Dreaming of Starting a Business in Georgia? Let’s Talk Costs!

So, you’re stirring up a brilliant business idea and Georgia seems like the perfect place for your dream to come true. However, before you jump into Peach State’s entrepreneurial scene, there is one very important question that needs to be answered: How much does it cost to form an LLC in Georgia?

In this post, we will explain start-up expenses, ongoing costs, and other hidden expenses related to forming a Limited Liability Company in Georgia. This knowledge will be helpful for a seasoned entrepreneur or someone just stepping into the world of business as it will help them make informed choices and budget their finances appropriately.

LLC Cost in Georgia

Initial Costs

1. Filing Fee

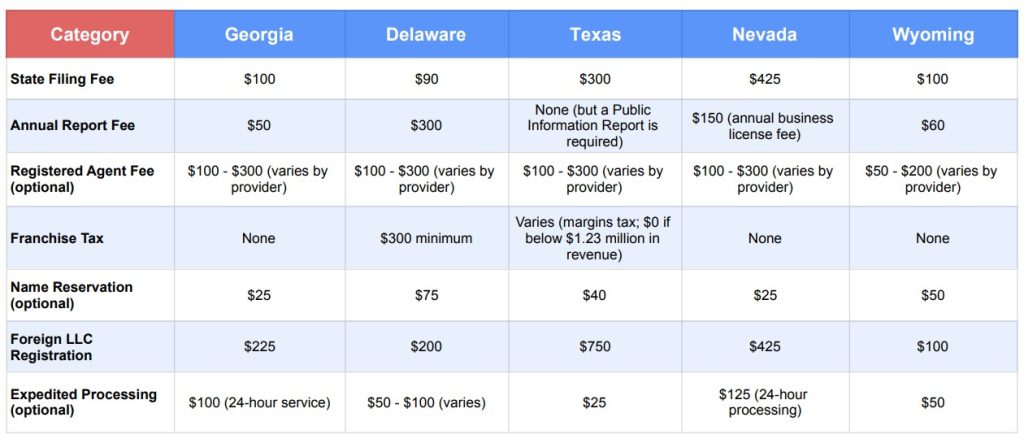

To officially establish your LLC, you must file Articles of Organization with the Secretary of State of Georgia. The cost for this filing is $100.

2. Name Reservation (Optional)

If you want to reserve the name of your LLC before filing Articles of Organization with the secretary of state, then it can be done by paying $25. It’s optional but useful if you need more time to prepare your papers.

3. Operating Agreement (Optional but Recommended)

Creating an operating agreement even if not required by law is highly recommended. You can make one yourself at no price or use some templates where prices run from $50 to $200.

Ongoing Costs

1. Annual Registration Fee

Every year, your LLC must file an annual registration with the Secretary of State of Georgia, a fee of $50 helps keep the business in good standing.

2. Registered Agent Fee

For Georgia-based businesses having an agent registered for the service process is compulsory as per state regulations. You could also act as your registered agent without any charge; however, be ready to pay anywhere between $50 and $300 per annum should you decide on using professional services.

3. Business Licenses and Permits

Depending on what type of company you are running there may be further licenses or permits needed. Prices can differ greatly depending on the industry and location, ranging from as little as $50 to several hundred.

Price Comparison of Georgia LLC and Other States

Benefits of Incorporating a Company in Georgia

1. Tax Benefits

The state of Georgia offers various tax advantages to LLCs:

- No State Capital Gains Tax: You will not incur any state capital gains taxes in Georgia, thus preserving more profit for you.

- Lower Corporate Tax Rate: Compared with other states, Georgia has relatively lower corporate taxes at 5.75%.

- Local Incentives: There are many credits and exemptions given by the state, particularly in technology, manufacturing, and research and development businesses.

2. Simple Formation Process

Creating an LLC in Georgia is an easy process:

- Online Filing: Articles of Organization can be filed through the Secretary of State’s website on the Internet.

- Quick Approval: Most filings are approved within seven business days, meaning that you can start operating your business quickly.

- Affordable Fees: The filing cost is just $100 which is less than many other states charge for registering an LLC.

3. Asset Protection

Georgia LLCs provide very strong personal asset protection:

- Limited Liability: Members of an LLC cannot be held personally responsible for the company’s financial obligations.

- Charging Order Protections: Additionally, Georgia law includes special provisions that safeguard member interests from possible creditors thereby adding another level of security.

4. Convenient Business Activities

Georgia Limited Liability Companies (LLCs) give you the freedom to operate your business:

- Member-Managed or Manager-Managed: You can decide to set up your LLC as a member-managed or manager-managed entity, depending on the preferred management style for your company.

- Flexible Profit Distribution: Unlike corporations, Georgia LLCs can allocate profits in any desired manner among members irrespective of ownership shares.

