When it comes to the global marketplace, the United States holds an iconic status as a land of opportunity, offering a fertile ground for businesses to thrive. It’s no surprise that many international founders eye the U.S. as the ideal place to start or expand their ventures. However, diving into the U.S. business environment comes with its set of regulatory requirements – a key one being obtaining an Employer Identification Number (EIN).

An EIN, also known as a Federal Tax Identification Number, is essential for a multitude of business activities, from opening a bank account to hiring employees, and most importantly for tax purposes. If you’re a non-U.S. resident looking to establish or operate a business in the U.S., understanding the EIN landscape is crucial. This post will explore why an EIN is important, how it can benefit your business, and provide a step-by-step guide on how to obtain one from outside the U.S.

International founders, buckle up as we embark on a comprehensive journey to secure your golden ticket – an EIN – and unlock the potential of the U.S. market.

Understanding EINs for Non-Resident Business Owners

Firstly, let’s clarify the purpose and significance of an EIN. An EIN is used by the Internal Revenue Service (IRS) to identify businesses for tax purposes. Think of it as a Social Security Number for companies. While you may not have a physical presence or employees in the U.S., an EIN is still required for various operational needs, ranging from tax reporting to compliance with U.S. federal regulations.

Beyond tax implications, an EIN legitimizes your business. It allows you to maintain a professional image when dealing with other businesses and customers. Furthermore, it’s essential for establishing a credit profile for your business, which could be beneficial for attracting potential investors or securing contracts.

Importantly, without an EIN, non-U.S. residents will find it nearly impossible to navigate the business processes within the United States. It’s the foundational identifier that integrates your business within the U.S. system.

The Benefits of Having an EIN for International Founders

Holding an EIN offers a plethora of advantages for international business owners:

- Banking: An EIN enables you to open a U.S. business bank account, which streamlines financial transactions and operations within the U.S. economy.

- Compliance: It ensures compliance with IRS requirements, thereby avoiding potential legal and financial pitfalls.

- Credibility: An EIN provides credibility to your enterprise, showing clients and partners that you’re fully invested and committed to operating within the U.S. business landscape.

- Growth: It allows for the possibility of hiring U.S.-based employees should you choose to scale your operations.

- Global Payment Systems: An EIN might be required to access certain global payment systems and online merchants, including e-commerce platforms.

With these benefits in mind, let’s walk through the process of obtaining an EIN from abroad.

How to Apply for an EIN as an International Founder: A Step-by-Step Guide

Step 1: Determine Eligibility

Before applying for an EIN, confirm that your business requires one. If your business is incorporated in the U.S. or if you are planning to hire U.S. employees, an EIN is mandatory. Additionally, if you plan to file any U.S. tax returns, an EIN becomes necessary.

