Every person and entity in the United States is required to file taxes. After receiving all the necessary documentation, you can either e-file it to the IRS or send it via traditional paper mail.

Both methods have pros and cons, and the deciding factors include your preference for convenience, security, speed of processing, and overall cost.

This guide aims to equip you with the information necessary to help you choose a tax filing method that is ideal for you (E-file vs Paper Filing).

What Is E-Filing?

This is the process of submitting tax returns through an online platform using either IRS-authorized software or tax services. The IRS aims to maximize security and efficiency and has made e-filing the preferred method for 90% of taxpayers in the country.

Pros of E-Filing:

Faster Processing: Refunds from e-filed tax returns are processed in 21 days easily as opposed to the 6-8 weeks required for paper returns. This speed is certainly favorable for taxpayers.

Greater Accuracy: Since IRS e-filing systems are set to automatically check for potential errors, they are often more accurate than manual filing. Automated verification avoids the potential for errors in calculations which would often result in severe penalties.

Electronic Confirmation: Electronic confirmation systems grant you confirmation from the IRS that your return has been accepted. This means that mailing your return no longer requires you to wait in uncertainty for acknowledgment.

Faster Refunds: If you are entitled to a refund, direct deposit with e-filing ensures that you receive your money faster. Many citizens get their refunds within days instead of months like other taxpayers.

Enhanced Security: E-filing reduces the chances of your tax return getting misplaced or stolen E-filing also shrinks the chances of when filing through interstate mail. E-filing IRS-approved systems court for advanced encoding practices to sensitive information.

Eco-Friendly: Submitting your taxes online helps in cutting down on paper and therefore, trees. In turn, making it a much more sustainable choice. With the millions of e-filing done around, the waste attributed to paper usage is significantly lowered.

Easy Recordkeeping: Most online tax filing providers give you a digital copy of your return which helps in holding your information for future reference. Some even go a step further and give cloud storage.

Cons of E-Filing

Software Costs: While the IRS has Free File options for simple returns e-filing can come at a cost for more complex filers. Most online tax services charge a fee for e-filing and complex returns.

Concerns with Data Security: Although e-filing is safe, cyber threats are always a possibility. Taxpayers need to make sure that they work with credible software vendors and use two-factor authentication wherever possible.

Not Applicable for Every Return: Certain electronic tax filing situations like complex filings with many documents may not qualify for e-filing. Some forms, especially those requiring significant additional evidence, must be submitted via paper.

What is Filing by Paper?

Filing by paper means completing the required tax forms and submitting them through regular mail to the IRS. It is one of the older methods of filing tax returns, and it is still an option for those who prefer a more hands-on approach. Regardless of how easy e-filing has become, some still prefer manual filing for several reasons.

Advantages of Filing by Paper:

No Extra Costs Incurred: Paper filing does not incur the cost of using tax software and e-filing services as e-filing does, so it is far more cost-effective. This method is useful for taxpayers who prepare their returns manually.

Security: A portion of taxpayers feel more secure submitting their tax returns via post rather than using an online platform. Digital breaches are a big concern these days and filing through the paper method eliminates that concern.

Forget About Internet Accessibility: Filing on paper is a great option for old-school people or people who don’t have access to the Internet. This is especially beneficial for people living in more remote or rural regions.

Supporting Documents Can be Included: If your return has a lot of supporting documents, paper filing makes it easier for you to attach them. Most taxpayers normally prefer to send paper copies rather than scanning and uploading documents online.

Disadvantages of Paper Filing:

Delayed Processing: Paper tax returns take significant time to process which hinders getting refunds promptly. During tax season, the IRS may take six to eight weeks or longer to process paper returns.

More Errors: Manual filing is filled with guesswork which increases the chances of mistakes causing processing delays or audits from the IRS. Unlike e-filed returns, there are no automatic checks to eliminate errors in paper-based returns.

Slow Confirmation: Paper filers, as opposed to those filing electronically, do not receive an instant confirmation from the IRS. Taxpayers who were subject to losing their return documents may have to repay and will be penalized for challenges met from submission delays.

