Is establishing an enterprise in North Dakota on your mind? In any state of the US, an LLC or Limited Liability Company is a very common type of business structure that combines the features of a sole proprietorship and a corporation.

If you’re thinking of starting a business in the Peace Garden State, then forming an LLC might be a suitable option.

To set up an LLC in North Dakota, follow the articles in this detailed guide. We will explain the procedure of registration step by step from selecting the name to completing the paperwork.

Why Form an LLC in North Dakota?

Personal Liability Protection: This is the most important advantage of an LLC. Creative thinkers do not have to worry about losing business control when the company is in debt or loses face in front of investors.

Tax Options: Limited liability companies (this definition of LLCs is taken from there) are flexible and can opt to be taxed as a sole proprietorship, partnership, or corporation. Such liberty would help your business situation in a much better way.

Ease of Application: LLCs avoid rigid structures and formalities such as board meetings that corporate entities have. This makes them all the more easy to control and function through.

Pass-Through Taxation: The profits and losses are usually directly reflected on owners’ tax returns and LLC does not have this tax level, unlike corporations who get double taxed.

Credibility: An LLC, creates an impression of the business when working with clients, suppliers, and investors.

Steps to Form an LLC in North Dakota

Step 1: Choose a Name for Your LLC

Must be Unique: The company name of the LLC cannot be identical to any business entity in North Dakota. It has to be checked if the name is similar to all the registered names so that there will be no confusion in the customers’ minds and no legal problems. It would be wise to consider having multiple names brainstormed so that one will most likely be feasible and able to pass all the requirements.

Include LLC Designator: The words ‘Limited Liability Company’ and its abbreviation i.e. ‘LLC or L.L.C’ must be incorporated in the name. This must be done while forming LLCs otherwise there is no bearing. This incorporation designates the legal form of the business and is beneficial since it clarifies the nature of limited liability.

Check Name Availability: Go to the ND Secretary of State website to check whether your preferred name for the company you wish to form exists. It may be wise to pay a small amount and reserve a name to avoid other companies using it as you finalize the formation papers.

Step 2: Choose a Registered Agent

Registered Agent Functions: A registered agent is your LLC’s go-to for any legal papers, including service of process and documents from the state. This aspect of the service is very relevant, as it allows for your LLC to be effectively reached and for essential papers to be obtained around the clock.

Requirements: A registered agent is someone who is a resident of the state of North Dakota or an authorized business doing business in the state. They need to have a physical street address located in the North Dakota state (not P.O. Box) so that they can be able to have access to receiving documents during business working hours.

Step 3: Complete and Submit Articles of Organization

Responsibility: This officially verifies that your LLC exists with the state and creates a legal framework for your LLC. It serves to legalize the activities of your company and is a required step for the state to legally recognize your LLC.

How To Submit: You can file your Articles of Organization with the North Dakota Secretary of State either electronically which is easier, or via traditional paper filing through the mail. Both of these methods will take some time, that’s why weigh all the pros and cons and choose the best for you.

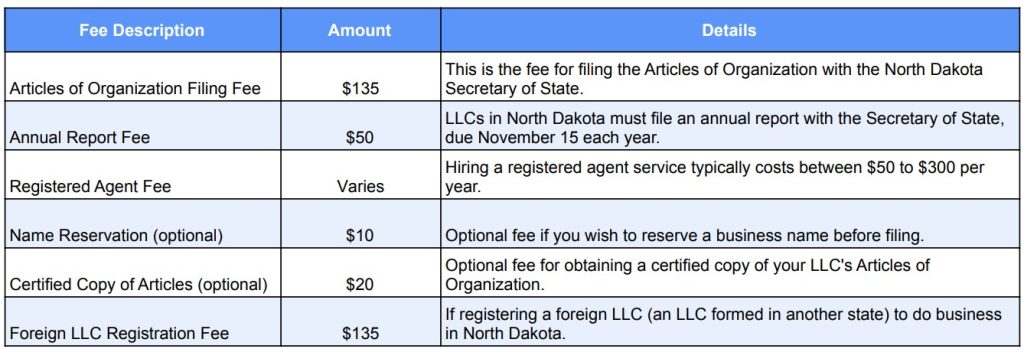

Filing Fee: The present cost to file Articles of Organization is $135. Payment can be undertaken via cheque or credit card for online payments, enabling the timely discharge of this obligation.

