A Series LLC is a new type of limited liability company (LLC) that permits the establishment of several sub-entities, called “series,” with the main parent being one LLC only.

Each series may be regarded as a separate entity about ownership of assets, liability exposure, and other operational activities. Structural organization is useful for companies with several operations/ assets because it is cost-effective and offers limited liability protection.

Established in Delaware in 1996, the Series LLC has steadily been adopted and is now offered in Illinois, Texas, Nevada, and Tennessee. It continues to be a rare choice however owing to its structure that is highly regulated and is also not recognized by many states.

Key Features of a Series LLC:

✅ Liability Segregation:

Another major distinctive feature of a Series LLC is that it allows for liability protection between series. If one series is subject to a lawsuit or has a debt, the general liabilities of the other series and parent LLC will be insulated, assuming that there are adequate boundaries in recording and operational conduct.

✅ Independent Operation:

Every other series can have its assets, sign contracts, and carry out business activities without the intervention of other series. It can also have unique members, managers, and operating agreements hence enabling specific governance for each series.

✅ Cost Savings:

Starting and managing a Series LLC involves much lower costs than starting and managing multiple LLCs. For example, the cost of filing and annual report fees tend to be incurred for the parent LLC only and not on all the series.

✅ Centralized Management:

Even though every series functions on its own, all the series fall within the operational framework of the parent LLC. Such a structure can help to streamline the administration of many of the routine business functions such as compliance, reporting, and taxation.

✅ State-Specific Nature:

The Series LLC is not recognized in all states. Even in states that permit the formation of this type of business entity, the statutory requirements and protections given to Series LLCs diverge greatly. Likewise, Series LLCs are likely to encounter difficulties when they operate in states that give no overt support for them.

✅ Flexible Taxation:

Within a Series LLC, every series can choose the type of tax that they want to be classified as; be it a disregarded entity, partnership, or corporation depending on its situation. Such a variable can present many favorable tax alternatives in tax planning.

How a Series LLC Works:

1. Formation Process:

A Series LLC is established in the same way as a regular LLC: by filing Articles of Organization (or equivalent) with the appropriate state. At this stage, the parent LLC indicates that it wishes to operate as a Series LLC.

Not every state has Series LLCs and, where they do, they may differ in how they need to be formed. For instance, Delaware and Illinois require that the Articles of Organization of the parent LLC contain a statement to the effect that it is permitted to set up a series.

2. Operating Agreement:

The parent LLC adopts the more comprehensive operating, management, and governance rules of the entire entity/framework. In turn, series can each have their operating agreement to define their unique operational and governing structure. This offers a lot of room for customization.

3. Asset Segregation:

One fundamental principle underlying the retention of liability protection between series is that there should be an appropriate degree of segregation as regards the assets and records. Each series must open and maintain separate sets of bank accounts, financial records, and documentation of asset ownership. If a series of this separation is violated loss of protection may be held by a Court in a situation where the liability cover between series is inviolable.

4. Business Operations:

Every individual series is allowed to:

- Possess assets like properties, which may include real estate and intellectual property

- Sign contracts and other agreements.

- Operate as a separate business and accordingly advertise itself under different names of its choice.

- Hire employees.

Although these operations are carried out independently, all series deprive the concerned customers of the administrative burden as many duties are centralized and fall under the required parent LLC level.

5. Taxation Considerations:

The treatment and tax implications of Series LLCs are different in different jurisdictions:

- At the federal level also, one series does not interfere with the status of other series of the same company.

- There are several states in which all income tax treatment of series accompanied with LLCs are treated as a single entity for taxation purposes making returns for the series.

- Cross-state businesses should seek the services of a tax consultant, for navigation through the rough sea of tax compliance of their businesses.

Use Cases for a Series LLC:

1. Real Estate:

A majority of the real estate investors and property holders that are involved in Series LLCs frequently have more than one property. This is sufficient to place each in its series for liabilities to be isolated. For example, if a tenant wanted to file a lawsuit that caused damages to one single property, all other properties owned by any different series are abundant and are not at all threatened.

2. Franchising:

A series can be allocated to each franchised location hereby every franchiser is free to allocate even all resources to opening more franchises. This organization maintains the management structure but all of the one’s franchise’s assets are insulated from the others that have incurred hazards.

3. Investment Management:

Divided ownership is very well useful in managing a series LLC The Unit holders will be able to appoint each series to every investment or type of asset, thus limiting cross-liability.

