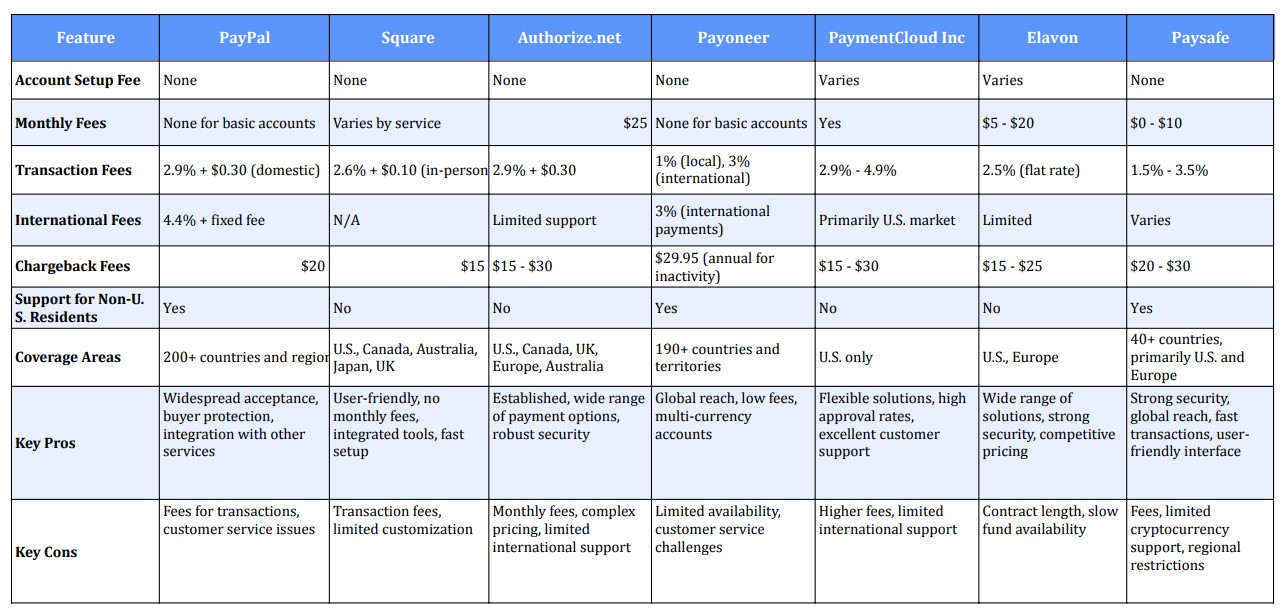

Comparison of Top 7 Stripe Alternatives in 2024

1. Paypal (est: 1998)

PayPal is widely used as a convenient means for transacting funds online by individuals and businesses alike. It enables internet-based payments for goods, services bought online and even transfer of money electronically without making use of paper money or any other method that does not involve cash.

Users can simply connect their PayPal accounts with their bank accounts, credit cards, or debit cards to make smooth payments. PayPal also offers such services as buyer protection and fraud prevention which makes it very efficient and secure for global financial transactions.

Paypal Users in 2024

236.7 Million Users – Continuing Growth (2024)

The forecasted numbers for 2024 show an increase of about six percent bringing PayPal users up to 236.7 million people.

Paypal fees

Account setup: No fees when creating a PayPal account.

Domestic transaction charges: Usually around 2.9% + $0.30 per transaction.

Foreign transaction charges: A flat fee plus 4.4% when converting foreign currencies.

Currency conversion charge: An extra three to four percent of the prevailing exchange rate charged above its base price.

Withdrawal expenses: Varies by method (e.g., bank transfer is usually free; instant transfer to debit card may incur a fee).

Chargeback fee: $20 for each chargeback initiated by a buyer.

Pros:

Global Acceptance: It is possible to shop online with PayPal because millions of vendors globally accept it.

User-Friendly Interface: Even people who are not technical can easily navigate this platform.

Sophisticated Security Features: There are advanced security features put in place by PayPal to protect the financial information of its users.

Instant Transfers: Users can send and receive money instantly making transactions convenient.

Buyer Protection: PayPal has buyer protection policies that resolve disputes and unauthorized transaction cases.

Integration with Other Services: Various e-commerce platforms and apps work well with PayPal thus helping to make it more user-friendly.

