In today’s rapidly changing business environment, navigating the complex landscape of regulations is increasingly crucial for entrepreneurs, small business owners, and startup visionaries. Ensuring compliance not only helps avoid legal pitfalls but also sets the foundation for sustainable growth. A key regulatory aspect that is gaining attention in 2024 is the Beneficial Ownership Information (BOI) Filing.

This comprehensive post is designed to demystify the process of BOI filing. We will dive deep into what BOI filing entails, outline the specific requirements set forth for businesses, and provide detailed, actionable advice to ensure your business does not just remain compliant but thrives in doing so.

Understanding the intricacies of BOI can seem daunting at first, but with the right information and approach, it is a manageable and crucial part of your business’s legal responsibilities. Let’s explore how you can navigate these regulations effectively, ensuring your business is well-positioned for the future.

What is BOI Filing?

BOI filing is a regulatory requirement that involves submitting information about the beneficial owners of a company. A beneficial owner is typically someone who owns or controls a significant percentage of the company’s shares or voting rights, or who has significant control over the company’s management.

The primary goal behind BOI filings is to enhance transparency, combat financial fraud, and prevent money laundering activities.

What are BOI Filing Requirements for 2024?

The new mandate requires all business entities, including LLCs, partnerships, and corporations, registered in the United States, to complete the Beneficial Ownership Information Report. This move aims to enhance transparency and accountability in business operations. Non-compliance could result in penalties, making it more important than ever to ensure you’re prepared.

What to Report?

The report requires details about beneficial ownership. This includes names, addresses, and identification documents for individuals or entities that directly or indirectly own or control your company. Be prepared to provide documents like a driver’s license or passport for identity verification.

- Identification of Beneficial Owners: Companies must identify individuals who directly or indirectly own 25% or more of the company’s equity interests or have significant control over the company.

- Submission of Personal Information: For each beneficial owner, companies must submit personal information, including name, address, date of birth, and an identification number (such as a Social Security number or passport number).

- Annual Updates: Any changes in beneficial ownership must be reported within a stipulated time frame to ensure the information is current and accurate.

BOI Filing for Process

Limited Liability Companies (LLCs) are not exempt from BOI filing requirements. If you own an LLC, you must file a BOI report if your business meets the criteria specified for reporting entities. This includes newly established LLCs, foreign LLCs operating in the U.S., and existing LLCs undergoing changes in beneficial ownership.

Before we dive into the filing process, it’s essential to understand what a BOI entails for an LLC. A BOI typically includes information about the company’s management structure, operational procedures, and compliance strategies with state and federal laws. This document is vital for maintaining transparency with regulatory bodies and can be required for various operational or financial activities.

Step 1: Determine the Requirement

- Check Local Laws: The first step in the BOI filing process is to check with your state’s Secretary of State office or local business agency to determine if a BOI is required for LLCs. Requirements can vary significantly from one jurisdiction to another.

Step 2: Gather Necessary Information

Once you’ve decided that your LLC requires a BOI, you’ll need to compile the following details:

- Business Name and Address: Your LLC’s legal name and its principal business location.

- Employer Identification Number (EIN) and Incorporation Date:

- Beneficiary Owners’ Details and Address: Information such as Passport, Date of Birth, Address, etc.

