Choosing the right state for your LLC(Limited Liability Company) can be difficult as this will directly affect the success and growth of your business. With different states offering unique and special advantages and regulations, sailing this decision can be frightening. To help guide diligent entrepreneurs and small business owners, We’ve built a list of the top five states to file an LLC.

Before jumping into the best states to form an LLC let’s learn about what an LLC is.

A Limited Liability Company (LLC) is a type of organization in the U.S. that protects the assets of its owner from lawsuits and creditors concerned with the company’s business debts. This means that an owner of an LLC is not personally liable for the company’s debts and obtains certain tax advantages.

A Limited Liability Company(LLC) is a formal business arrangement that is easier to set up than a corporation and provides more flexibility and protection for its investors.

Domestic vs Foreign LLC

LLCs were first introduced in Wyoming in 1977, They offered almost the same benefits as corporations, which included limited liability protection and flexibility in the business structure and taxes. But, LLCs also have some strict rules and regulations as corporations, making them easier to manage.

Domestic LLC:

A Domestic Limited Liability Company (LLC) is an LLC formed and operated within the state where it is initially registered. It refers to an LLC that only operates business in the state where it was formed. Operating business within the state means your LLC will only do business within your home state and have no physical presence in another state.

The main advantage of forming a domestic Limited Liability Company (LLC) is that it is simple to manage, you only need to comply with the laws of your state, which are usually less complex. Additionally, Domestic LLCs can be less expensive to form and maintain than foreign LLCs, because you only need to file paperwork with one state government.

Foreign LLC:

A Foreign Limited Liability Company (LLC) is an LLC that is formed in one state but conducts business in other states. This means you can have a physical location, employees, customers, or any significant presence or operations within that state. For example, if you live in Florida and own a Florida LLC and then move to New York or want to start an LLC in New York, you will have to file the necessary paperwork with the New York Secretary of State to form a foreign LLC.

The main advantage of forming a Foreign Limited Liability Company (LLC) is that it allows you to do business in multiple states without having to form separate LLCs in each state, which is beneficial if you have multiple customers in different states and if you want to expand in different states in the future.

Having a Foreign LLC also allows you to tap into different new markets and explore them as it gives you a broader reach. A foreign LLC can be beneficial. Foreign LLCs may also be beneficial if you are doing business in a state with helpful tax laws.

5 Best States to file an LLC

There is no accurate answer for the best state to form a business. But, It is always exciting to decide to start an LLC for most of the people. Making the right choice can be challenging as choosing the right state for your LLC will make huge impact on taxation and regulations you have to follow.

If you can’t decide on a fixed location, you can consider your home state, Delaware, Wyoming, Nevada or New Mexico as your destination, as these states have friendly laws and regulations that may be appealing to you. So, before deciding on which state you want to form a business in, It is crucial to learn about the different laws and regulations each state holds.

1. Home State

The Home state is where your business activities will be conducted, money will come into play and all the operations work will be performed. Regardless, of where you reside, if you don’t have any intentions to move your business anywhere, that state will be the best state where you can form your LLC. Most businesses do not necessarily conduct business where the members reside.

For instance, if you and your other three friends form an LLC who live in the other three states, and start and operate the store out of the state you reside in, then the best state forming an LLC could be California. However, if they decide to open a franchise in the state they reside, each of them has to register a foreign LLC in each additional state.

2. Delaware

Although small in a geographical sense, if you are looking to move somewhere new and thinking of upgrading to a corporation at some point in the future, Delaware could be one of the best states. Like Wyoming, Delaware also has a privacy policy to protect its member’s identity from the public. Over 60% of U.S. publicly traded corporations and 700 companies are incorporated in Delaware.

The cost to file your Organization documents with the state fee is only $90 for the domestic and 200$ for the foreign LLCs. you should also pay 300$ state tax fee each year, but you don’t need to file any annual reports.

Learn how to start an LLC in Delaware.

3. Wyoming

Although there are far fewer fraudulent activities in Wyoming compared to Nevada, It is a great state to form an LLC. Wyoming has become a popular choice among business owners with business applications in the state skyrocketing. Not only Wyoming being the first state to introduce an LLC business structure, but it also has no state income tax rate, have affordable tax rate, and an inexpensive LLC filing fee of just 100$.

Wyoming has a very protective privacy law. Unlike other states that keep the owners’ information visible to the public. Wyoming holds multiple opportunities to be taken advantage of and patrons who can utilize what your business has to offer.

Learn how to start an LLC in Wyoming.

4. Nevada

Nevada Offers robust asset protection for LLC members, making it challenging for creditors to seize personal assets. As it is known for its favorable tax climate with no state income tax, no corporate income tax, and no franchise tax, Nevada could be one of the best states to form an LLC.

Like Wyoming and Delaware, Nevada also has very high privacy policies, as it doesn’t disclose the member’s identity to the public.

5. New Mexico

Many business owners consider New Mexico one of the best states to form LLCs. As it offers limited liability protection and privacy protection and requires no tedious annual reporting filing. Also, the state fees for LLCs in New Mexico are among the lowest in the U.S.

