The popularity of the Delaware LLC is due to its tax advantages, limited liability, and enhanced privacy which are part of a flexible and legally protected business structure. The state’s reliable legal proceedings facilitated by the specialized Court of Chancery create a business-friendly environment.

Moreover, Delaware offers businesses from start-ups to giant corporations an efficient process for making and maintaining LLCs.

6 Benefits of Forming an LLC in Delaware

1. Business-friendly laws

One of the main strengths of Delaware is its well-established corporate legal framework. The state’s statutes are drafted to be adaptable and favorable to companies thus it will be easier for you to run your day-to-day business operations in this jurisdiction. This supportive legal environment is one reason why many businesses incorporate in Delaware.

Chancery Court: Legal issues on commercial matters are resolved speedily and fairly through an efficient dispute settlement system in place at the Court of Chancery known globally for its expertise in corporate law where complex commercial disputes can be settled.

No Minimum Capital Requirement: Unlike most other states, there is no minimum capital requirement needed to start a corporation in Delaware hence it’s accessible even for startups. For this reason, entrepreneurs can establish their businesses without having to meet strict capital requirements thereby giving them much more flexibility right from scratch.

2. Privacy protection

Those who value confidentiality find it advantageous that shareholder identification may not be necessary when incorporating a company in Delaware.

Anonymity: You don’t have to disclose names of shareholders or members while filing public information as would be required by many other jurisdictions hence enhancing confidentiality. This amount of secrecy may prove helpful, particularly concerning celebrities or individuals wishing their transactions done secretly; in addition, Delaware allows nominee directors and officers to beef up privacy protection.

3. Tax benefits

These tax benefits enjoyed by many corporations operating under the laws of Delaware could determine whether such firms will continue growing stronger financially or not.

No State Income Tax: Delaware does not tax businesses that have operations outside its boundaries, an aspect that leads to huge savings, especially for companies operating in more than one state. Consequently, by not taxing income earned outside of the state of Delaware, it creates a friendly environment for corporations whose aim is to minimize their tax liability.

Low Franchise Taxes: Delaware’s franchise tax is typically lower than what many states charge, which is especially beneficial for large corporations. Consequently, Delaware remains one of the cheapest places in terms of cost but with a very business-friendly franchise tax structure in place even for high-revenue firms that would like to incorporate here.

4. Established Reputation

Having your company incorporated in Delaware can improve its image thereby increasing its competitiveness in the marketplace.

Widely Recognized: Many Fortune 500 companies choose Delaware as their home base, providing a sense of legitimacy and credibility to your business. Such recognition may boost the reputation of your firm hence opening up chances for creating new networks and establishing partnerships.

Investor Confidence: The favorable legal environment and well-established corporate laws make most investors prefer firms incorporated under this domicile jurisdiction. This stability as well as predictions creates trust among investors hence it becomes less difficult to get financing or any other form of support for your firm from them.

5. Flexibility in Corporate Structure

Corporate Structures for the most part are much more liberal in Delaware than in other states, thus they can fit different corporate needs and objectives.

Various Stock Classes: These corporations can offer multiple types of stock that come with distinct voting rights as well as preferences, helping them attract investors. This adaptability enables businesses to fashion their capital configurations that meet the unique requirements of various groups of investors thereby fostering growth and expansion.

Flexible Laws You Can Modify: Business organizations in Delaware can develop bylaws that meet their exclusive operational requirements, which provide for greater flexibility. This means they can customize their governance structures and procedures to align with their strategic objectives and operational needs.

6. Favorable Business Environment

Delaware State plays an active role in promoting business growth through various initiatives, programs, and resources.

Business Resources: Whether it’s a question of networking forums or study courses, Delaware offers rich resources for entrepreneurs and private enterprise owners. Through these resources, companies can overcome the challenges of growth and expansion by providing useful insights as well as connections.

Access to Capital: Delaware has more investors and venture capitalists than most other states, meaning higher chances of finding capital through these sources. The state’s robust investment ecosystem makes it possible to finance new projects while expanding existing ones thereby allowing businesses to achieve their goals within a highly competitive environment.

Also read, Comparing LLC Formation States for Non-Residents: Delaware vs Wyoming>>

Steps to Form Your Delaware LLC

1. Choose an LLC Name

Your name should be unique among the businesses already registered in the state of Delaware. It must contain ‘Limited Liability Company,’ ‘LLC’ or ‘L.L.C.’ Use the database provided by the secretary of state office to verify whether your preferred name is available.

2. Designate a Registered Agent

A registered agent is a natural person or business entity who takes legal papers and official communications from government institutions for the company in his/her name. A registered agent should have a physical address found in Delaware.

3. File the Certificate of Formation

Certificate of Formation is what you need when you want to set up your firm officially as an LLC according to Delaware Secretary of State rules. Included information about this includes:

- Name of your LLC,

- The name and residence address of the registered agent,

- Whether it will exist forever or for a limited time,

You may pay a $90 filing fee through online submission or by mail.

4. Develop an Operating Agreement

While not mandatory under the law, you should have one. This document outlines the ownership structure, management, and operational procedures of your Limited Liability Company (LLC) and it is an internal document that will help prevent future disputes among the members.