Cons:

Transaction Charges: Pay Pal levies fees on some transactions like currency exchange as well as payments made by businesses.

Account Limitations: Some accounts have limits or are held, especially if there is concern over unusual activity occurring on them.

Customer Service Problems: Users have faced difficulties getting their customer service representatives to respond quickly enough or solve their problems satisfactorily and promptly.

2. Square (est: 2009)

Square is a payment app for businesses and individuals that makes doing business easy. It is suitable for small businesses and freelancers since they can send, and receive money quickly, and securely. With POS systems, invoices, and online payment solutions, Square can streamline payments.

The application offers users valuable analytics and tools that help them better manage their finances. In short, Square allows people to transact more efficiently in today’s digital economy.

Square Users in 2024

Continuing Growth: 4+ Million Users (2024)

Square Fees

Creating an Account:

- No setup charges when creating an account.

- Monthly subscription charges may apply for specific services (e.g., Square for Restaurants, Square for Retail).

Transaction Fees:

- In-person payments: 2.6% “+” 10¢ per transaction.

- Online payments: 2.9% “+” 30¢ per transaction.

Invoices: 2.9% “+” 30¢ per transaction.

Virtual Terminal: 3.5% “+” 15¢ per transaction.

Additional Fees:

- Chargeback fee: $15 for disputed transactions

- Instant deposit fee: 1.5% to have funds available immediately.

Always visit Square’s official website for the most current rates and any changes.

Pros and Cons of Square in 2024

Pros:

A User-Friendly Interface: This makes it easy for users to navigate through the system. It saves time during transactions.

Comprehensive Payment Solutions: Different types of businesses, use different kinds of payments like mobile, online, and those that are done physically.

Integrated Tools: Sell out your merchandise in inventory management, sales analysis tools as well as customer relationship management amongst others thus making your business operations easier.

No Monthly Fees: The service charges for what you only use because no monthly fees are charged which is favorable to companies with irregular profits or start-ups.

Fast Setup and Deployment: With the help of this tool, businesses can get started quickly without wasting their precious time waiting for money transfer services.

Cons:

Transaction Fees: However, it should be noted that a commission fee is paid by a seller for each deal. It becomes very expensive when you have many sales every month.

Limited Customization: Others may argue that compared to other payment options, the square offers less customization- a disadvantage especially when dealing with specific needs in business management.

Customer Support Issues: Here the clients complained about poor response time from customer support agents; it is important to make sure such things do not happen again on our watch.

3. Authorize.net (est: 1996)

The platform enables businesses to accept credit card payments and eChecks via both websites and applications. Fraud protection measures have been put in place enabling secure payment processing alongside recurrent billing and subscription management tools provided by this company.

Authorize.net simplifies the payment process for businesses with features like a user-friendly interface, customizable payment forms, and integration with several shopping carts and platforms aimed at improving customer experience. Due to several payment methods used by Authorize.net, merchants’ flexibility has increased significantly since buyers’ demands have become more varied than ever before.

Authorize.net Users in 2024

2024: 430k Users – Still Growing

Authorize.net Fees

- Setup Fee – $0

- Monthly renewal fee – $25

- Processing rates per transaction – 2.9% + 30¢

Pros and Cons of Authorize.net

Pros:

Well-known Reputation: This has been a payment gateway for a long thereby providing reliability.

Wide Range of Payment Options: It caters to the needs of various customers including electronic wallets, debit cards, credit cards, and e-checks.

Robust Security Features: Transactions made through this platform are secured by advanced fraud detection tools as well as PCI compliance.

User-Friendly Interface: This is simple for sellers to understand hence it becomes easier for them to use credit card processing systems online or on their business premises.

Integration Capabilities: For example, it allows several applications from different e-commerce platforms; this feature has made it widely accepted.

Cons:

Monthly Fees: However, some people may be discouraged by the fact that there is a monthly fee required every month, which may not be good news especially if you are running a business with low demand volumes.

Complex Pricing Structure: Different fees such as transaction costs among others make it difficult for users to budget since they do not know how much they will spend on the system.

4. Payoneer (est: 2005)

Payoneer came into existence in two thousand and five. It was created to offer online money transfer and digital payment solutions. This has made it a preferred choice among freelancers, e-commerce merchants, and businesses that need international payments.