Step 2: Preparation

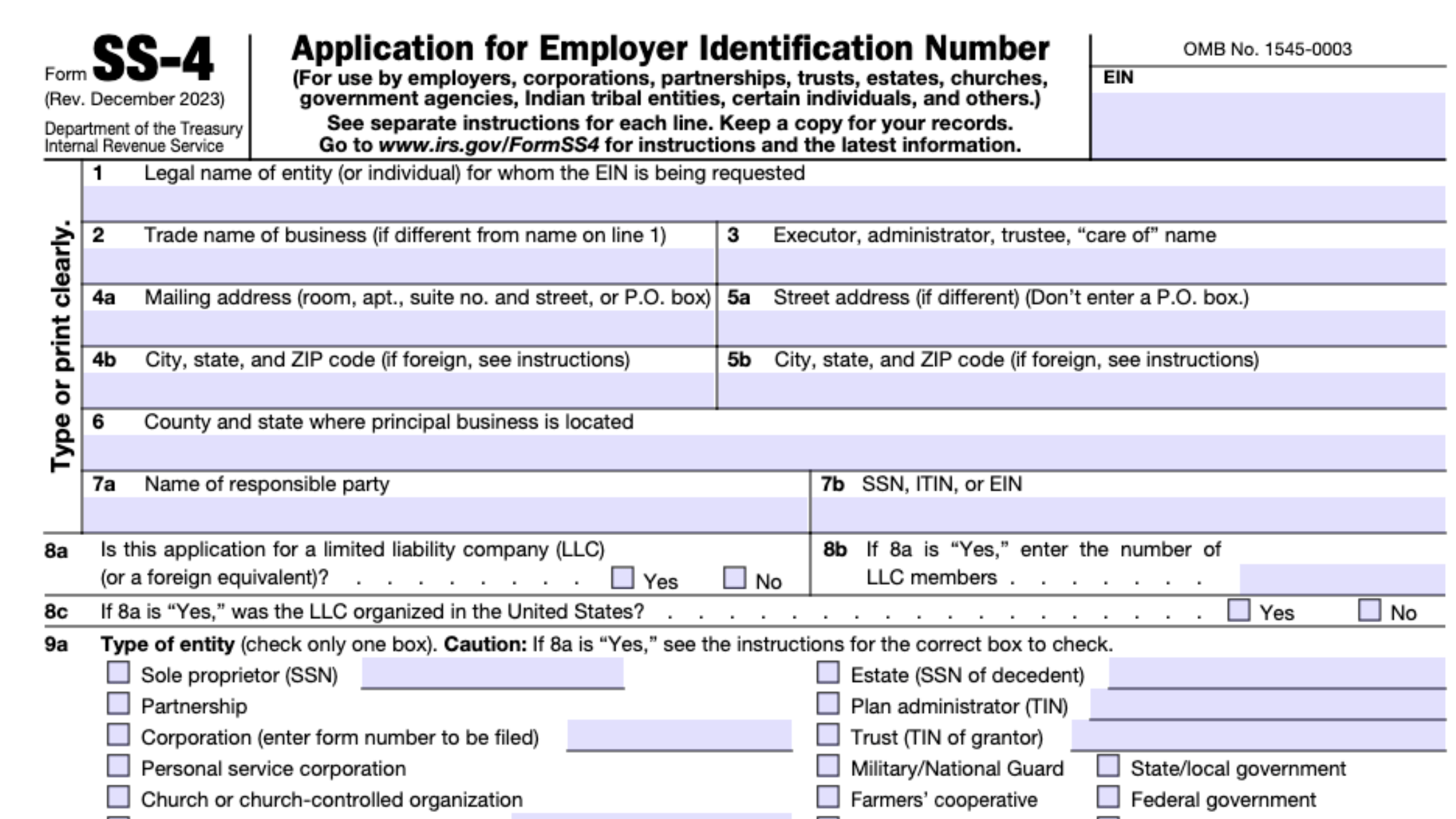

Before you begin the application process, ensure that you have all the necessary information at hand. This information typically includes:

- The legal name of the entity or individual applying.

- The business address and mailing address (if different).

- The country of incorporation and the principal place of business.

- The type of business entity (e.g., corporation, partnership, LLC).

- The date you started or acquired the business.

- The primary activity of the business.

- Details of the responsible party (ordinarily the primary owner or main officer of the company).

Step 3: Filling Form SS-4

To apply for an EIN, all applicants must complete IRS Form SS-4, Application for Employer Identification Number. The form may be filled out online or printed and mailed or faxed to the IRS. As a non-U.S. resident without a Social Security Number or Individual Taxpayer Identification Number (ITIN), you’ll need to fill out the paper form as the online system requires one of these numbers.

Step 4: Submitting the Application

There are several ways to submit your completed SS-4 form:

- By Mail: Send your application to the IRS. The processing time typically takes around four to six weeks.

- By Fax: You can fax the form to the IRS service center. This method cuts down the processing time significantly.

- Telephone: International applicants can receive their EIN by calling the IRS EIN International Toll-Free phone line. The EIN is given immediately upon verifying the information.

Step 5: Wait for EIN Confirmation

Once the IRS processes your application, you will receive a confirmation letter containing your EIN. Keep this document safe – it’s an important record for your business.

Also read, Waiting for your EIN?>>

Step 6: Using Your EIN

After you’ve received your EIN, you can proceed to open bank accounts, apply for business licenses, and otherwise start integrating your business into the U.S. economy. Remember that if there are changes in the structure or ownership of the business, you may need to apply for a new EIN.

Maintaining Your EIN and Compliance

It’s not enough to simply obtain an EIN; you need to keep your information up to date with the IRS. If your business changes address or the responsible party changes, you need to inform the IRS promptly.

Each year, your business will also have to file a U.S. tax return, even if it didn’t generate any income in the U.S. This is a crucial part of compliance, and failure to file can result in penalties.

Conclusion

For international founders, attaining an EIN serves as a stepping stone towards leveraging the economic potential of the U.S. market. It’s an essential process that, once complete, offers a world of opportunities for your business to grow, innovate, and prosper.

Although the process to obtain an EIN from outside the U.S. may seem complex, it’s a fairly straightforward endeavor that opens doors to the infrastructural and financial resources of the world’s largest economy. Properly navigating these waters means setting sail toward greater business success.

Be proactive, be prepared, and with your EIN, embark on a promising adventure in the expansive ocean of U.S. commerce. With each regulatory requirement you meet, your business stands stronger, more credible, and better integrated into the global market.

Remember, the world is evolving, and so is the role of technology in simplifying these processes. With persistence, the right guidance, and a commitment to fulfill all legalities, your global business aspirations are well within reach. Welcome to the future of international business—may your journey be as thrilling as the vast potential that awaits.

FAQs

When is an EIN required for a business?

An EIN is required for a business if it is incorporated in the U.S. or if there are plans to hire U.S. employees. Additionally, if the business intends to file any U.S. tax returns, an EIN becomes necessary.

How can I fill out the Form SS-4 to apply for an EIN?

To apply for an EIN, all applicants must complete IRS Form SS-4, Application for Employer Identification Number. The form can be filled out online or printed and mailed or faxed to the IRS. Non-U.S. residents without a Social Security Number or Individual Taxpayer Identification Number (ITIN) need to fill out the paper form as the online system requires one of these numbers.

How long does it take to receive the EIN confirmation?

Once the IRS processes the application, a confirmation letter containing the EIN will be sent. The processing time may vary, but it is typically within a few weeks.

What can I do with my EIN?

After receiving the EIN, you can open bank accounts, apply for business licenses, and integrate your business into the U.S. economy. It is important to keep the confirmation letter safe as it serves as an important record for your business.

Do I need to apply for a new EIN if there are changes in the structure or ownership of the business?

Yes, if there are changes in the structure or ownership of the business, you may need to apply for a new EIN.

What should I do after receiving my EIN?

Once you have received your EIN, you can proceed to open bank accounts, apply for business licenses, and integrate your business into the U.S. economy. Remember to apply for a new EIN if there are changes in the structure or ownership of your business.

What should I do to maintain my EIN and ensure compliance?

It is important to keep your information up to date with the IRS. If your business changes address or the responsible party changes, inform the IRS promptly. Additionally, your business will need to file a U.S. tax return each year, even if it didn’t generate any income in the U.S. Failure to file can result in penalties.