Also read, What is the cost of starting an LLC in Delaware?>>

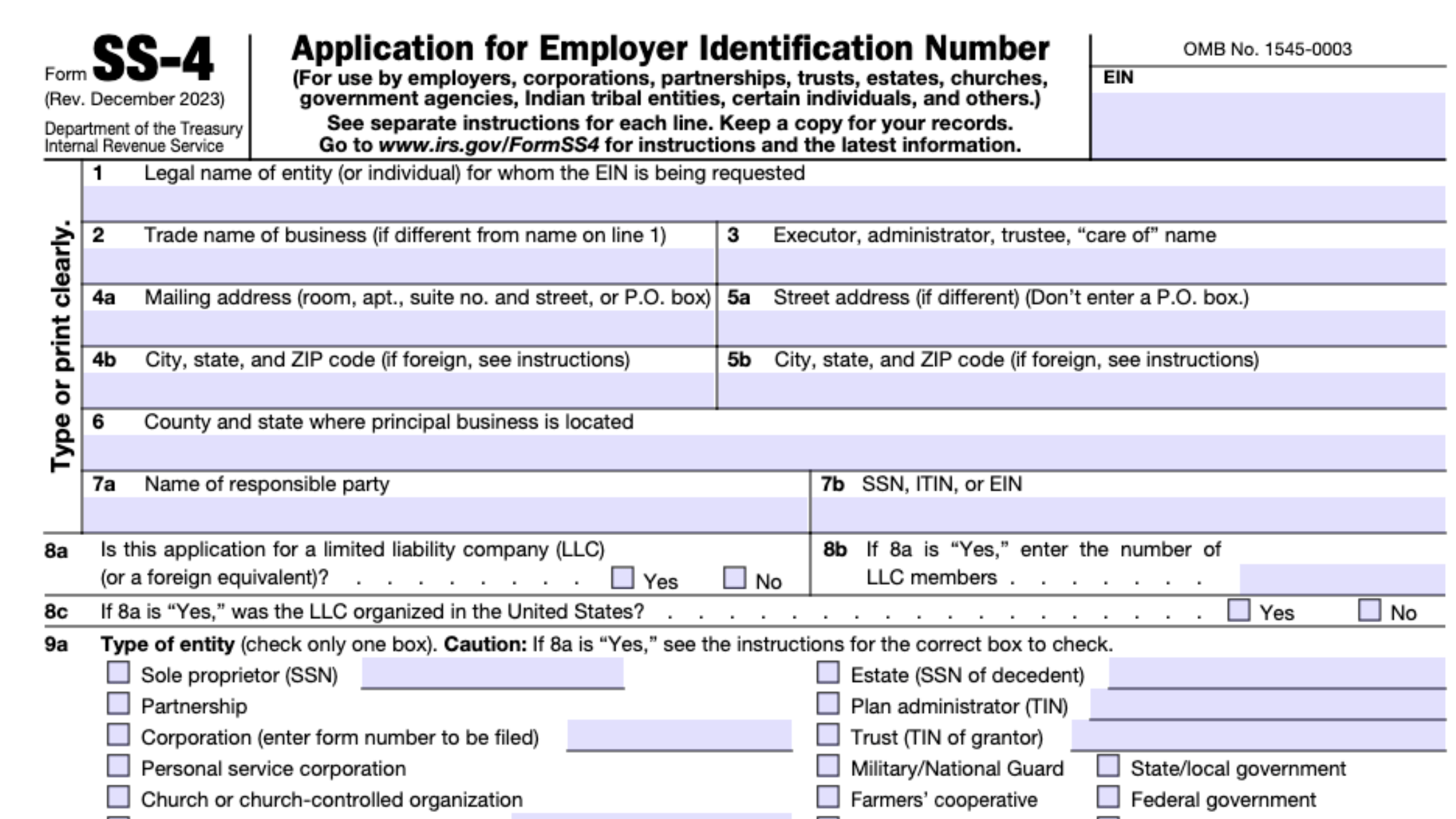

5. Get an Employer Identification Number (EIN)

An EIN becomes a requirement when you have more than one member for your LLC or planning to hire employees. The Internal Revenue Service (IRS) offers free EIN registration through its website.

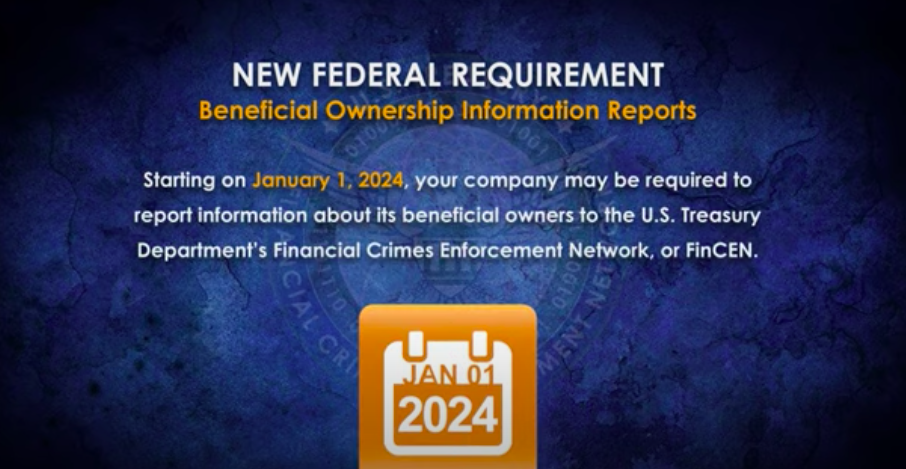

6. Comply With Additional Regulations

Depending on the kind of business you run and its location, there could be a need for business licenses, permits, or zoning approvals. Be sure to follow local as well as state rules.

Conclusion

Where you create your LLC significantly impacts the way it operates, the costs incurred as well as the legal status of such firms Delaware has an efficient formation process, privacy protections, and a great business climate compared to other states. Nevertheless, some other states may have lower business costs and fewer regulations which may give them a competitive edge over Delaware based on your specific business needs and operational plans.

Consider your company’s goals first before seeking advice from a legal expert (EasyFiling) who can give better insight into the most favorable jurisdiction for forming an LLC. Irrespective of whether it is in Delaware or any other state where you eventually form it; proper compliance and strategic advantages ensure that your enterprise gets established in the right way.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now