Forming a Limited Liability Company (LLC) in New Mexico has hundreds of benefits, which include enhancing privacy protection and minimal reporting requirements.

Considerations before choosing the state to file an LLC

Choosing the right state to form an LLC is one of the most important crucial steps, as choosing a state will directly impact your business, ranging from tax implications to legal matters. Here, let’s talk about the considerations before choosing the state to file an LLC:

1. Formation Fees and Annual Cost:

For incorporation of an LLC in any state, a filing fee is associated with it. The filing fee can be different depending on the state you have chosen to go with. Also, the majority of the states need to file an annual report along with the payment of annual fees.

2. State Taxes:

All the LLCs don’t have to pay income tax in all states. Your LLC profit will appear on the owner’s tax returns whether they are taxed as a partnership or as a corporation. However, some states tax LLCs directly, and others consider your tax status. Also, if your LLC provides different goods and services that are subject to sales tax, then you will have to apply for a sales tax permit in each state where you have a physical presence or economic activity. It is crucial to understand the sales tax and state income tax implications in different states.

3. Business Climate Regulations:

Some states within the US have gained good recognition by offering business-friendly tax regulations. These business regulations offer benefits such as member anonymity or a simplified business structure. Particular state laws may apply to your business. Evaluate each LLC law and policy as it may create difficulties for your business operations in the future.

4. Foreign LLC registration:

If you are willing to operate your business in multiple states, then you must register your business as a foreign LLC in those states. This will cost you additional fees and other formalities. Choosing the state that holds a simple foreign LLC incorporation method so that you can operate it in different states is crucial.

Best state to file an LLC for Non-US Resident

There are no specific laws and regulations that make it more suitable for LLCs than other states, Wyoming and Delaware are the states of choice for LLCs due to their business-friendly tax laws. Delaware could be the best option if you have plans to convert your LLC into a C-corp (To raise venture capital from a U.S. investor) shortly.

On the other hand, Wyoming is the most popular state for non-resident business owners and entrepreneurs who are seeking to form a business in easy and simple steps ways and manage their company.

Cost of forming LLC in multiple states

For most business owners, filing fees will account for the majority of their LLC startup costs. It’s better to consider an LLC filing service to file articles of incorporation to form an LLC, for low costs associated with the service. Using a legal service provider is crucial as it reduces the risk of improperly filing paperwork, which can lead to additional fees to fix the application.

| S.N | State | Cost of forming LLC |

| 1 | Home State | – |

| 2 | Delaware | $110 |

| 3 | Wyoming | $100 |

| 4 | Nevada | $75 |

| 5 | New Mexico | $50 |

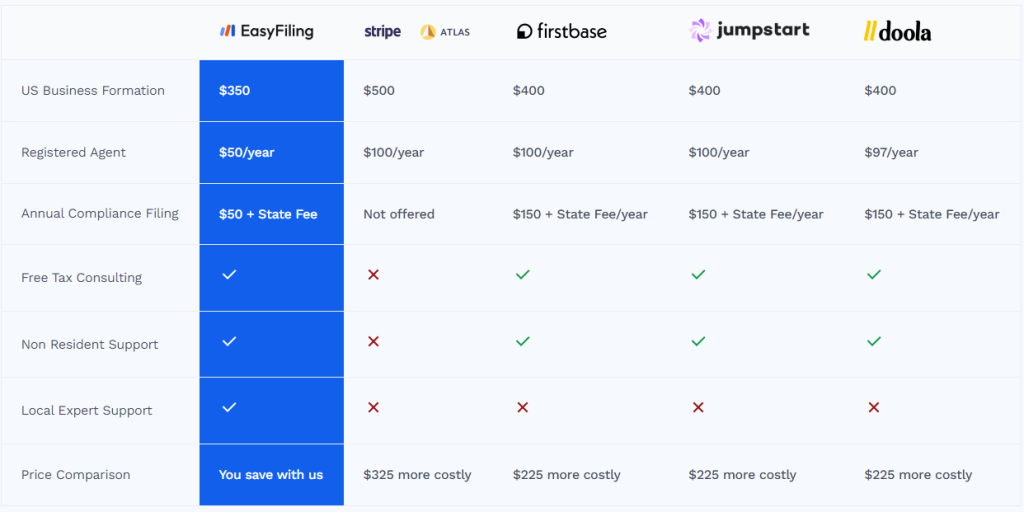

Cost of Filing an LLC with EasyFiling

Conclusion

Forming an LLC can always be an exciting thing but if you don’t choose the correct state it could turn into a mess. Before considering any state for forming an LLC you must research the advantages and disadvantages of the individual states. Here at Easyfiling, we are always excited to solve your queries and guide you to come up with the solution. If you are also the one confused about which state to choose forming an LLC, contact us.

Frequently Asked Questions(FAQs)

Can we form an LLC, while staying in Canada?

Yes, you can form an LLC, from any part of the world, without physically being present in the USA.

What is the estimated time to form an LLC?

The estimated time varies depending on different state regulations.

Which state has the Lowest LLC tax rates?

Most of the states have Low tax rates, out of which Nevada has the lowest tax rate.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now