A limited liability company is a type of business in the United States that combines elements of both Corporations and partnerships. The LLC Business model is popular among small to medium-sized businesses due to its simplicity, flexibility, and protection features. An LLC Business model is designed to protect personal assets, such as the real estate of the business owner from the liabilities and debt of the company.

Well, talking about forming an LLC in the United States, one of the best and most prominent options is to start your business in Wyoming. Many young entrepreneurs are eager to start their business in Wyoming state as the state offers more services and ease of business setup than other states.

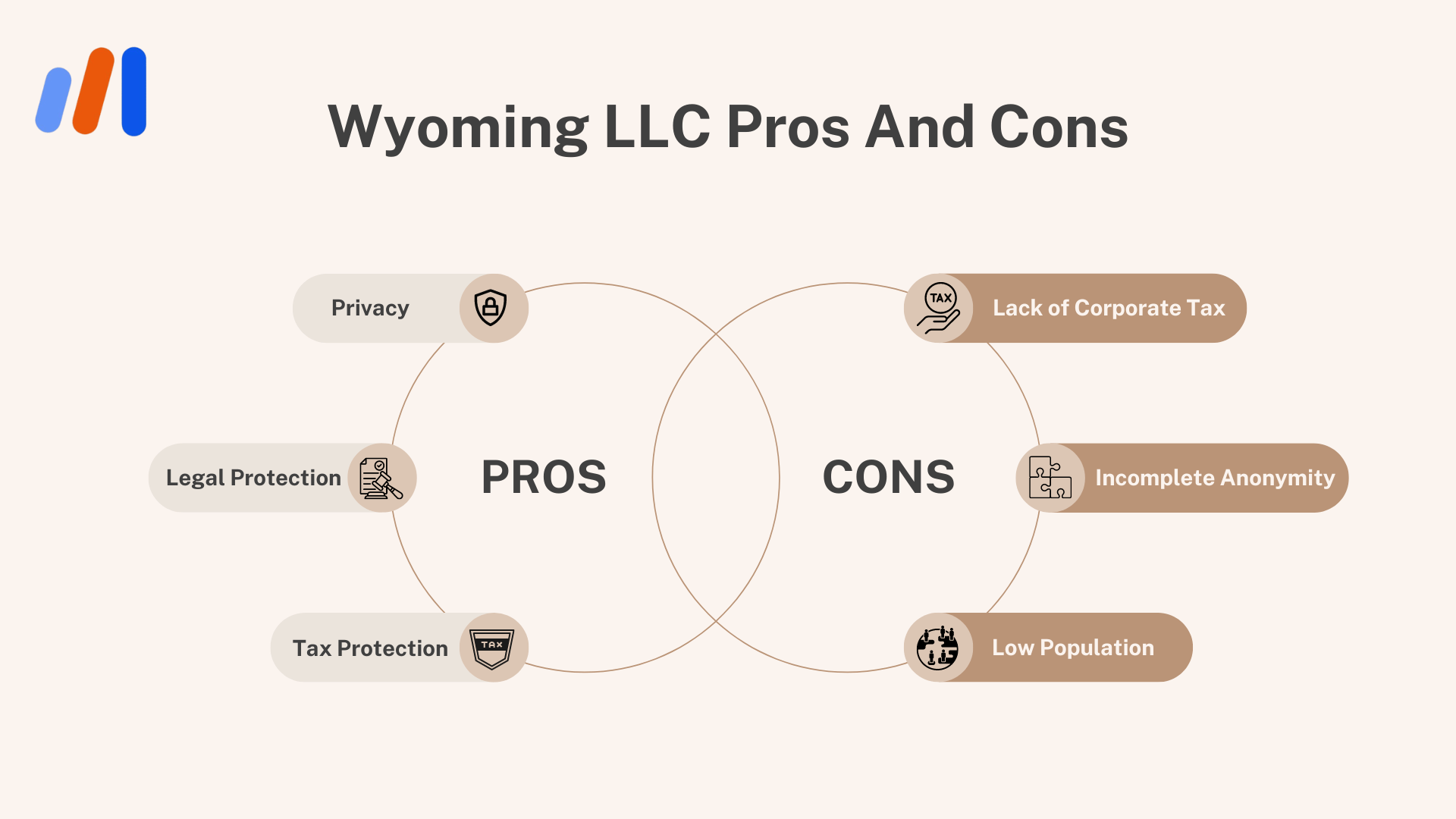

In this article, we will be discussing the Wyoming LLC pros and cons.

There are many benefits to Wyoming LLC and one of the great things about Wyoming is the tax benefits. It does not impose income taxes. Wyoming LLC members effectively do not pay any state income tax which can easily save thousands of dollars.

Wyoming LLC Pros

- Privacy

- Legal Protection

- Anonymous LLCs

- Few Regulations and Formalities

- Tax Protection

As they are protected from state registration requirements, the majority of firms operate as sole proprietorships. In a small business, however, the assets of the small business owners are identical to those of the company.

