If you are planning to start a new business in the USA or do you need an Employer Identification Number (EIN) for tax purposes? Now the good news for you is that if you have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) you can now apply Online for your EIN. In this blog post, we’ll guide you step-by-step through how you can get your EIN quickly and effectively.

What is an EIN & why is it important?

To identify your business Nature, the Internal Revenue Service (IRS) provides you with a unique nine-digit number known as an Employer Identification Number (EIN). No matter whether you are a sole proprietorship, an LLC, or a corporation it’s necessary to manage your business’s Financial and legal responsibilities you will require an EIN for various other purposes Such as:

- Filing Tax returns

- Opening a business bank account

- Applying for business licenses

- Hiring employees

- Processing payroll

What are the Requirements to Apply an EIN Online?

Before you begin the online Application process you need to have the following documents:

- Personal Identification: Your SSN or ITIN

- Business Information: Legal name, trade name (if possible) mailing address

- Responsible Party Information: The name, SSN, ITIN, or EIN of the responsible party (the person who owns or controls the business)

- Business Type: The legal structure of your business (e.g., sole proprietorship, partnership corporation, LLC)

- Reason for Applying: The purpose of the EIN (e.g., starting a new business, hiring employees, banking purpose)

Step-by-Step Guide to Apply an EIN Online:

Access the IRS EIN Application Website & Begin Your Application:

Visit the IRS EIN application page. The application process is available online and is free of charge,

Click on the “Apply Online Now”

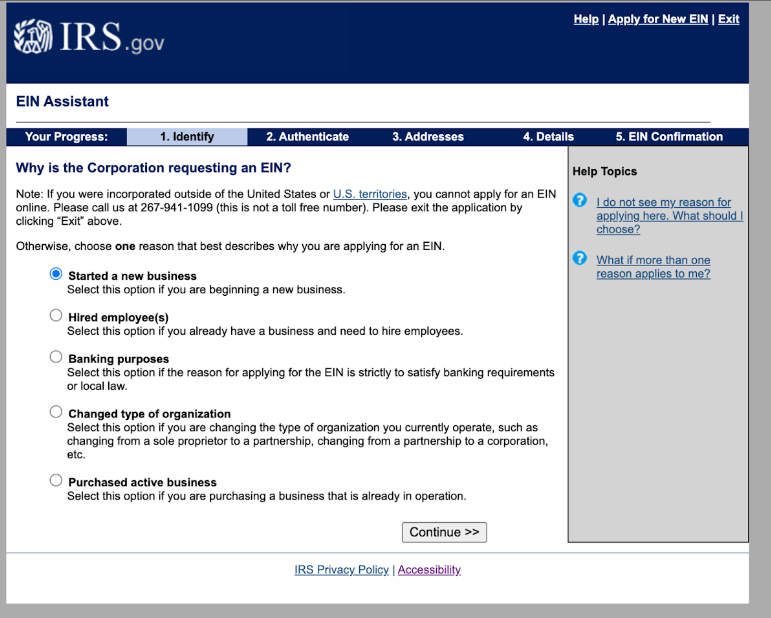

1. Identify

Select the reason why you are applying for an EIN (e.g., starting a new business, banking purpose, hiring employees, changing the type of business, or buying an active business) then click on continue.

