Determining the legal structure of your company is a critical step you must take when starting an online business.

Forming a Limited Liability Company (LLC) is especially popular among e-commerce entrepreneurs.

For those looking to cement their online business with a solid framework, an LLC is appealing due to the operational flexibility, legal protection, and tax advantages it offers.

This article delves into the benefits of an eCommerce LLC, examines whether all businesses should incorporate one, and details how anyone can set one up easily.

What is an LLC?

A Limited Liability Company (LLC) is a hybrid business structure that combines the characteristics of a corporation with a sole proprietorship or partnership.

LLCs protect their members, or owners, by safeguarding their personal belongings from any debts or legal issues that the business may incur.

An LLC also allows flexibility in taxation and management which is beneficial for small business owners, including eCommerce business owners.

Rather than having a set structure like a corporation does, running an LLC gives managers the freedom to dictate how business is conducted.

Business owners can decide to either manage the business personally or designate someone else as a manager to handle day-to-day operations.

Furthermore, LLCs do not have to comply with many of the rules and regulations that are set for corporations, for example, they do not need to hold yearly meetings or keep detailed files.

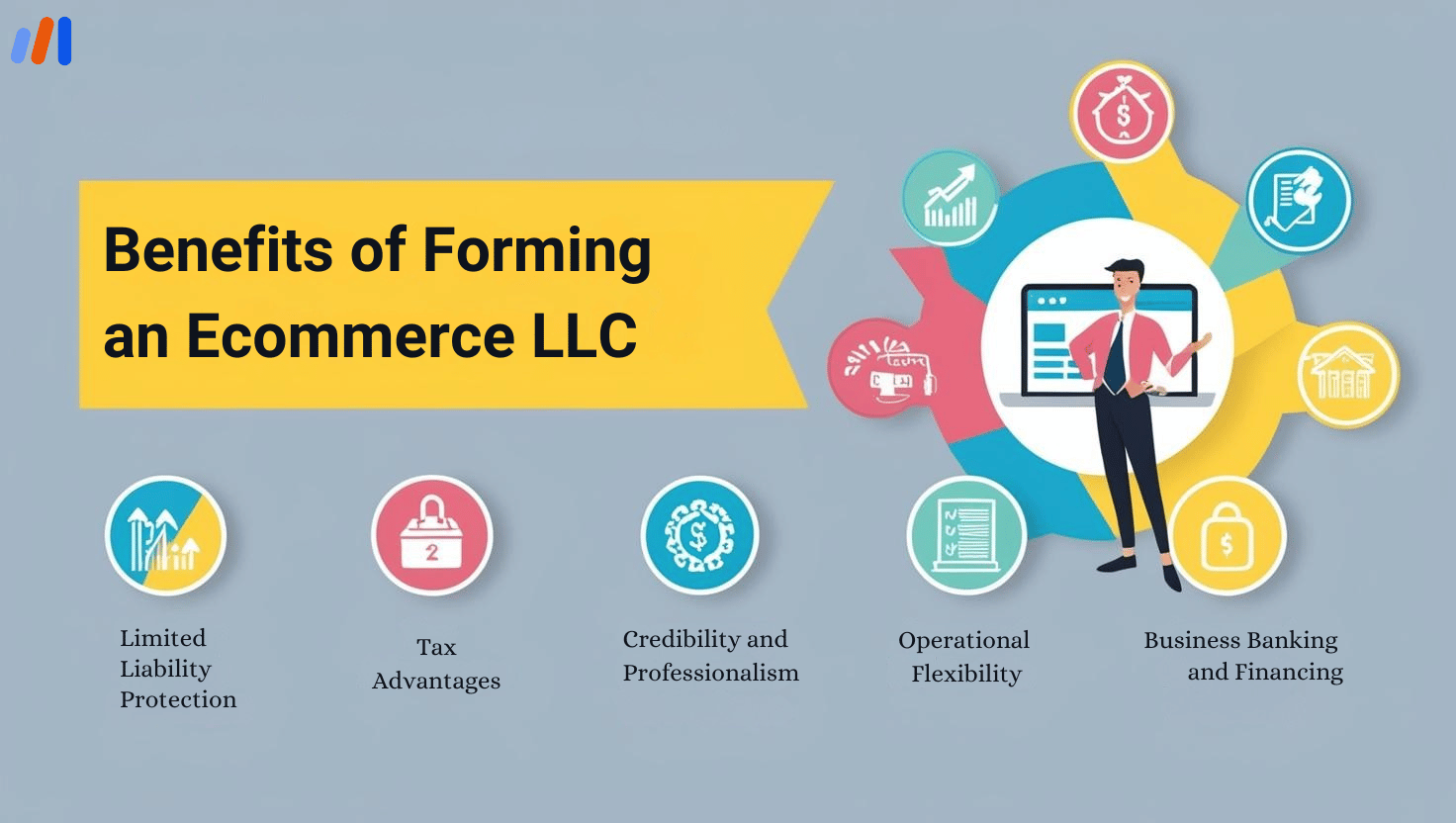

Benefits of Setting Up an Ecommerce LLC For Your Online Business

1. Limited Liability Protection

One of the biggest benefits of an LLC is that personal and business assets are completely separate.

In case your eCommerce venture has to face a lawsuit, debt, or other legal issues, your personal belongings like a house or bank savings will not be impacted.

This is critically important for online businesses, which are more susceptible to legal issues due to the wide variety of customers, vendors, and transactions that usually take place on the Internet.

2. Tax Advantages

Online LLCs are also eligible for pass-through taxation, where the business’s income is considered the owner’s income for tax purposes.

LLCs also have the option to be treated as an S Corporation to lower self-employment taxes.

Furthermore, many online e-commerce businesses are eligible for considerable tax deductions over expenses such as the purchase and upkeep of the website, advertising, and even software subscriptions.

3. Credibility and Professionalism

Forming an LLC helps with trust building as it offers an e-commerce business model a professional touch which is essential to build credibility with customers, suppliers, and even potential investors.

Having an LLC also increases the credibility of an online brand business which leads to branding perception as being more established. Higher credibility boosts customer confidence leading to improved conversion rate and increased revenue.

4. Operational Flexibility

An LLC has more freedom with management and decision-making compared to corporations that have to operate under severe restrictions.

E-commerce companies can easily craft their LLCs to fit their business needs without facing stringent regulations.

