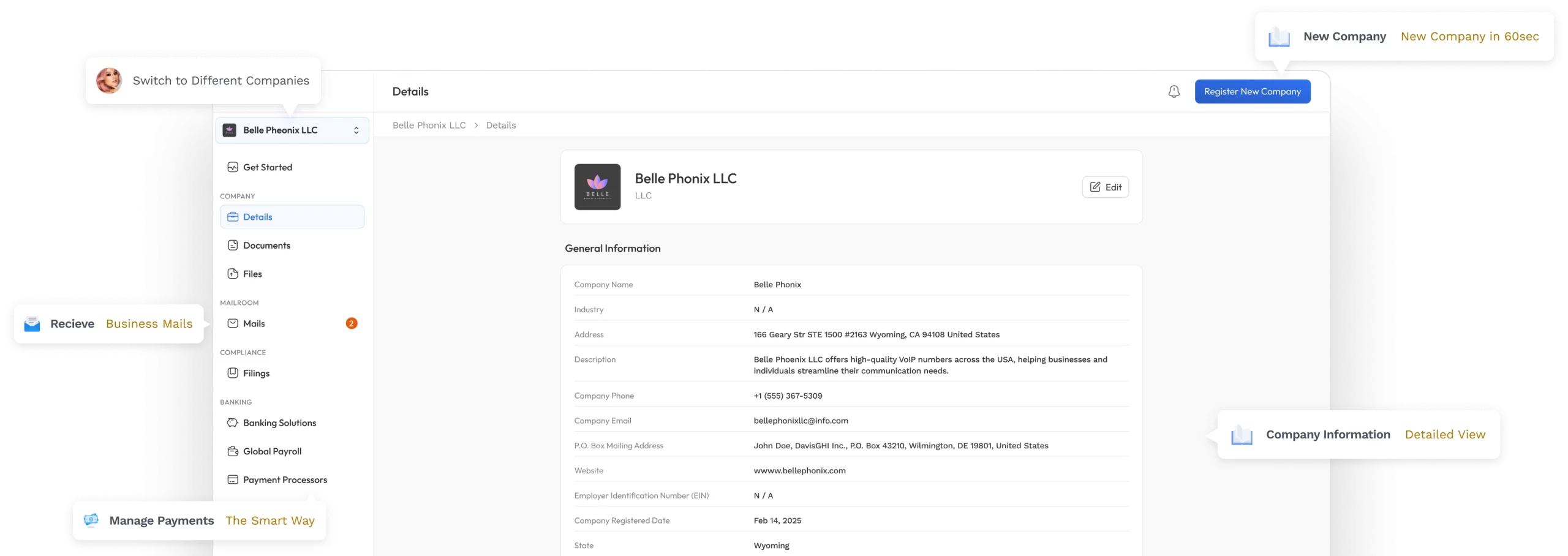

Launch Your US Company in Minutes From Anywhere

EasyFiling provides fast, affordable US company formation with EIN and essential services to launch your business.

Loading pricing plans...

Basic

Get only what you need to officially register in your state.

SERVICES:

| What’s included | Basic | Pro | Premium |

|---|---|---|---|

| Formation | |||

| Standard Company Incorporation | |||

| Employee Identity Number(EIN) | + $150 | ||

| BOI Filling | + $50 | + $50 | |

| Compliance | |||

| Registered Agent | + $75/year | ||

| Operating Agreement (LLCs only) | |||

| Annual State Filing | + $100/year | + $100/year | + $100/year |

| Tax Support | |||

| CPA Consultation | + $100/Hour | + $100/Hour | + $100/Hour |

| IRS Tax Filings** | + $250-$500/year | + $250-$500/year | + $250-$500/year |

| Financial Management | |||

| Bookkeeping Software | + $300/year | + $300/year | + $300/year |

| Customer Service | |||

| Dedicated Account Manager | + $600/year | + $600/year | + $600/year |

HR at IBM

“I was impressed with EasyFiling’s affordability and comprehensive services. The team was always available to answer my questions and guide me through the process. I couldn’t be happier with my decision to use EasyFiling.”

CEO & Co-founder at Timetracko

“EasyFiling made starting my US business a breeze! The process was straightforward, and the customer support was top-notch. I highly recommend EasyFiling to any non-resident looking to establish a business in the US.”

Director at MasterCard

“EasyFiling is a highly recommended service for non-residents looking to start a US business, with a simple process, competitive pricing, and outstanding customer support. It is a modern, founder-friendly alternative to other services, providing a streamlined and secure way to incorporate your business in the US and reap the benefits of operating on US soil.”

Ceo at Gillette

“As a non-resident, I found EasyFiling to be the most reliable and cost-effective option for starting my US business. The team’s expertise and support were invaluable in ensuring a smooth process.”

How it works

3 Simple Steps To Launch Your US Company

Embark on your entrepreneurial journey with unwavering confidence

FAQs

Common Questions About US Company Formation

Find quick answers to common questions on US company formation, from LLC setup to EIN, costs, and compliance.

Yes, non-residents can apply for business licenses and permits for their LLC or Corporation in the US. They may need to comply with additional requirements and regulations.

Yes, EasyFiling offers ongoing compliance support to ensure that the LLC remains in good standing with the state authorities

Non-residents must have a registered agent and provide a physical address in the US.

Depending on the state and the intricacy of the corporate structure, different states have different time requirements for non-residents to incorporate an LLC or corporation. It can take a few of days or a few weeks.

Yes, a non-resident can operate a US LLC or Corporation from outside the US.

Get Expert Help in Minutes

Can’t find the answer you’re looking for? Please chat to our friendly team.