Step 3: File Online

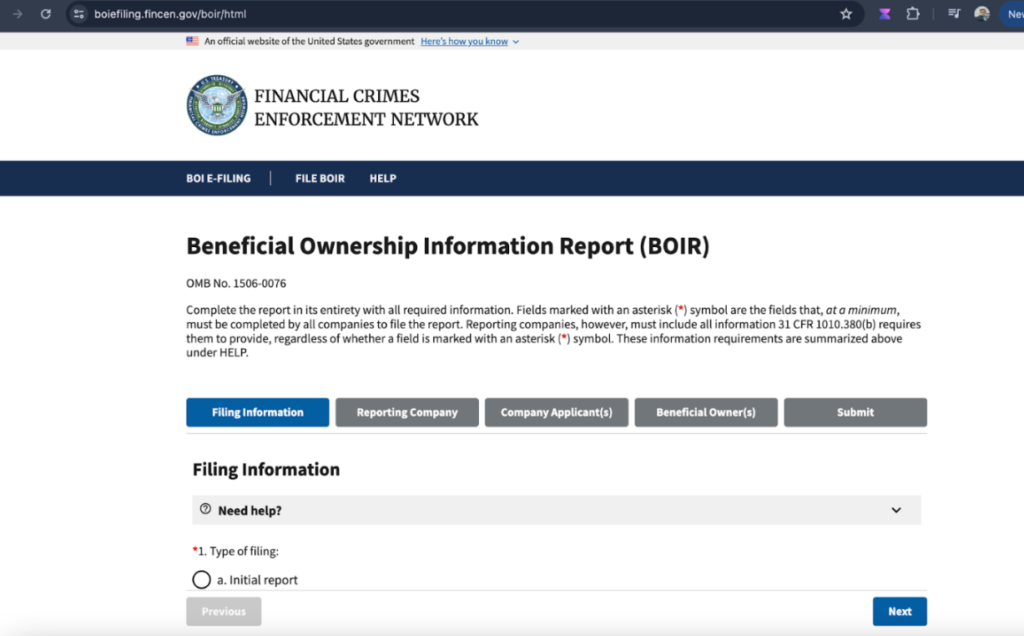

Go to the Fincen BOI Reporting web portal FinCen choose File Online BOIR and Go to the BOI Efiling and provide the details required for the report as Reporting Company, Company Applicant, and Beneficial owners and submit. shown in the image below:

- First, direct your browser to FinCen. This is the gateway to accessing the Bureau of Financial Crimes Enforcement Network’s (FinCEN) Bank Owned Insurance (BOI) reporting tools.

- Upon arrival, you’ll want to select the “File Online BOIR” option.

- The next step is entering the BOI E-filing system. Here, you will be prompted to provide detailed information necessary for the report. This includes data about the Reporting Company, the Company Applicant, and the Beneficial Owners. Each category must be filled out accurately to ensure that the submission meets all regulatory requirements.

- Finally, after double-checking the information for accuracy, submit your report. The process is designed to be intuitive, but accuracy and attention to detail are paramount to ensure compliance.

