Did you know you can change your business structure anytime you wish? Well, changing your business structure that best suits your business needs can be beneficial to your business.

Well, in today’s world, the majority of business owners go with S Corporation or change their business structure to S corporation. For that, the business owner has to file Form 2553 with the Internal Revenue Service (IRS).

Therefore, if you are also looking forward to restructuring your business to an S corporation then, it is time to file Form 2553 to make an election to be an S corporation.

What is Form 2553?

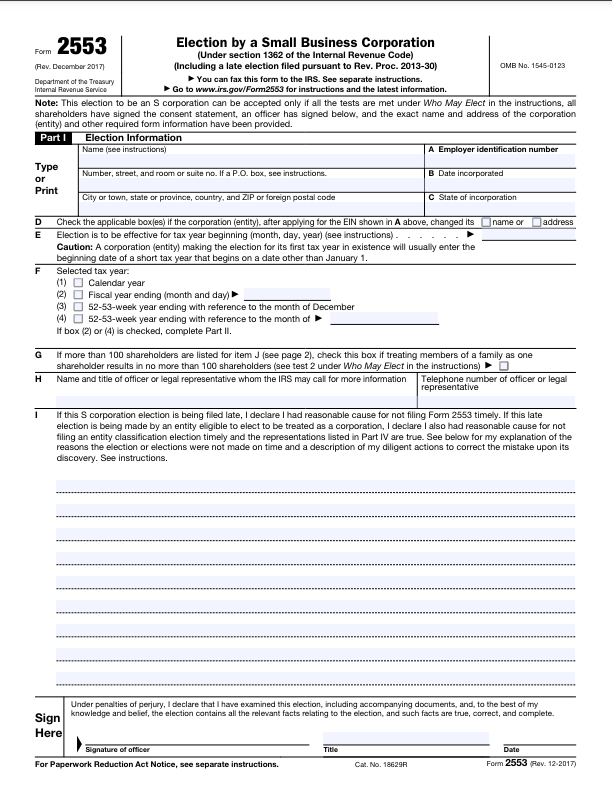

Form 2553 also known as “Election by a Small Business Corporation” is the process through which you request an IRS to elect your corporation to S Corporation.

S Corporations or “S Corp” are business corporations that pass corporate income taxes as the business income, losses, or deductions are handled by their shareholders for federal income tax.

With S Corp, the business corporation is free of federal taxes at the entity level and has the protection of the personal assets of the shareholders. Due to these benefits, business owners today are highly focused on electing S Corp status in substantial tax savings.

Information needed to fill Form 2553?

Before filling out this form, you need several documents of your corporation such as:

- A fax machine or digital scanner to fax the form to Internal Revenue Service offices.

- Name and address of the corporation

- Employer Identification Number of the corporation

- Date and state of incorporation

- Date of new S Corporation status

- Contact information of legal representative

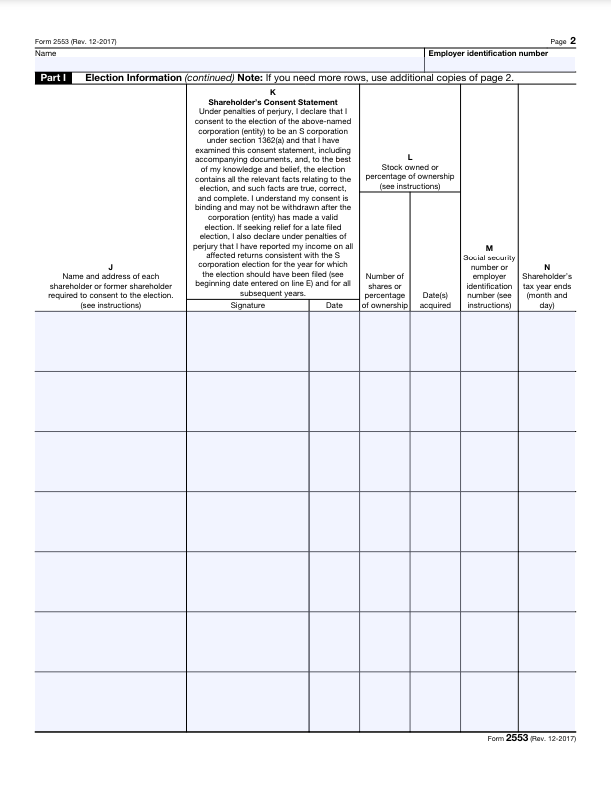

- Signature of all shareholders

Requirements to quality for Form 2553

In order to file this form, your business must be qualified as per the IRS conditions which are:

- The business is to be registered as an LLC to be treated as a corporation.

- The business must not have over 100 shareholders.

- Shareholders have only one class of stock

- Businesses must not have non-resident alien shareholders

- All shareholders consent to the election

When Do Corporations Need to Fill Out Form 2553?

Once your corporation is qualified to file Form 2553, you have to make sure to file before the due date which is two months and 15 days after the beginning of the tax year.

How to fill out Form 2553?

