There are several reasons why an Individual Taxpayer Identification Number (ITIN) necessary for individuals living or working in the United States. First and foremost, an ITIN allows individuals who do not have a Social Security Number (SSN) to file their taxes and comply with tax laws.

What is an ITIN?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the Internal Revenue Service (IRS). It’s meant for individuals who are required to have a U.S. taxpayer identification number but do not have or are not eligible to obtain, a Social Security Number (SSN) from the Social Security Administration (SSA).

ITINs are issued regardless of immigration status because both resident and nonresident aliens may have U.S. tax returns and payment responsibilities under the Internal Revenue Code.

Why is an ITIN Needed for Amazon, PayPal, & eBay?

Online selling platforms like Amazon, PayPal, and eBay require sellers to provide tax identification numbers for various reasons.

1. Compliance with Tax Regulations: These platforms need to abide by U.S. tax laws, which require reporting of income earned to the IRS. An ITIN allows them to report sellers’ earnings accurately.

2. Avoidance of Account Limitations and Penalties: Sellers failing to provide an ITIN might face account restrictions or suspensions, limiting their ability to sell or withdraw funds.

Providing an ITIN not only ensures compliance with tax laws but also helps avoid potential disruptions to your business operations.

How to Get an ITIN

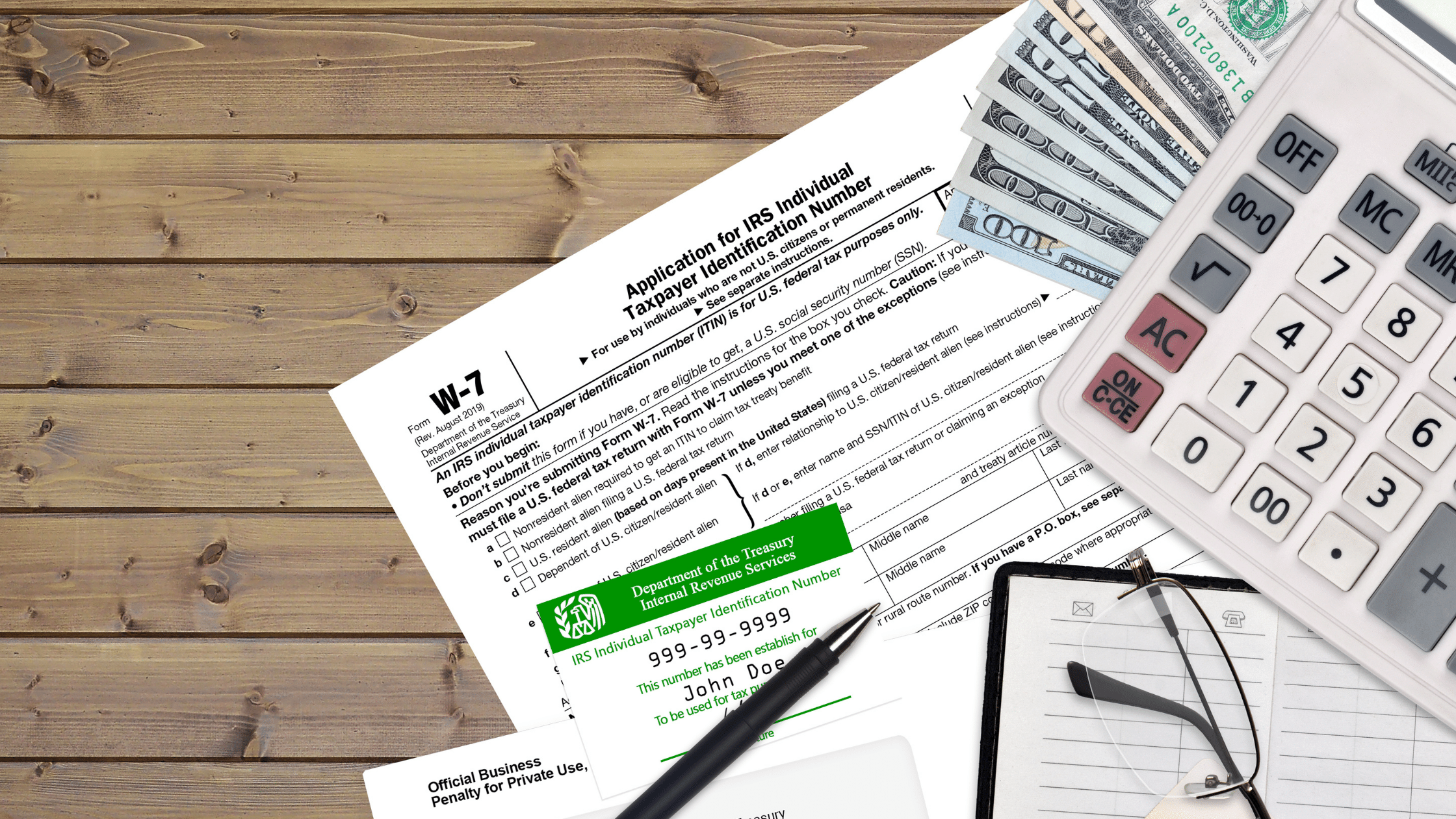

Obtaining an ITIN involves a step-by-step process that includes filling out forms and submitting specific documents.

1. Complete Form W-7: This is the IRS Application for IRS Individual Taxpayer Identification Number.

2. Attach your federal tax return: Unless you meet one of the exceptions, you must file a tax return with your Form W-7.

3. Include original documentation: This should prove your identity and foreign status.

4. Submit the application: You can submit your application through mail, at an IRS authorized Acceptance Agent, or at an IRS Taxpayer Assistance Center.

Remember, the ITIN application process might seem complicated and time-consuming if you’re unfamiliar with IRS procedures. Consider seeking professional help if you’re unsure about any step along the way.Learn More about the process for ITIN from here.

Benefits of Having ITIN

1: Driver’s License: In countries that allow undocumented immigrants to obtain licenses, you may also have the opportunity to obtain a driver’s license using an ITIN. Currently, 12 states in the United States permit individuals residing outside the country to acquire a license, using their ITIN as proof of identification.

2: Credit Card and Building Credit Score:Using an ITIN, you can establish a credit history and improve your credit score. This can be beneficial when applying for credit cards or loans in the future.