Mailing Expenses: The expenses of sending and printing become expensive when accompanied by lengthy tax returns. To avoid getting lost documents, tax submits might need to change to certified mail, making them trackable.

Increased Chances Of Missing Documents: Sending tax returns via mail escalates the risk of forms getting lost or misplaced. The IRS recommends saving copies for all documents and using trustworthy mail service providers.

Waiting Too Long For Refunds: When expecting a tax refund, filing through paper means waiting longer than e-filing. The wait could be longer by several weeks depending on how busy the IRS is.

Which Filing Method Is Best for You?

Your tax circumstances, preferences, and priorities dictate the best filing method.

Consider E-Filing If:

- You need quicker processing and refund payouts.

- You like error corrections and automatic calculations.

- You are familiar with online filing for tax returns.

- You wish to reduce paperwork and expenses related to postage.

- You are looking for an economical option and are eligible for Free File services.

- You want a digital copy of your tax return that is easy to access.

Consider Paper Filing If:

- You choose a conventional, offline way of filing.

- You have a complicated return that needs to be filed with a paper.

- You wish to avoid paying for software.

- You do not trust the security of online data.

- You choose to amend a tax return with supplementary details.

- You do not have consistent access to the Internet.

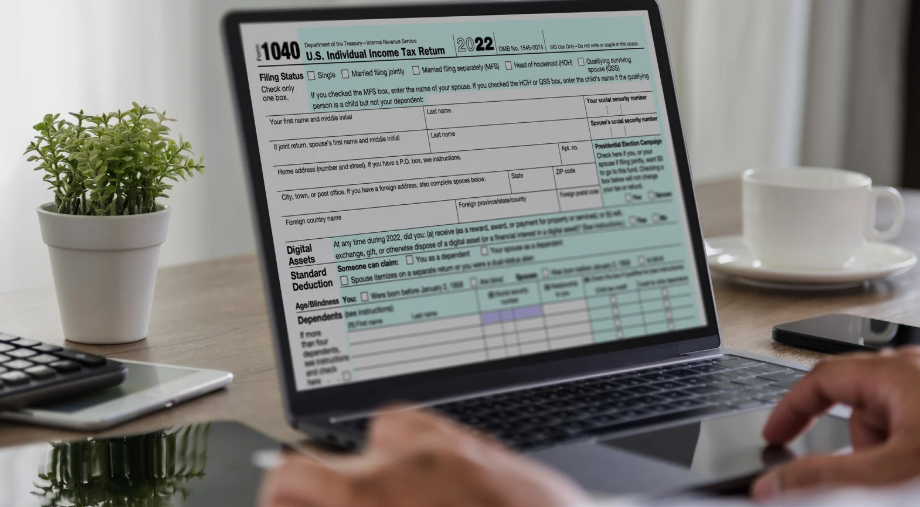

How EasyFiling Can Assist in E-Filing IRS Taxes

EasyFiling makes e-filing simple for users by providing an easy and dependable solution to tax filing. With easy filing, the process is streamlined for both personal and business-level tax filing.

EasyFiling assists with both personal and business tax filing and makes sure you meet all IRS compliance standards.

With EasyFiling, you do not need to worry about errors, inefficiencies, and delays. We speed up tax filing and prepare all the work so that you can enjoy effortless and maximized growth for your business.

Register for EasyFiling and we will enable you to effortlessly file your IRS taxes.

Conclusion

For many taxpayers, e-filing remains the most preferred option mainly because it is faster and more convenient than filling out paper forms. For others, filing their taxes by paper is an option, albeit a traditional and tedious one.

No matter what method you decide to go with, be sure that you pay your taxes correctly, thoroughly, and punctually to avoid unwanted fines and delays in processing. An experienced tax professional or IRS-free e-file help can help you complete this process easily.

Weighing the advantages and disadvantages of your choices gives you a chance to select the method that works best for your needs.

You may choose to e-file for quickness or use paper forms for confidentiality, but either way, abiding by the law of the IRS is the only way to successfully fulfill your tax obligations.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now