Details needed:

- Name of the LLC

- Principal office address which is the address used where the business records are kept, for easy accountability.

- Name and the address of the registered agent, to provide an actual contact.

- The term of the LLC is perpetual or time-limited, which outlines how long is the LLC supposed to last. This aspect has consequences concerning how the business will be owned and managed.

- State the aims for creating the LLC, in vain, the accused may aver that ENI was formed for other purposes or it could simply state that it was formed for any lawful purpose. Stating this will focus on the purpose of forming your business and how it will operate.

Step 4: Draft the Operating Agreement

Purpose: It is worth noting that in North Dakota, an Operating Agreement is not a legal requirement, however, its practice is encouraged. It states the proportion of the interests of the LLC owners and their operational responsibilities, which helps avoid miscommunication among the participants. This legal document will be important during the alteration of members or where there is a conflict that arises among them.

Components:

- Member roles and responsibilities of the member in decisions taken pertinent to each member, describing the contribution level each member expects all around, to prevent lack of clarity about what a member is supposed to do.

- The profits and losses sharing ratio, which determines how surplus or deficit is repaid, ensures there is no confusion and injustice regarding finances.

- Rules regarding the admission and expulsion of members including how such changes will happen, which is important for ensuring change occurs without hitches and also the take over smoothly.

Step 5: Apply for Employer Identification Number (EIN)

Requirement: In the USA, an EIN is mandatory when a business is opened as it is needed for tax purposes and for opening a business bank account. It is a number similar to a Social Security Number and is essential when filing taxes on behalf of the entity.

How to Apply: An EIN can be obtained from the Internal Revenue Service free of charge. This can be done online, by mail, or by faxing a paper application. It is the fastest mode of obtaining the number. This is a vital number for the business’s credit and tax identity to be established.

Step 6: Other Regulatory Requirements

Business Licenses and Permits: Depending on the type of business and its location, there may be additional local or state licenses or permits required. Liaise with relevant local authorities and regulatory agencies to avoid non-compliance, which may lead to penalties and disruption in carrying out business.

State Taxes:

- Make registration with the North Dakota Tax Department for state taxes that you may be liable to pay such as income tax, if applicable, or any state tax. Clarifying your tax responsibilities is quite critical for proper financial planning and remaining on the right side of the law.

- You may be required to obtain a sales tax permit where you sell goods so that you charge and remit sales tax. It is worth noting that penalties that may be imposed for failure to collect and remit sales taxes accurately are punitive.

Step 7: Consistency in Compliance

Annual Report: The state of North Dakota demands that the LLCs file an annual report to keep the state updated and the company’s good standing with the state. This report makes it possible for your entity’s records to be up to date and for the entity to still be recognized legitimately in the eyes of the law.

Due Date: The annual report should be submitted within a year from when such a report was last submitted, which is November 15th in any given year. Failing to meet this deadline may attract some penalties or even the forfeiture of good standing status which will harm the legal standing of the LLC in the state.

Fee: A fee of 50 dollars is charged for the filing of the annual report which is remitted at the time of submission online or through mailing the report. Timely payment ensures your LLC remains in compliance with state regulations.

Costs of Forming an LLC in North Dakota

For business owners looking for flexibility and security for their assets, an LLC in North Dakota is a sound decision. Following these procedures accurately, one can set up the business with ease and concentrate on the business goals.

In case of questions or difficulties, get comprehensive assistance from an attorney or a reasonable business formation service to comply with all the requirements properly.

Book a free consultation for clear guidance on how to set up a North Dakota Limited Liability Company and any other services that you may need.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now