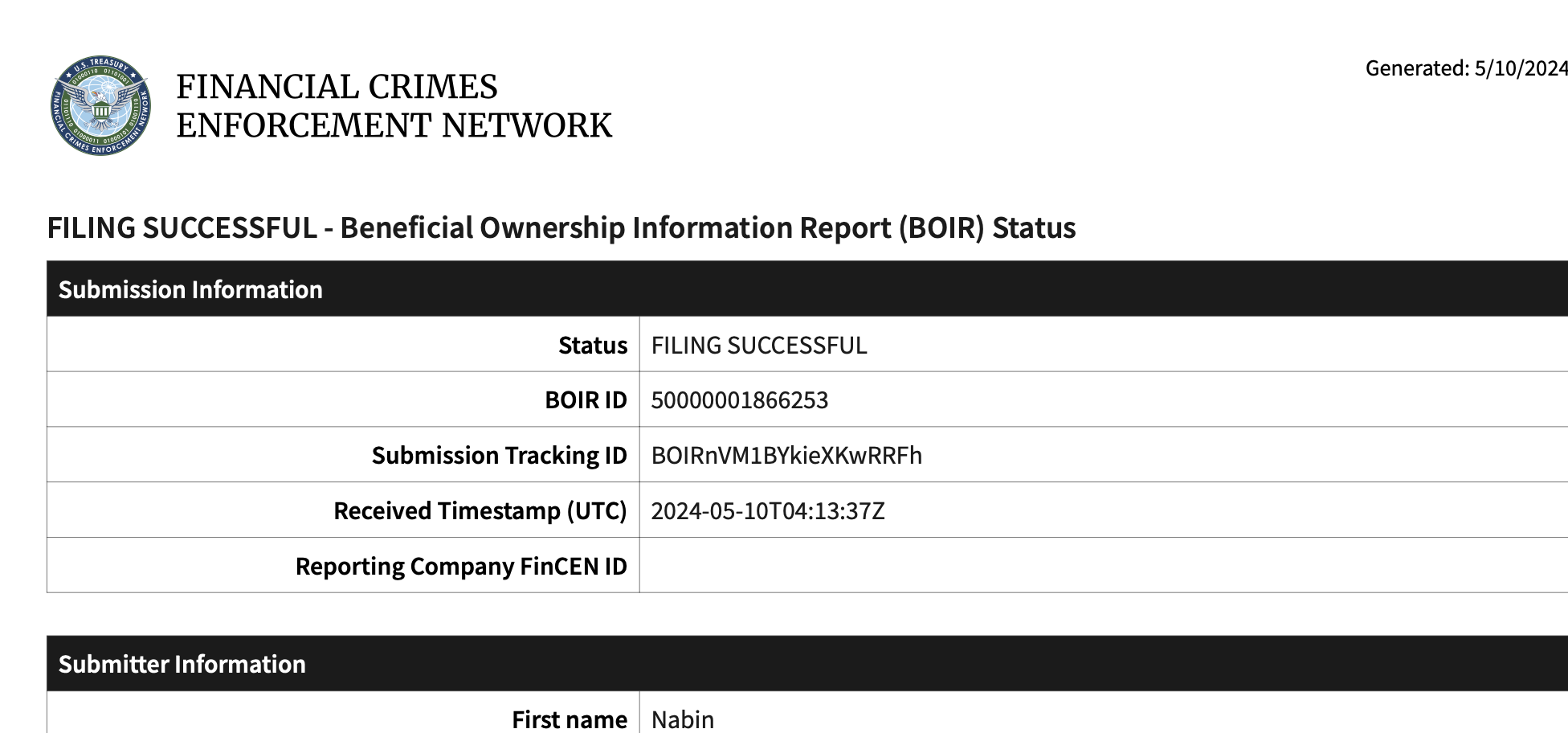

- Upon submission of the report, a transcript along with a submission ID will be generated as shown below. Please retain this document for future reference.

Deadline for BOI Reporting

The Financial Crimes Enforcement Network (FinCEN) has unveiled its Beneficial Ownership Information (BOI) E-Filing portal, which went live on January 1, 2024.

Any reporting entity established or registered to operate before this date is granted until January 1, 2025, to submit its inaugural BOI report. All new companies registered in 2024 must report to BOI within 90 days of registration, followed by a subsequent report after 30 days.

Penalties for Not Filing BOI Report

The penalties for not meeting BOI reporting obligations or for unauthorized disclosure or use of BOI have increased from $500 to $591 daily, starting January 25. This adjustment stems from the Corporate Transparency Act (CTA), enacted in 2021, which requires BOI reporting. Failure to comply with the CTA could lead to civil penalties of $500 per day and criminal sanctions, including fines up to $10,000 and up to two years in prison. The severity of the penalties depends on the degree of non-compliance.

Who Needs to File a BOI Report?

FinCEN BOI reporting entities include:

- Corporations, Limited Liability Companies (LLCs), limited partnerships, and any entities established through the submission of a document to a secretary of state or a similar state agency, or a tribal government agency.

- Foreign entities, such as corporations and LLCs, that have registered to conduct business in the U.S. by filing a document with a secretary of state.

All entities within the U.S., regardless of their formation date, are considered reporting entities unless they qualify as exempt entities.

How to File a BOI Report for a Limited Liability Company (LLC)

Filing a BOI report is a critical process that involves a few detailed steps:

1. Identify Beneficial Owners: The first step in this process is to determine who qualifies as a beneficial owner under current regulations. This typically includes individuals who own a certain percentage of the company or who have significant control over the company’s decisions.

2. Collect Required Information: Once beneficial owners have been identified, the next step is to gather all necessary personal information from each of these individuals. This information often includes full names, addresses, and social security numbers or other identification numbers.

3. Choose a Filing Method: After collecting all the required information, you must decide on the most suitable method for filing the report. This decision involves choosing between submitting the report online, which is often the most efficient method, or opting for other means that the regulatory authority may provide, such as mail or in-person submission.

4. Submit the Report: The final step is to accurately complete the BOI report and submit it by the deadline specified by the regulatory body. This involves ensuring that all information is correct and that the report meets any format or content requirements set forth by the authorities.

By following these steps carefully, LLCs can successfully comply with regulations requiring the submission of BOI reports, thus maintaining transparency and helping to prevent financial crimes.

Conclusion

BOI filing is a pivotal aspect of promoting business transparency and integrity within the financial ecosystem. By understanding and adhering to the 2024 requirements, entrepreneurs and business leaders can play a significant role in this initiative while steering clear of the consequences of non-compliance. It’s important to remember that maintaining compliance is not only about following regulations—it’s about building trust and credibility for your business.

In wrapping up, we at EasyFiling are proud to offer top-tier BOI filing services designed to cater to your specific business needs. Our dedicated team is here to demystify the reporting process, ensuring that your business not only stays compliant but also remains informed and ahead in the realm of financial transparency.

We are committed to making compliance easy for you, providing customized support, and employing our expertise to manage the intricacies of BOI reporting for you. With EasyFiling as your reliable compliance partner, you can concentrate on what you excel at expanding your business.

FAQs about BOI Reporting

Q: Can I file a BOI report myself, or do I need a lawyer?

A: While it’s possible to file a BOI report on your own, consulting with a lawyer or a compliance expert can ensure accuracy and completeness, especially if your business structure is complex.

Q: How often do I need to update my BOI information?

A: You must update your BOI information anytime there’s a change in beneficial ownership or if any of the information previously submitted has changed.

Q: Are there any resources available to help with BOI filing?

A: Yes, many online resources, including official regulatory websites, offer guidance and tools to assist with BOI filing. Additionally, professional services specializing in compliance can provide tailored support.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now