4. E-commerce and Retail:

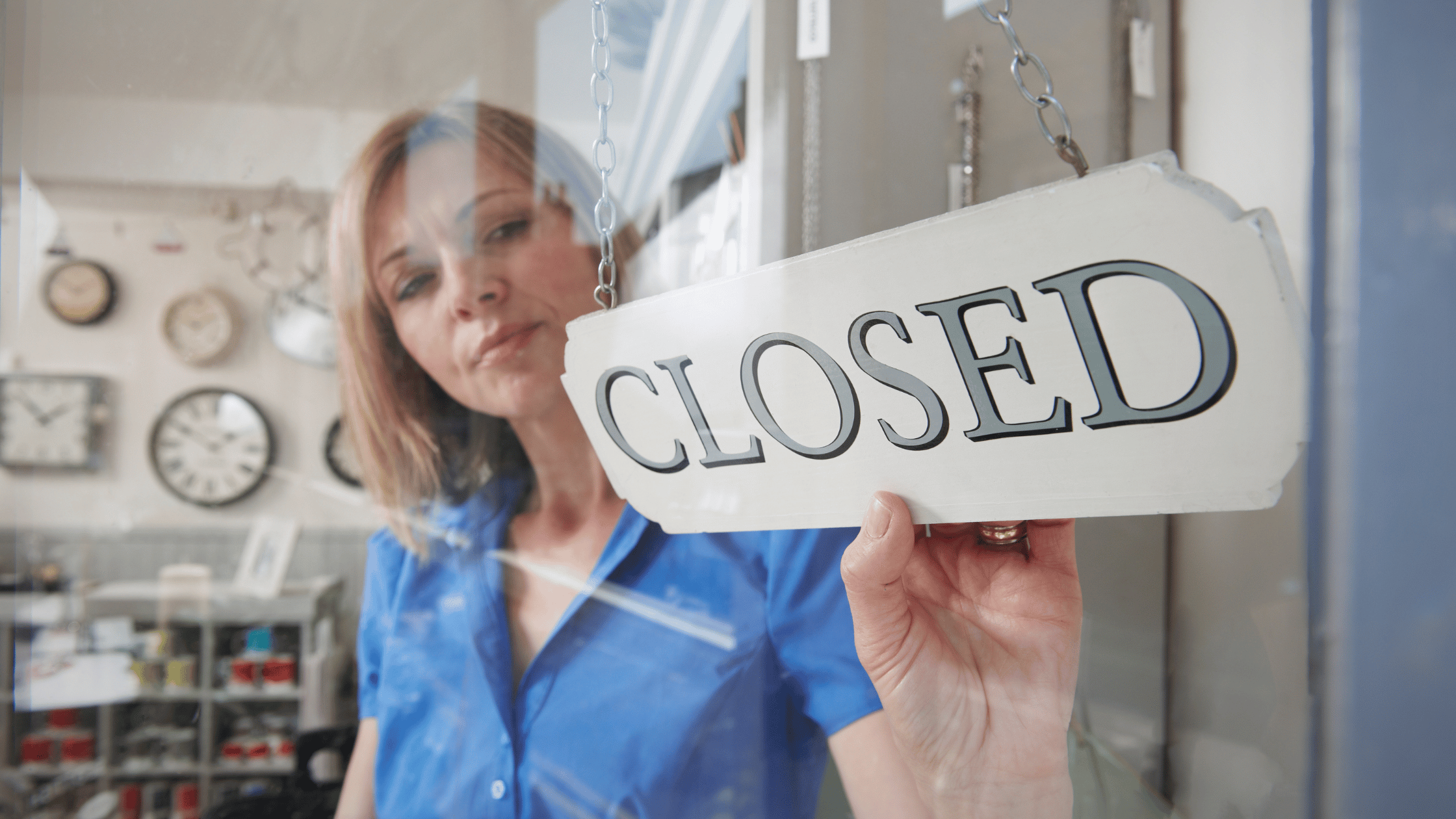

A business owner possessing several online stores or retail shops may be able to incorporate Series LLC sections to cater to their separation needs. To secure liabilities, sub-divisions under a store or a line of a products can be utilized.

5. Professional services:

Valuable ideas come with actionable recommendations or consultants therein, who can divide their division to accommodate various services. A consultant, for example, could specialize in providing its services, marketing services, and business strategy, each of which may be established in its series.

Advantages of a Series LLC:

✅ Cost Efficiency:

Given that Series LLC is a single entity, it becomes cheaper and cost-effective when compared to creating several LLCs, both for filing and operational costs such as annual renewal fees are greatly reduced.

✅ Enhanced Liability Protection:

If followed to the letter, all the series will be protected from any liability arising from the other series or the parent LLC.

✅ Customizable Structures:

Managing One series or the requirements of one series allows for more operational flexibility when it comes to the management, ownership, and operation of each series.

✅ Simplified Administrative Tasks:

The parent LLC structure is more organized and assists with regulatory issues, reporting, and management processes.

✅ Tax Flexibility:

This implies that each series will be able to select its desired tax classification.

Challenges and Considerations:

✅ Limited State recognition:

Not all states recognize Series LLCs. In states that do not have beneficial legislation, the liability protections may not be upheld.

✅ Augmented Record Keeping:

To ensure liability protection and avoid legal pitfalls, one has to carefully record every transaction and do record keeping. A distinct set of financial records, bank accounts, and documentation should be maintained for each series.

✅ Uncertain Legal Status:

In places without a definitive designation of Series LLCs, courts may pierce what is supposed to be a separate layer of liabilities and unshielded assets.

✅ Tax Complexity:

Taxes differ greatly from state-level taxes and federal taxes. Companies that operate in numerous states often face a situation of various requirements and their associated reporting.

✅ Administrative burden:

Though less expensive, managing multiple series in a single organization can still have administrative challenges, especially concerning growth scenarios.

Is a Series LLC Right for Your Business?

Series LLC is useful for businesses or an entrepreneur who has multiple assets, multiple ventures, or multiple projects that are completely different from each other but whose ownership has to have different liability covers. But its appropriateness would rely on the following factors which include:

- Type of business: Probably the most suited structure to this structure are those involved in real estate, franchising, and management of investments.

- Location: It is imperative to be in a state that provides for and endorses the establishment of Series LLCs to enforce the limitations of liability.

- Operational Structure: This structure is best suited to businesses that have well-defined operational boundaries across series.

Due to its distinctive features in legal and taxation practice, it is important to seek legal and financial advisory to ensure full advantages are obtained and associated risks of Series LLC are not lost.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now