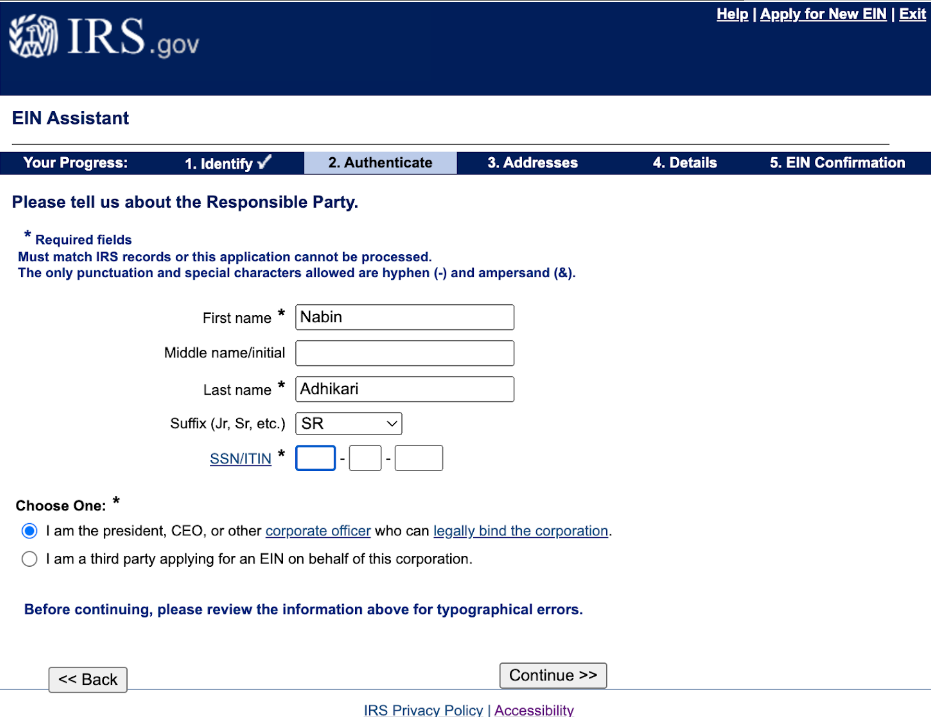

2. Authenticate

Enter the name and SSN/ITIN of the principal officer, general partners, grantor, owner, or trustor. Then review the information once again and click on continue.

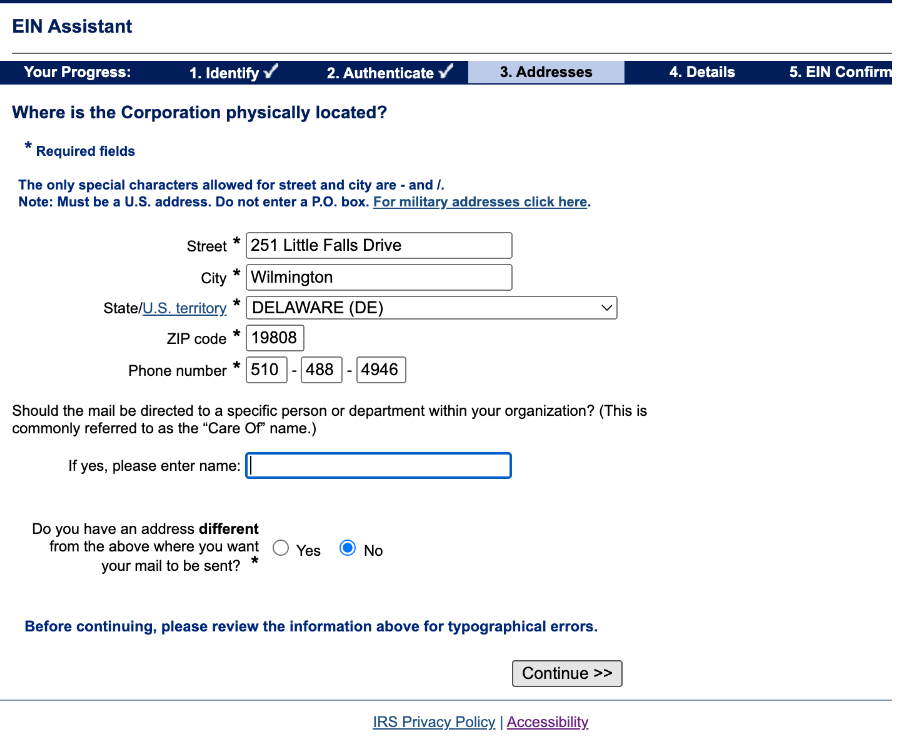

3. Addresses

Where is your business located, fill in correctly including street, city, state, ZIP code, and phone Number. Do you have an address that is different from your business address? If yes you can set a different address where you want mail to be sent otherwise click on NO review once again and Click on Continue.

