Are you ready to finally achieve your dreams of being your boss in Maryland, the beautiful Free State?

For many budding entrepreneurs, establishing a Limited Liability Company (LLC) makes perfect sense. One can find in Maryland a combination of natural beauty, historical richness, and a vibrant economy that is so fertile for entrepreneurship.

Though it’s not everything before stepping into business matters, let us look at the advantages of an LLC and how it can be formed in Maryland.

Step 1: Name Your LLC

The name of your LLC is important as it represents your brand and image to the public eye. The name of your business entity should be such that it can be distinguished from other businesses registered with the state. Look online at Maryland Business Express to see if anyone is already using what you’ve chosen.

Tips:

Include “LLC”: Remember this status when formulating the wordage for its title; include either “Limited Liability Company” or rather “LLC.”

Don’t use restricted words: There are terms like bank or insurance that need authorization from relevant authorities before they are utilized/employed by any other company with different names instead.

Domain Name Check: When making plans to have an online presence, you must check if your preferred website domain name is available to maintain a consistent brand image.

Step 2: Appoint a Registered Agent

A registered agent is a person or business that you designate to receive important paperwork for your LLC. This would include such things as service of process, tax notices, and other official mailings. In Maryland, your registered agent can be either an individual who resides in the state or a business entity authorized to do business in Maryland.

Registered Agent Requirements:

Physical Address: Your registered agent should have a physical street address in Maryland; P.O. boxes are not allowed.

Availability: The registered agent has to be available during regular office hours to ensure the timely delivery of critical documents.

Step 3: File Articles of Organization

To formally set up your LLC, you need to file Articles of Organization with the Maryland Department of Assessments and Taxation (SDAT). This is how you officially register your LLC with the state.

Here’s What You’ll Need:

LLC Name: The name that will be used by your limited liability company (LLC).

Principal Office Address: Where the main business location is situated

Registered Agent’s Information: Name and address of registered agent.

Duration: The life span of the Limited Liability Company (LLC) can be left open but it is commonly specified.

Purpose: It is also optional to specify the activities that the company will engage in.

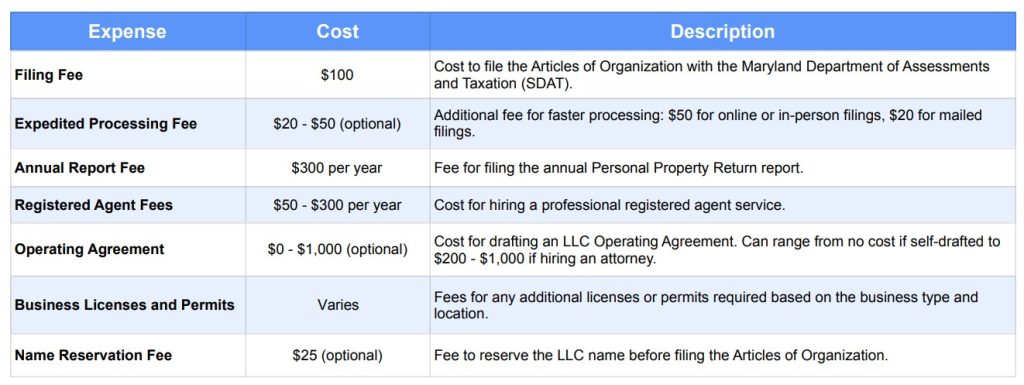

You may file your Articles of Organization electronically, by mail, or in person; a $100 fee is charged at the time of submission.

Step 4: Draft an Operating Agreement

Operating Agreement: Although not required under Maryland law for an LLC, it is recommended that one be created. This document gives ownership structure, management procedures, and operational rules for your LLC thus ensuring clarity and minimizing potential disputes between members.

Components of an Operating Agreement:

Member Roles and Responsibilities: Clearly outline each member’s specific roles so everyone knows what their responsibilities are.

Voting Rights: Define decision-making processes and voting rights held by all members in this agreement.