The company also provides various services such as multi-currency accounts, payment processing, and withdrawal options. Users can get paid in multiple currencies that can be converted into their local bank accounts for withdrawals. Furthermore, Payoneer gives out prepaid MasterCard which could be used to make purchases or withdraw money at an ATM.

Payoneer Users in 2024

2024: 5+ Million Users – Continuing Growth

Payoneer Fees

- Account formation fee: $0 (no initial fee for account setup)

- Monthly maintenance fee: $0 (no monthly fees for basic accounts)

Foreign currency conversion fee: 2 percent above the mid-market exchange rate.

Withdrawal fees:

- Wire transfer: $1.50 per transaction

- Check withdrawal: $5 per check

Costs of transactions:

- Receiving payments: 1% for local and 3% for foreign payments

Annual fee for inactive accounts: $29.95 (if there is no activity on the account in 12 months)

Pros and Cons of Payoneer in 2024

Pros:

Worldwide Coverage: With Payoneer, you can make or receive payments in many currencies, which is good for freelancers or companies that have clients in various countries.

Low Charges: In most cases, Payoneer takes lower fees than banks do while making cross-border transfers; thus, it is considered an economical method.

Quick Access to Finances: It allows users to either withdraw money from their account to a personal bank account or use the prepaid Mastercard offered by the organization to spend funds; this way one has freedom of choice as regards cash availability.

Multiple Currency Accounts: By offering one place where different currencies can be held and managed, even international financial operations are simplified.

Marketplace Integration: It also collaborates with such online platforms as Amazon, Upwork, and Fiverr among others thus simplifying payment methods used by sellers and freelancers.

Cons:

Limited Availability: Payoneer has not yet covered all over the world which restricts some people from using it.

Customer Service Problems: Sometimes customer care delays are experienced when customers need help with their accounts because it takes too long to complete queries.

Account Verification Procedure: For newbies who have just joined it may be frustrating having to go through so much verification process including submitting lots of documentation.

5. Paymentcloud Inc (est: 2016)

PaymentCloud Inc. began operations in 2016 as a payment processing firm. The company offers merchant services customized for high-risk businesses such as subscription services, e-commerce, and various niche markets. Some of the products that PaymentCloud deals in include credit card processing, virtual terminals, and payment gateways among others.

As a result, customers should expect excellent support services as well as tailor-made solutions that will help their businesses overcome payment process bottlenecks and improve overall efficiency. Consequently, PaymentCloud is constantly upgrading its products to fit into modern-day merchant needs while maintaining customer satisfaction.

Fees Charged by Paymentcloud Inc

What are some of the existing charges associated with Paymentcloud Inc?

Account Setup Fee: Once-off fee for the creation of a merchant account.

Monthly Fee: Fees are charged monthly to maintain an account.

Transaction Fees: A certain percentage of each transaction carried out typically ranging between 2.9% and 4.9%.

Chargeback Fees: Charges on every chargeback made usually at about $15 to $30.

Gateway Fees: Regular fees involving payment gateway use are either charged per month or per transaction.

PCI Compliance Fee: Annual compliance fee based on PCI standards being met.

Return Item Fee: Charges linked to returned checks or insufficient funds in an account.

For the most accurate and up-to-date fee structures, please contact PaymentCloud directly.

Pros and Cons of PaymentCloud Inc. in 2024

Pros:

Flexible Payments Software: With different payment options available through this agency, companies can choose between these options when considering e-commerce activities versus point-of-sale transactions.

High Approval Rates: This Company achieves high success rates in approving merchant accounts thereby enabling firms across all levels of creditworthiness to access instant online payment facilities.

Great Customer Support Team: They offer dedicated customer service staff who ensure business gets any help it urgently needs hence making it easy to address problems quickly.

Security Features Provided by Paymenrcloud Inc.: The system has employed advanced detection technology which keeps them on the leading edge of fraud detection and in compliance with the PCI DSS thereby protecting customers’ sensitive information.

Cons:

Fees and Costs: Some users have reported that PaymentCloud’s fees can be higher than those of competitors, which might be a concern for small businesses or startups.

Limited International Support: PaymentCloud primarily serves the U.S. market, which may limit options for businesses looking to expand internationally.

Contract Length: Some merchants have found the contract terms to be lengthy or restrictive, which can make it difficult to switch providers if needed.