3: Proof of Residence:The ITIN serves as evidence of how long you have lived in the United States. For instance, if you plan on applying for legal US citizenship in the future, having an ITIN can be crucial for immigration officers to assess the number of years you have resided in the country and fulfilled your tax obligations.

4: Open Bank and PayPal Accounts:With an ITIN, you can open bank accounts and PayPal accounts, allowing you to manage your finances effectively. Additionally, you may earn interest on the funds deposited in your accounts.

Case Studies

Let’s consider a real-life example of “John,” who started selling homemade crafts on eBay. Initially, everything went smoothly. However, when his sales exceeded a particular threshold, eBay asked for a tax identification number. Without an ITIN, John faced account limitations that severely restricted his sales and growth. Only after obtaining his ITIN was John able to resolve these issues and resume his regular business operations.

Conclusion

For online sellers on platforms like Amazon, PayPal, and eBay, obtaining an ITIN is a crucial step towards ensuring smooth business operations. An ITIN not only helps you comply with U.S. tax laws but also prevents potential account limitations, allowing you to focus on growing your business.

If you’re an online seller or e-commerce business owner in need of ITIN assistance, don’t hesitate to reach out. Our team of professionals is ready to guide you through the entire process, ensuring you can continue to operate seamlessly and successfully in the online marketplace. Contact us today for all your ITIN needs!

FAQs

Why do I need an ITIN?

An ITIN is necessary for individuals living or working in the United States who do not have an SSN. It allows them to file taxes and comply with tax laws.

How do I get an ITIN?

Getting an ITIN involves filling out Form W-7 and submitting specific documents to prove your identity and foreign status. You can submit the application by mail, through an IRS authorized Acceptance Agent, or at an IRS Taxpayer Assistance Center.

What are the benefits of having an ITIN?

Having an ITIN can help you obtain a driver’s license, establish a credit history, serve as proof of residence, and open bank and PayPal accounts. It also ensures compliance with U.S. tax laws for online sellers.

What happens if I don’t have an ITIN as an online seller?

Online selling platforms like Amazon, PayPal, and eBay may impose account limitations or penalties if you fail to provide an ITIN. Obtaining an ITIN is crucial to avoid disruptions to your business operations.

What is an ITIN

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the Internal Revenue Service (IRS). It’s meant for individuals who are required to have a U.S. taxpayer identification number but do not have or are not eligible to obtain a Social Security Number (SSN).

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now