Profit and Loss Distribution: Indicate how profits and losses are going to be allocated among owners.

Procedures for Bringing New Members/Removing Existing: Provide straightforward instructions on getting new partners or getting rid of existing ones.

Step 5: Get an EIN

An Employer Identification Number (EIN) is a distinct identifier given by the IRS, which is essential for different tax and business purposes. One can acquire an EIN without any charge and it is simple to do it online.

Why an EIN Is Needed:

Business Bank Account: Most banks require an EIN for opening a business checking account.

Tax Purposes: EIN is essential for federal and state tax purposes.

Hiring Employees: You will need an EIN to pay workers if you intend to employ people in your company.

Step 6: Comply with Local and State Regulations

Depending on the nature of your business and where it operates, you may have other permits or licenses that you must have to be legally compliant. For specific requirements regarding your business, simply go to the county clerk’s office in your locality as well as the Maryland Department of Labor, Licensing, and Regulation.

Common Requirements:

Business Licenses: You might need either a general business license or a particular industry license based on the kind of business you run,

Zoning Permits: Your site should abide by local zoning laws.

Sales Tax Permits: In case your enterprise is engaged in the sale of goods or services, then it could be necessary for you to acquire sales tax permit(s).

Step 7: File Annual Reports and Taxes

To remain in good standing, Maryland requires LLCs to file annual reports and submit Personal Property Returns (PPR). Both these documents are due on April 15th each year.

Filing Details:

Annual Report Fee: The annual report fee is $300, which goes towards the administration of business regulations by the state.

Filing Method: You can make these filings on the Maryland Business Express portal for convenience purposes

Costs of Forming an LLC in Maryland

Benefits of Forming an LLC in Maryland

Limited Liability Protection: One major advantage to incorporating as an LLC in Maryland is that it provides personal asset protection to its owners. This means that in case of business debts or lawsuits, your personal belongings, like your home or savings, are generally safe from creditors.

Pass-Through Taxation: Pass-through taxation is also a feature of this type of business entity. In other words, an LLC is not subject to corporate tax but profits and losses are accounted for on the individual tax returns filed by each owner thereby simplifying the filing process and potentially reducing overall taxes paid.

Flexible Management Structure: A limited liability company allows for flexible management structures as well as different methods of owner management. Members can decide how to run the business, whether by appointing managers or involving all members in decision-making, catering to various business needs and preferences.

Credibility and Professionalism: Constructing an LLC increases credibility among clients. As such, many customers consider it more reputable compared to sole proprietorship thus increasing trade opportunities.

Ease of Formation and Maintenance: Forming an LLC in Maryland is pretty simple as compared to corporations; hence there are fewer ongoing papers to deal with. In this way, business owners can concentrate on growth rather than compliance making it a popular choice among many entrepreneurs.

Conclusion

Starting an LLC in Maryland entails several key steps such as the selection of a unique name and ensuring compliance with the rules of the state. By following this comprehensive guide, you’ll be well-equipped to successfully form your LLC in Maryland. Once established, it’s crucial to maintain good standing by filing required reports and adhering to all local and state laws so that your business thrives.

Need help getting started? Contact us today for expert assistance in forming your Maryland LLC and ensuring your business is set up for success!

Frequently Asked Questions (FAQs)

1. Can I convert my existing business to an LLC in Maryland?

Yes, you will be allowed to convert any existing businesses like sole proprietorships or partnerships into an LLC through the conversion process laid down by the state law. This means filing Articles of Organization together with other necessary documents according to the rule of Maryland law

2. What are the possible tax consequences of establishing an LLC in Maryland?

LLCs in Maryland have the advantage of “pass-through” taxation, meaning that any profits and losses of the LLC should be accounted for by its members on their tax returns. You will not pay federal income taxes as an LLC. Nevertheless, there may be state-level taxes applicable to Maryland LLCs including a $300 Annual filing fee for Personal Property Return.