Whether you are operating a drop shipping business, an Amazon FBA store, or an online boutique, an LLC helps you achieve your objectives by streamlining business management.

5. Easier Business Banking and Financing

As an LLC, you can easily open a business checking account, apply for business credit cards, and obtain financing which assumes an added layer of convenience. Additionally, bookkeeping and tax reporting become effortless with this financial separation.

Sole proprietors often have a harder time securing loans or credit lines to grow their business, however, LLC owners have an advantage because most financial institutions prefer working with registered business entities.

6. Protection of Brand and Intellectual Property

Filing your e-commerce business as an LLC protects your brand name and intellectual property from competitors who may try to impersonate your business.

With a registered legal business entity, your claim to trademark, brand assets, product names, and other market differentiators is secured and strengthened.

Is an E-commerce LLC Suitable for Everyone?

An LLC has many advantages but may not apply to every e-commerce entrepreneur.

If you do not have much risk in your side gig, a sole proprietorship may be more suitable for you, but, if you expect to grow your online business, work with suppliers, or manage large transactions, then an LLC is the most effective choice.

Some e-commerce businesses may need more sophisticated legal corporate structures than a browser-based LLC S-Corporation or C Corporation primarily if they will be raising venture capital.

Business goals and risk appetite are the determining factors of whether an LLC is preferable or not, which is best discussed with a business advisor or legal practitioner.

What Are the Steps to Create an E-commerce LLC?

Step 1: Create a Business Name

The name of a company is one of the first elements that potential consumers look out for. Ensure that it is:

✅ Distinctive: The name of your LLC must be unlike or quite different from any business registered in your state. You can check name seasoning through your state’s Secretary of State website.

✅ Accurate: The name must have, as a minimum, “LLC” or “Limited Liability Company” or some abbreviation as your state accepts.

✅ Compliant: As you run an e-commerce business, having a relevant domain widens your reach when it comes to branding and online business chances.

💡 Tip: If you are not prepared to file right now, it is a great recommendation to save your name. A lot of states give you the option to take a name for a specific fee.

Step 2: An LLC demands the filing of Articles of Organization.

This is done with the office of the Secretary of State. In certain states, it may be termed a Certificate of Formation. Once an LLC is registered, we can file for eCommerce. The articles comprise of the following details:

📌 Business Name

📌 Registered Agent Details (A person or service assigned to take care of legal documents)

📌 Business Address

📌 LLC Member Information (Members/owners of the LLC)

💲 Registration costs: between $50 and $500, varying from state to state. Other states may demand a report at the beginning or end of the year.