Privacy:

Different states have different laws while Wyoming has strong privacy laws, which protect the identities of LLC owners and Managers. Members already get protection from company liabilities through the LLC, which allows LLC owners to remain anonymous as member names and other personal details are not required in the public record this is one of the benefits of having income or business taxes, the state does not get access to the personal information it’s a member through tax filings.

Legal Protection:

Wyoming state law allows a registered agent to act as a manager on behalf of LLC members in order to safeguard them. Instead of listing the name of the LLC members, the registered agent is listed as the manager of the LLC in the Article of Organization.

The members still have actual control over the LLC, though. Agree to something different.

In addition, LLCs are protected by charging orders under Wyoming law. If a member has a charge order protection, the creditor cannot compel them to liquidate LLC assets or their shares in the business to settle the debt. In the United States, this legal protection is only provided by Alaska, South Dakota, Nevada, and Delaware.

Anonymous LLSs:

Wyoming’s privacy rules do not allow members to go publicly and permit a registered agent to represent the company, an LLC in Wyoming can remain anonymous. Where you can also set up a mail forwarding address for the business so that no mail gets sent to you directly, adding yet another layer of secrecy.

Nobody knows who the real owners of an LLC are, not even the tax office or state government.

Few Regulations and Formalities:

When it comes to rules, Wyoming has far more flexibility than corporation law, which requires officers to manage day-to-day operations and directors to make important decisions that do not abide by the same regulations. Also, Wyoming does not require LLCs to make a minimum capital commitment. Managers can act on behalf of the company so that Wyoming does not want meetings of shareholders.

Tax Protection:

One of the significant benefits of Having LLCs in Wyoming is there is absence of state tax, this means that both individual members and the LLC itself are not subjected to state income tax on earrings, which attracts business owners to start their LLCs in Wyoming and retain more of their profits.

Wyoming LLC Cons

- Incomplete Anonymity

- Asset Protection

- Lack of Corporate Taxes

- Low Population

- Expenses

Based on the above pros you may have got an idea why many business owners and entrepreneurs are attracted to open their LLCs in Wyoming, however, Wyoming LLC’s pros and cons would not be complete without the cons. While there are mostly minor, knowing the worst would still be there

Incomplete Anonymity:

In fact, Wyoming does not require LLC members to reveal their personal identities in the publicly accessible article of the organization, the privacy laws anonymity, meanwhile has a little catch. Wyoming requires LLC members to give the registered agent their name address (no PO Boxes ) and manager’s information.

Asset Protection:

The charging order protection statutes of Wyoming are a helpful means for members to protect their LLC ownership and protect their assets from creditor garnishment.

Lack of Corporate Tax:

The IRS does not classify LLCs as such, which is something you should know about Taxes and LLCs. An LLC will be subjected to partnership, C-Corporation, or S-Corporation taxes from the IRS. The type of LLC will be determined by which one applies. One-member LLCs are usually taxed by the IRS as S Corporation which means that the owner is responsible for paying individual taxes. The IRS views LLCs with two or more members as partnerships, even though they are still subject to individual income taxes.

Low Population:

Wyoming has the lowest population in the US when you realize that the thought of funding a Wyoming LLC looks like a brilliant idea. From an exclusive statistical perspective, it reduces the size of any business’s local market in the era of online delivery and E-commerce. As long as the Wyoming LLC is conducting interested commerce it is lawful for the LLC to have clients and consumers outside of Wyoming without facing fines, penalties, or additional fines.

Expenses:

Business owners who join an LLC in Wyoming but reside in another state are subjected to the final drawback in our list of Wyoming LLC pros and cons. Then the expenses start to get a little tricky. A non-resident owner is required to register the Wyoming LLC as a foreign LLC in their home state. As a result, the non-resident is required to pay filing and annual fees and annual fees to both the home state of Wyoming and Wyoming.

Start Your LLC in Wyoming with EasyFiling

If you are considering creating an LLC in Wyoming, EasyFiling can be your best solution in the market. Our 24/7 customer service and expert-led team handle all the paperwork for you. With hundreds of satisfied business owners and entrepreneurs, choosing to register your business in the US and Wyoming, known for its business-friendly laws, can be the ideal choice with EasyFiling.

Frequently Asked Questions

Why is Wyoming one of the Best states to Start an LLC?

Wyoming has many advantages compared to other states for building an LLC. It has no state income tax, filing and reports costs are low, members’ privacy is assured, and it has to charge order protection law.

In Wyoming, how can I make my LLC anonymous?

In Wyoming, you can make your LLC anonymous by leaving the member name out of the Articles of Organization. In order to serve as a nominee director manager for the LLC, Wyoming will accept the relevant information provided by the registered agent.

Does Wyoming have any LLc Filing requirements?

In fact, on the first day of the LLC’s anniversary month, Wyoming LLCs are required to file an annual report to the Secretary of State. A license tax or two-tenths of a mill on each dollar of the company’s assets in Wyoming, is levied on the annual reports, whichever is higher. In terms of assessed property value, one mill is one-thousandth of a dollar for every $1. The LLC may be revoked and permanently dissolved for failing to file an annual report for two years if the report is not submitted and tax is not paid within sixty days.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now