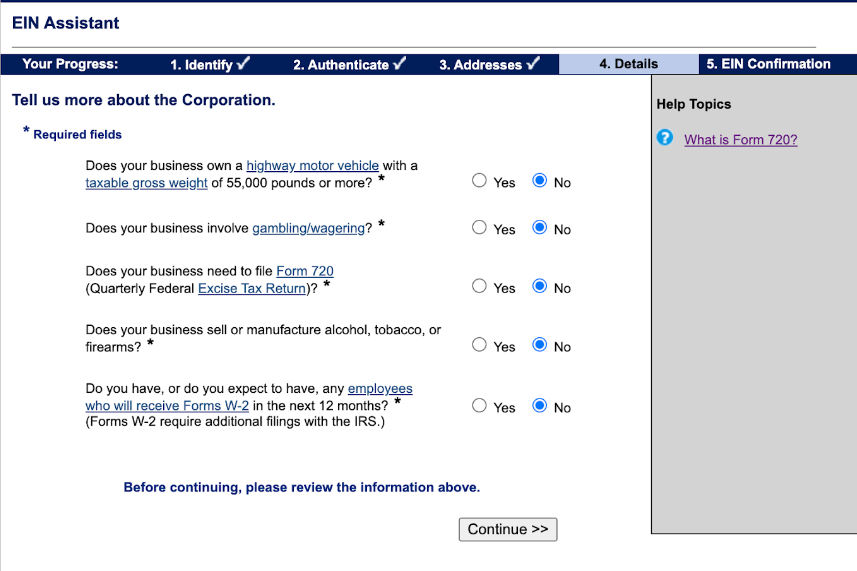

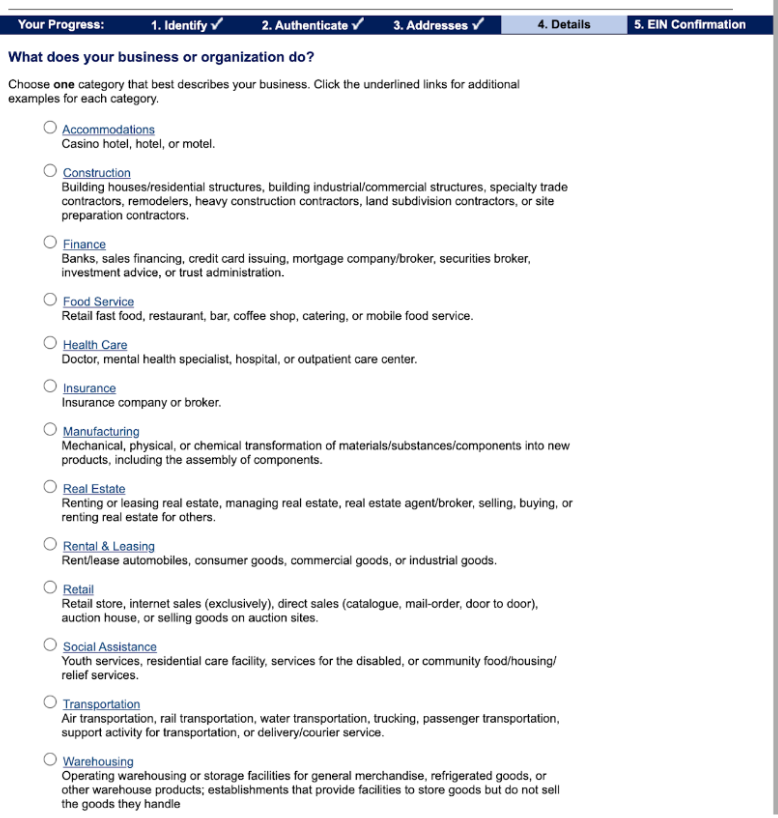

4. Details

Depending on the business type you choose, you will be asked for specific details, provide additional information about your business, and click continue after providing the necessary information.

Review the information entered to ensure accuracy before submitting the application or if you are missing any information you can assign a person who can help you to fill in the missing details.

EIN Confirmation

If the application is completed successfully, you will receive your EIN immediately upon completion. You will have the option to download, save, and print the confirmation notice containing your new EIN.

Now how can you get your EIN without any hassle?

If you are a business owner, or entrepreneur who wants to get your EIN, but don’t have time to fill in this information online then EasyFIling is all you need. With our expert team who are helping businesses and entrepreneurs all over the world, you can be the next to get your EIN without filing any documents by yourself just by providing your details to us.

Why choose EasyFiling?

- Positive Customers Review

- Time-saving Convenience

- Experts Assistance

- Fast Procession

- Transparent Pricing

- Excellent Customer Service

Still, if you don’t have your SSN or ITIN number ready, you can now apply for your EIN. For that, you can read the article, How to apply for EIN without an SSN or ITIN. Easy option! Simply connect with EasyFiling.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now