📅 Wherever an application is made, documentation can take a few days or lag for weeks. There are also advanced filing expedites that are available at an additional cost, for those that are in a hurry.

Step 3: Obtain an EIN (Employer Identification Number)

Regardless of what type of business you have, all LLCs and Corporations have to be filed with an EIN. The reason one is given an Ein is also referred to as Federal Tax ID Number, the head office of Internal Revenue Services will be granting you this.

🔹 Opening a business bank account

🔹 Filing federal tax obligations

🔹 Employee onboarding (if needed)

🆓 Cost: Simply go to the Internal Revenue Service’s website and you will find an EIN certificate. You have three options, online, fax, or mail.

Step 4: Create an Operating Agreement

An Operating Agreement is where your LLC will function. While this document is not mandatory in all states, we suggest having it because it does the following:

✅ Specifies ownership distributions to members

✅ Details of how company decisions will be made

✅ Provides procedures for adding and exiting members

✅ Avoids disputes between business associates

If you are a single member, Operating Agreements can also prove the separation between your business finances and personal finances which is extremely important to maintain your limited liability protection.

Step 5: Comply with Tax and Licensing Requirements

Because eCommerce businesses have an online footprint, tax regulations differ depending on where your business is based and the geographical location of your customers. Below are some important points:

📌 Sales Tax Permits: If you sell physical products on your eCommerce site, you’ll likely need a sales tax permit. This applies to states where even online sellers are required to take the tax.

📌 Business Licenses: Find out if you need to get an eCommerce or a home-based business license from your home state or local authorities. There are rules unique to certain states and cities regarding online businesses.

📌 State and Federal Taxes: LLC owners report business income on their tax returns (pass-through taxation).

Some states have an LLC franchise tax, and some have an annual tax fee for LLCs.

💡 Tip: Get expense tracking software or an accountant to manage bookkeeping and filing once tax season rolls around.

Step 6: Set Up a Business Bank Account

To protect your assets when you start your eCommerce business, you should open a business bank account. By doing this you can:

🔹 Make accounting and tax filing easier

🔹 Establish the business credit profile

🔹 Safeguard the limited liability feature

Mercury and Brex are some online banks that provide eCommerce businesses with business accounts that come with zero transaction fees and eCommerce platform integrations.

📌 Usually, you will require the following:

✅ EIN (Employer Identification Number)

✅ LLC formation documents (Articles of Organization)

✅ Operating Agreement (sometimes required)

💡 Pro Tip: You may apply for a business credit card to take care of expenditures while earning rewards simultaneously.

Step 7: Set Up Accounting and Bookkeeping Systems

Proper monitoring of the finances is crucial for the growth of a company or even fulfilling its tax obligations, for that you may check:

📌 Bookkeeping Service: Track profits, expenses, or tax liabilities with EasyBooks by EasyFiling.

📌 Accounting Software: Use QuickBooks, Xero, or Wave for automating invoicing, expenses, payrolls, and much more.

📌 Hiring an Accountant: A tax professional can help you file taxes so you remain compliant and can also assist in maximizing s deductions.

💡 Tip: Do not mix business and personal transactions to decrease your bookkeeping burden and prevent legal issues.

Why Choose Easyfiling to Form Your E-commerce LLC?

Although it might seem complicated, forming an LLC is easy with Easyfiling, as we work to make your life easier. Easyfiling provides:

- eCommerce LLC Formation Services, because time is of the essence and we ensure all terms get filled fast.

- You will receive Compliance Assistance to ensure all federal or state requirements are met including sales tax registrations and operating agreements.

- Also, business support in the form of tax and bookkeeping aid so that managing finances becomes easy.

- Cheap Rates, making certain you get the best out of their business set up services without having to pay too much money.

Easyfiling offers additional services like registered agent representation which ensures that your business is compliant and legal.

With Easyfiling, all of the heavy legal lifting involved in setting up an LLC is taken care of, allowing you to expand your online business.

In Summary

Limited Liability Companies are a great option for many e-commerce sites due to their liability protection, favorable tax treatment, and operational flexibility.

Although these benefits are appealing to every online entrepreneur, only those willing to expand their business should incorporate an LLC.

Having an established business structure mitigates any legal and financial issues down the road.

You are now able to breathe a sigh of relief knowing that Easyfiling makes it easy to have all the necessary documents at hand for the smooth running of an LLC for your online business.

What are you waiting for? Take the first step in guaranteeing your e-commerce success by reaching out to Easyfiling today!

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now