6. Elavon (est: 1991)

Elavon, established in 1991, is a worldwide payment processing firm. Elavon originally emerged as a spinoff from U.S Bancorp but has grown to be a major player in the industry of payment solutions. The company has a variety of products and services such as credit and debit card processing, mobile payments, and integrated payments tailored for different businesses.

Elavon serves both small and large enterprises in various sectors by providing tools and services that facilitate safe and efficient transactions. Over the years, Elavon has expanded its operations globally through establishing presence in many countries strengthening its position in this area.

Elavon Fees:

Account Setup Fee: It varies by plan; normally it is a one-time charge.

Monthly Service Fee: Account maintenance charges that often range between $5 to $20 per month.

Transaction Fees:

- Flat Rate: This is a fixed rate per transaction (e.g., 2.5%).

- Interchange Plus: A variable fee based on card type and transaction volume.

- Chargeback Fee: Generally around $15 to $25, applied for any chargebacks received.

- PCI Compliance Fee: An annual fee to maintain PCI compliance which usually goes for about $100.

- Equipment Fees: If applicable, costs associated with payment processing hardware.

- Annual Fee: Some plans may charge an annual maintenance fee.

(Note: Business type, transaction volume, etc., may cause fees to vary.)

Pros and Cons of Elavon in 2024

Pros:

Wide Range of Payment Solutions: Elavon has different types of payment processing options including mobile solutions as well as online payments for different business demands

Strong Security Features: They have advanced security measures i.e. EMV technology plus PCI compliance that safeguard customers from threats online when they transact using their system

User-Friendly Interface: They are designed to be easily navigated platforms that help businesses manage transactions conveniently

Excellent Customer Support: Elavon is reputed as the most trustful and reliable customer care team that can assist those doing business with them with any problem

Cons:

Contract Length and Fees: According to some users, Elavon has long contracts that come with penalties for cancellation creating a disadvantageous situation for firms

Slow Fund Availability: There are complaints regarding the time it takes for funds to be deposited into accounts, which can affect cash flow for some businesses.

Limited Integrations: Although PaySafe offers many services, certain customers have found that its third-party software and platform integrations are limited.

7. Paysafe (est: 1996)

Paysafe was founded in 1996 as a global provider of payment solutions such as internet-based payments, digital wallets, and prepaid cards. The company allows individuals and enterprises to conduct secure transactions on different platforms thus increasing the flexibility and convenience of online payments.

Paysafe Fees

Account Creation Fee: No fee is charged when you create a Paysafe account.

Monthly Maintenance Fee: Varies with the type of account usually from $0 to $10 per month.

Transaction Fees:

- Deposit Fees: Usually free on bank transfers. However, deposits made by credit/debit cards may attract charges ranging between 1.5% and 3.5%.

- Withdrawal Fees: They typically range between $5 to $10 depending on the withdrawal method used.

- Currency Conversion Fee: For currency conversions, this ranges from about 3% up to 5%.

- Inactivity Fee: Usually around $5 per month after being inactive for twelve months.

- Chargeback Fee: Often they hover around $20-$30 each time.

(Note: Specific services and regions determine the amount charged. For the most accurate and up-to-date information, refer to Paysafe’s official website.)

Pros and Cons of Paysafe in 2024

Pros:

Security and Privacy: This ensures that people’s personal information and transactions are safe from attacks due to strong security measures such as encryption and fraud protection.

Multiple Payment Options: Users have different payment methods from which they can select; this includes e-wallets, prepaid cards, and direct bank transfers for increased flexibility and convenience.

Global Reach: It is a viable option for international business because it can be accepted in many countries with different currencies.

Fast Transactions: Paysafe transactions are generally dealt with fast, therefore enabling timely payments and remittance of funds.

User-Friendly Interface: It is a user-friendly platform that has been designed in such a way that it is easy for users to navigate and complete their transactions.

Cons:

Fees: In line with some transactions, Paysafe does charge fees that may accumulate especially if the person uses it frequently or for business purposes.

Limited Cryptocurrency Support: The availability of cryptos on the Paysafecard system still lags behind other online payment platforms; something that crypto enthusiasts may find unattractive in these systems.

Regional Restrictions: Not all features or services will be accessible to all countries hence making such regions limited to certain categories of users.

Conclusion

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now