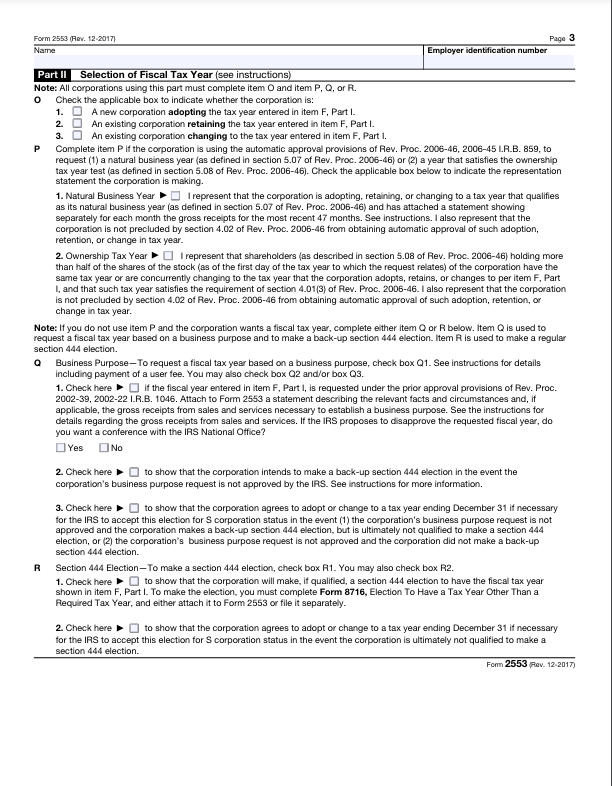

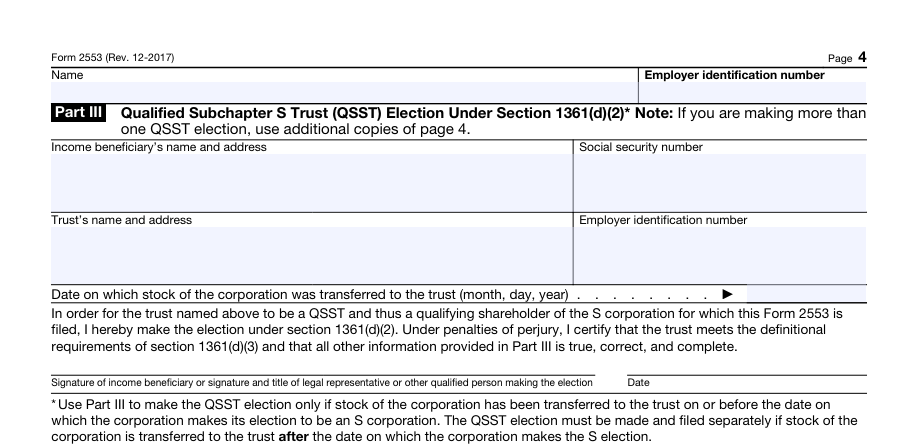

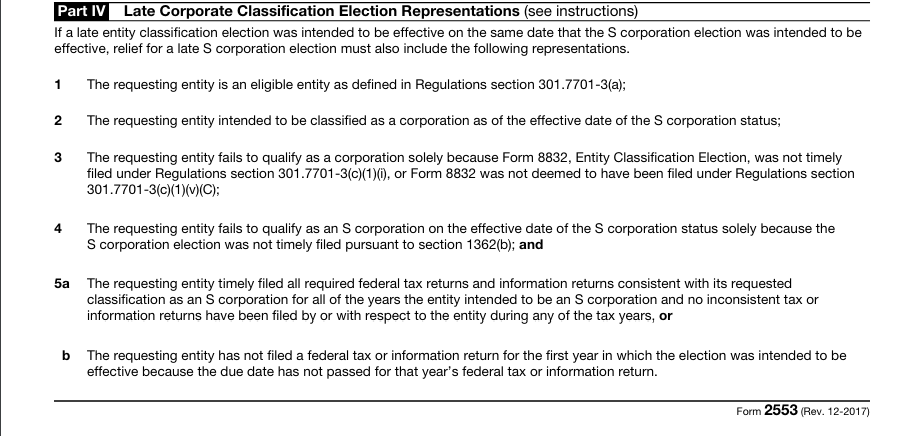

Form 2553 includes four parts such as:

- Part I: Election Information (Requires you to fill in the general business information)

- Part 2: Selection of Fiscal Tax Year

- Part 3: Qualified Subchapter S Trust (QSST) Election Under Section 1361

- Part 4: Late Corporate Classification Election Representations

Where to file Form 2553?

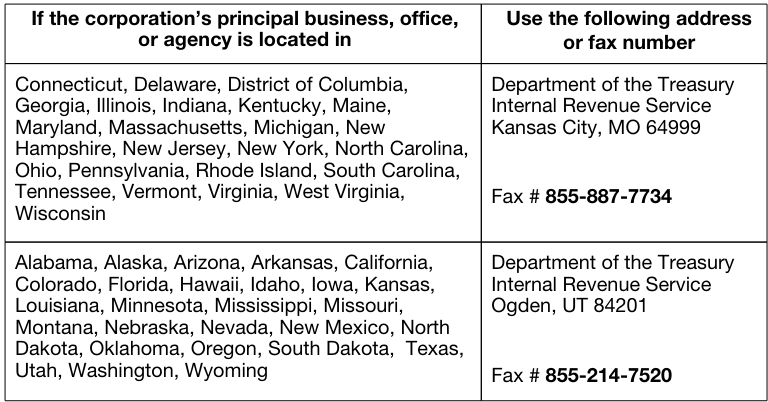

Form 2553 should be filed in the particular state department of the Treasury Internal Revenue Service. Here are the instructions to file as per your state.

Conclusion

Well, if you wish to change your business structure to S Corp and gain tax benefits and many more, then it is your time to fill up Form 2553 and complete the conversion process. Nonetheless, you can always seek support with EasyFiling during the entire process.

Frequently Asked Questions (FAQs)

How much does it cost to file Form 2553?

To file Form 2553 doesn’t require any additional fee unless you check box Q1 of the form Part II, which is to request a fiscal tax year based on a business purpose. However, the Q1 box requires a $6,200 user fee which you don’t have to pay upfront. You will be notified by the IRS during the fee due.

How long does it take to process Form 2553?

After submitting the form to the IRS, usually, the process takes around 60 days before you hear back from the IRS directly. Also, you can contact the IRS at (800) 829-4933 to check the status of your application.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now