If you have recently changed your physical address or would like to inform the IRS of the current one related to your EIN, it would be advisable to update all of this information with the IRS so as not to interfere with the running of the business. If the IRS address is not current then there will be possibilities of missing communication responses, delayed tax returns, and penalties being issued.

The steps toward addressing changes on the EIN are simple and require filling in certain forms with the IRS. You can control the activities of your enterprise by taking the necessary steps to update any of your business particulars that are changed so that they will not bother you when you are trying to expand your business.

Here’s a straightforward approach for address change related to the EIN letter.

Steps to Changing the Address on Your EIN Letter

Step 1: Gather All the Required Details

Prepare for the process by having the following details in hand:

- Your active EIN

- The exact registered business name

- Your previously used address and the address you intend to move to

- The nature/structure of your business (for instance, LLC or Corporation)

- Your phone number or other relevant contacts

Step 2: Select Your Preference

At this point, have a look at the options available to modify the address with IRS. You can choose to do it via fax or by mail. Choose the method of your choice now.

By Mail:

Write a letter: Compose a letter and sign it and include the business name, EIN, prior address services, and post office address, to update the address of the business. In the top left corner, it should be marked as to request changing of address.

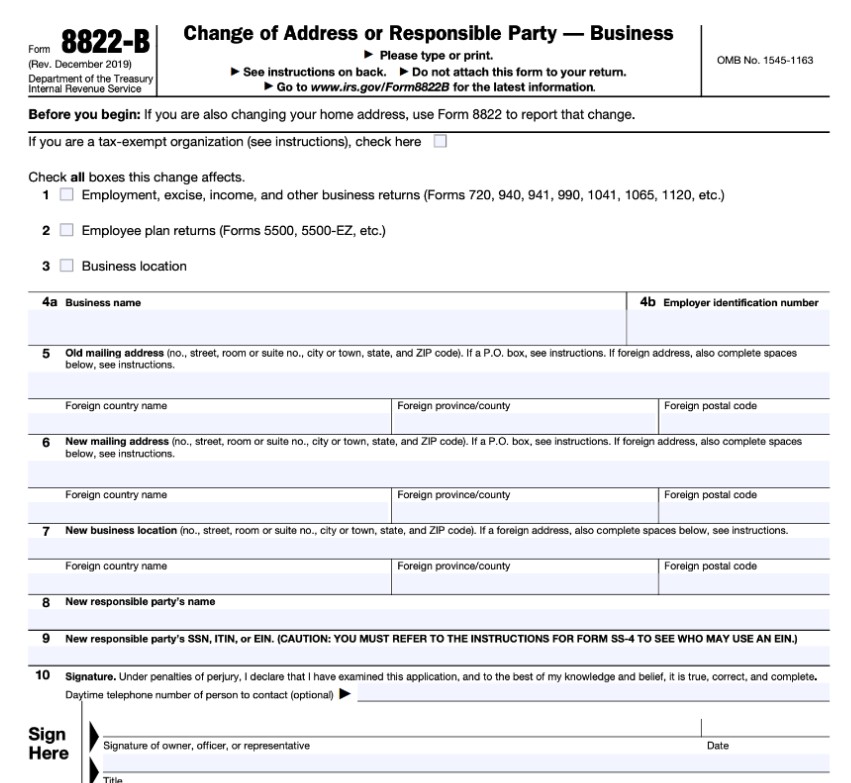

Use Form 8822-B: Form 8822-B is to be filled for any of the parties responsible for your EIN.

You can download the form from the IRS website by clicking here.

- Business Name: Mention the name of the business.

- EIN: Make sure to include your EIN. If you cannot recall where it is located, you will need to review earlier documents, or you may need to review prior videos.

- Old Mailing Address: The address that is currently linked to your EIN.

- New Mailing Address: Give the new address to which EIN will be sent in case of correspondence.

- Signature and title: Sign the form and include your capacity e.g. Members, etc.

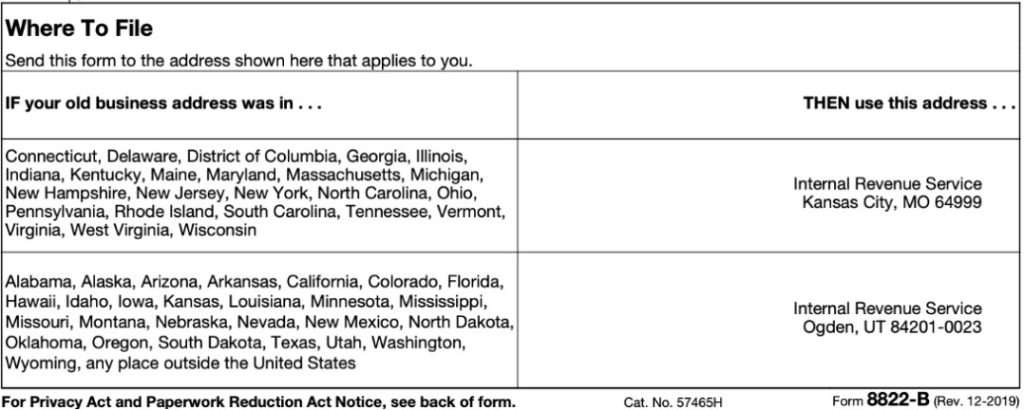

Send to the Correct IRS Office: This letter or form must be ‘sent via mail’ to the relevant IRS office in the concerned state. The address can be checked from the IRS homepage.

Examples: Send the completed form to the IRS at the appropriate address based on your business location (e.g., Florida).

Requesting the EIN Confirmation Letter

If you need to verify your Employer Identification Number (EIN), you can do so by getting a new EIN confirmation letter or using a 147C letter.

After the form is filled and sent to the IRS by post, you may contact them using a phone number dedicated to such queries; the number is 800-829-4933. This general procedure will help you get the formal affirmation of your EIN which will be required for other business matters.

Prepare yourself in the event of changing the automated system as follows:

- Choose Option 1 for English language or Option 2 for Spanish language.

- Choose Option 3 which covers that option for EIN.

- Politely ask the representative for the 147C letter and make it clear to them that you require this letter.

Things Needed for Verification:

Before making a call to the IRS, you must have several things in place including the relevant information required to establish who you are. You will be asked for the following:

- Your company’s complete name as it appears on its registration.

- The complete name of the beneficial owner of the EIN.

- Your Personal Identification Number which is your Social Security Number, when it suits your case.

- The date of incorporation of your organization.

- The last address that was supplied to the IRS by you.

- Your address also needs to change if it has changed recently.

Processing Time

Conclusion

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now