Invest in US stocks from Nepal may seem daunting, but with the right tools and guidance, it’s entirely feasible. To get started, you’ll need access to a global trading platform that accepts Nepalese residents. Platforms like Interactive Brokers, TD Ameritrade or Charles Schwab offer such services.

First, you’ll need to open an account with your chosen platform. The process typically involves filling out an online form with your personal and financial details. Next, you’ll need to fund your account. This usually involves transferring money from your bank account in Nepal to your new brokerage account.

Once your account is set up and funded, you can start investing in US stocks. You can buy and sell stocks on the platform, track your investments, and withdraw your earnings back to your bank account in Nepal. Remember to consider the exchange rates and tax implications of investing in US stocks from Nepal. Always do your research and consider seeking advice from a financial advisor before making any major investment decisions.

1: Investing in US Stocks from Nepal:

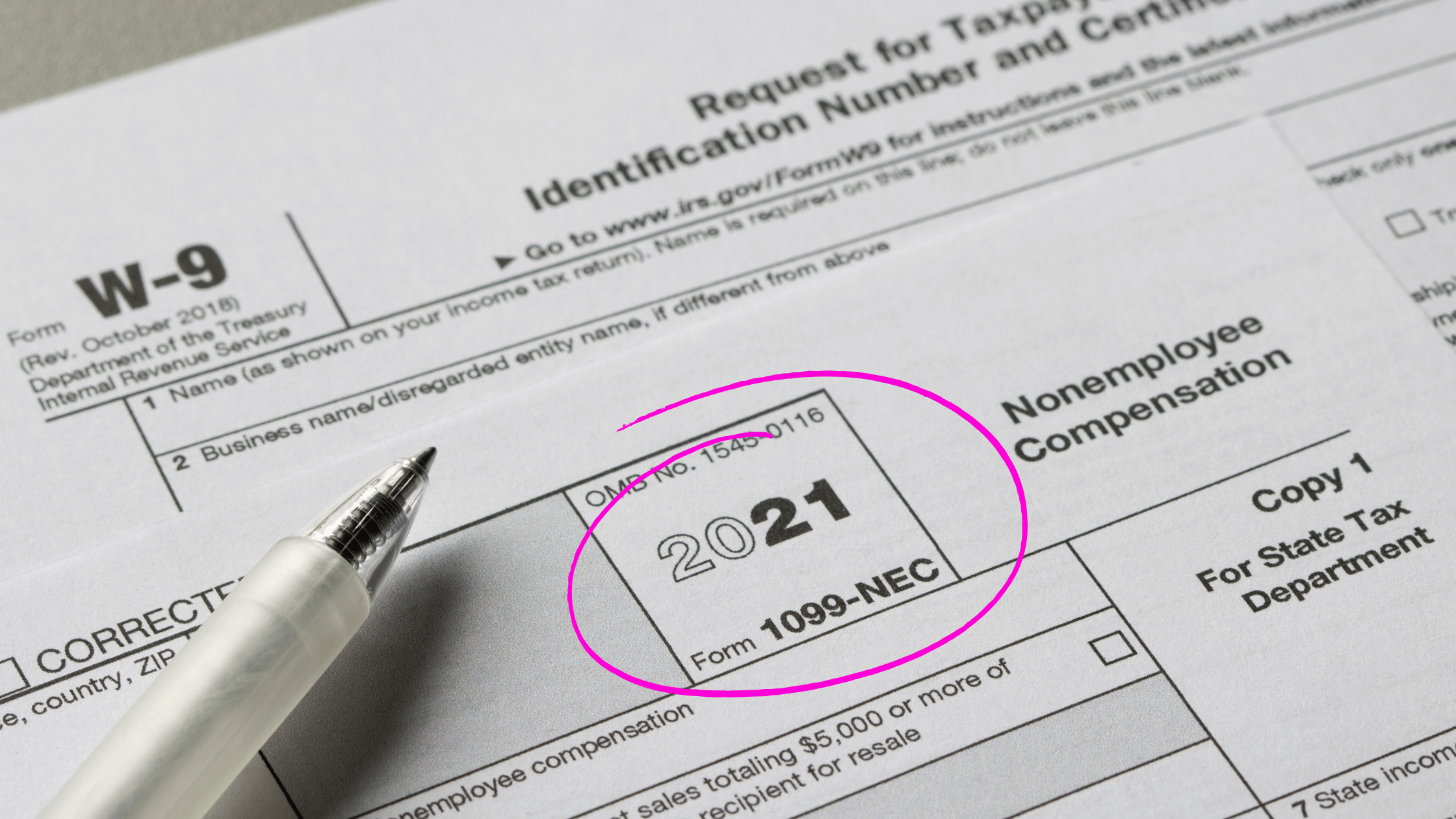

When it comes to investing in US stocks from Nepal, brokers typically require a Tax Identification Number (TIN) such as an Individual Taxpayer Identification Number (ITIN) for non-U.S. citizens or a Social Security Number (SSN) for U.S. citizens. The good news is that you can apply for an ITIN from any location with the help of [EasyFiling](https://easyfiling.us/), a reliable service that facilitates the ITIN application process. By obtaining an ITIN, you will be able to open a personal brokerage account and start investing in US stocks.

To open a personal brokerage account, you will usually need to provide the following documents:

- Tax Identification Number (TIN): Individual Taxpayer Identification Number (ITIN) for non-U.S. citizens or Social Security Number (SSN) for U.S. citizens.

- Proof of identity (such as a passport or ID card).

- Proof of address (utility bills or bank statements).

- Employment and Financial Information:

- Information about your current or most recent employer.

- Annual income.

- Statement of Net Worth (Asset Value minus Debts).

- Trading Experience and Objectives:

-

- Details about your trading background (duration, frequency, types of securities, etc.).

- Your investment goals (capital growth, income production, capital preservation, etc.).

2: Investing in US Stocks from Nepal:

Nepalese individuals and businesses can also invest in US stocks. If you are interested in tax savings and easy maintenance, we recommend setting up a Wyoming LLC. Forming a limited liability company in Wyoming offers advantages such as low tax rates and simple administration. With the assistance of EasyFiling, establishing a company in the United States becomes hassle-free. Once you have obtained the US formation certificate, EIN number, bank account, and proof of address, you can open a brokerage account. While there are other broker options available, we have found Interactive Brokers to be a reliable choice for international traders. To open a Business Brokers account, you will typically need to provide the following documents:

- Certificate of Incorporation: This document demonstrates the company’s existence and registration.

- Articles of Association: The legally binding document that outlines the internal operations and organizational structure of your business.

- Proof of Business Address: Documents that verify the physical address of your company, such as utility bills or lease agreements.

- Business Bank Account Information: Details of the company’s bank account, including the bank name, account number, and branch address.

- Tax Identification Number: The tax identification number issued by the relevant tax authority for your company.

- Financial Statements: Recent financial statements or audited reports that provide an overview of the company’s financial position.

- Corporate Resolution: A document authorizing specific individuals within the company to open and operate the Interactive Brokers account on behalf of the organization.

- Authorized Signatories: Identification documents (such as passports or ID cards) and signatures of the individuals authorized to act on behalf of the company.

Step 3: Familiarize Yourself with the US Stock Market

Learning the ins and outs of the US stock market is a must before investing in any companies listed there. Get familiar with stock market lingo, know the difference between fundamental and technical analysis, and study major stock exchanges including the New York Stock Exchange (NYSE) and the National Association of Securities Dealers (NASD). You can use this information to make smart choices about your investments.

Step 4: Monitor and Review Your Investments

Keeping an eye on your US stock portfolio and reviewing it on a regular basis is essential. Keep abreast of developments in the economy, company announcements, and the stock market that could have an effect on your assets. It’s essential to check in on your portfolio’s progress on a regular basis and make any necessary adjustments to keep it in line with your investing strategy.

Step 8: Stay Disciplined and Patient

Putting money into the US stock market is something you do for the long haul. Maintain self-control and don’t let short-term market swings influence your financial selections. Invest with a long-term horizon, keep your attention on the basics of your portfolio, and be patient when the market fluctuates.

Also read, Non-U.S. Resident? How to Invest in US Stocks as a foreigner ?>>

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now