5. Enterprise-Focused Economy

Pro-Business Climate:

- Economic Growth: While its economy is expanding and the regulatory environment favorable, Georgia remains one of the best states for conducting profitable businesses.

- Skilled manpower: well-qualified workforce, with numerous educational institutions and training programs.

- Infrastructure: Great infrastructure is seen in Georgia including the busiest airport worldwide, extensive road networks, and major ports.

6. Privacy Advantages

Some ways that Georgia provides privacy to LLC owners include:

- Minimum Disclosure Requirements: The Articles of Organization do not require listing names of members which makes it an important way in which business owners’ privacy is protected.

How to Form an LLC in Georgia

1. Choose a Name for Your LLC

The first step towards LLC formation is by selecting a unique name that meets the naming requirements as stipulated in Georgia. This means that your company’s name must have either “Limited Liability Company” or abbreviations such as “LLC” or “L.L.C”. Moreover, you should consider if the intended name does not resemble any other entity that has been registered with the Georgia Secretary of State office.

Pro Tip: You can check if your chosen name is available by using the online tool provided by the Secretary of State’s Office for Business Search.

2. Appoint a Registered Agent

A person or business that will receive legal documents on behalf of your company is known as a registered agent. Additionally, he/she must be physically residing within Georgia according to its requirements.

Tip: Although you are allowed to act as your registered agent it offers more confidentiality when you use this professional service since it may guarantee you that no essential papers are missed out.

3. File Articles of Organization

This paperwork will make your company official and you need to file it at the Office of the Secretary, State of Georgia. Among other things, these documentations should provide details like the name of the organization, address for notice purposes, and principal office situated at this address along with names and addresses (and capacity) of all members/ managers thereat.

How to File:

Online: The fastest way to submit the Articles of Organization is through the official website maintained by the Georgia Secretary of State. This is a quick process that gets results right away.

Mail: Alternatively, you may choose to mail in your application to the Secretary of State’s Office where you can download it from their website and complete it at home or your own office. However, this method will take more time due to the various administrative processes involved.

Filing Fee: The Articles of Organization require that a $100 fee be paid, which is relatively affordable when compared with all the benefits associated with creating an LLC.

4. Create an Operating Agreement

While not mandatory under Georgia law, it is highly recommended that every new limited liability company has its operating agreement. This document outlines how ownership is divided as well as sets out procedures for changing managers and owners among others.

Key Elements of an Operating Agreement:

Ownership percentages: Explains how ownership is shared among members.

Voting rights and responsibilities: Identifies who makes decisions and what role they play in managing operations.

Profit and loss distribution: Specifies how earnings are split up amongst different partners in terms of percentage shareholding size or amounts invested individually into such respective companies’ capital structures over the years leading up until now.

Management structure: Describe who will run day-to-day affairs within an organization as well his Job Titles thereat since these roles might change after some time;

Procedures for adding or removing members: Any person wishing to become an associate must have prior consent from existing partners so their names can be included hereon unless there were previous obligations between them anyway before having a partnership formed; whereas any partner desiring withdrawal shall do same by submitting written notice thereof addressed jointly along each other’s address list attached thereto either personally delivered at principal offices or mailed through certified postal service within 5 days following receipt thereof.

5. Obtain an EIN

An Employer Identification Number (EIN) is required for tax purposes and to open a business bank account. You may obtain one free of charge from the Internal Revenue Service (IRS).

How to Apply:

Online: The easiest way for you to get an EIN is by going through a simple IRS web form that takes just minutes.

Mail: An alternative option is to mail form SS-4 to the IRS, but this method will take more time because it’s slower.

6. Register for State Taxes

If your LLC will collect sales tax or have employees, you’ll need to register with the Georgia Department of Revenue. You can register online through the Georgia Tax Center.

Common Taxes for LLCs:

Sales tax: This is what you pay when selling products or services.

Employee withholding tax: It becomes necessary if you recruit people and must deduct their income taxes.

Unemployment insurance tax: Employers should have it to cover benefits given during joblessness.

7. Obey Local Requirements

Be aware that a local business license or permit is necessary for your type of business and where it is located. You can get in touch with your county and city government offices to ensure you are on the right side of all local regulations.

8. Make an Annual Registration

Every year, Georgia mandates LLCs to complete an annual registration through the Secretary of State. The filing takes place between January 1 and April 1 every year, for $50.

Reminder: Remember when you filed to avoid overdue charges and maintain good standing for your LLC.

Conclusion

When one starts an LLC in Georgia, they do not have to spend much money and thus save more since there exist definite advantages such as taxation benefits, solid asset protection along operational flexibility. For example, the initial filing fee is $100 but there are ongoing costs like the annual registration fee and possible registered agent fees.

Entrepreneurs who know these expenses well and follow what should be done can start their businesses quickly and tap into Georgia’s business-friendly environment.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now