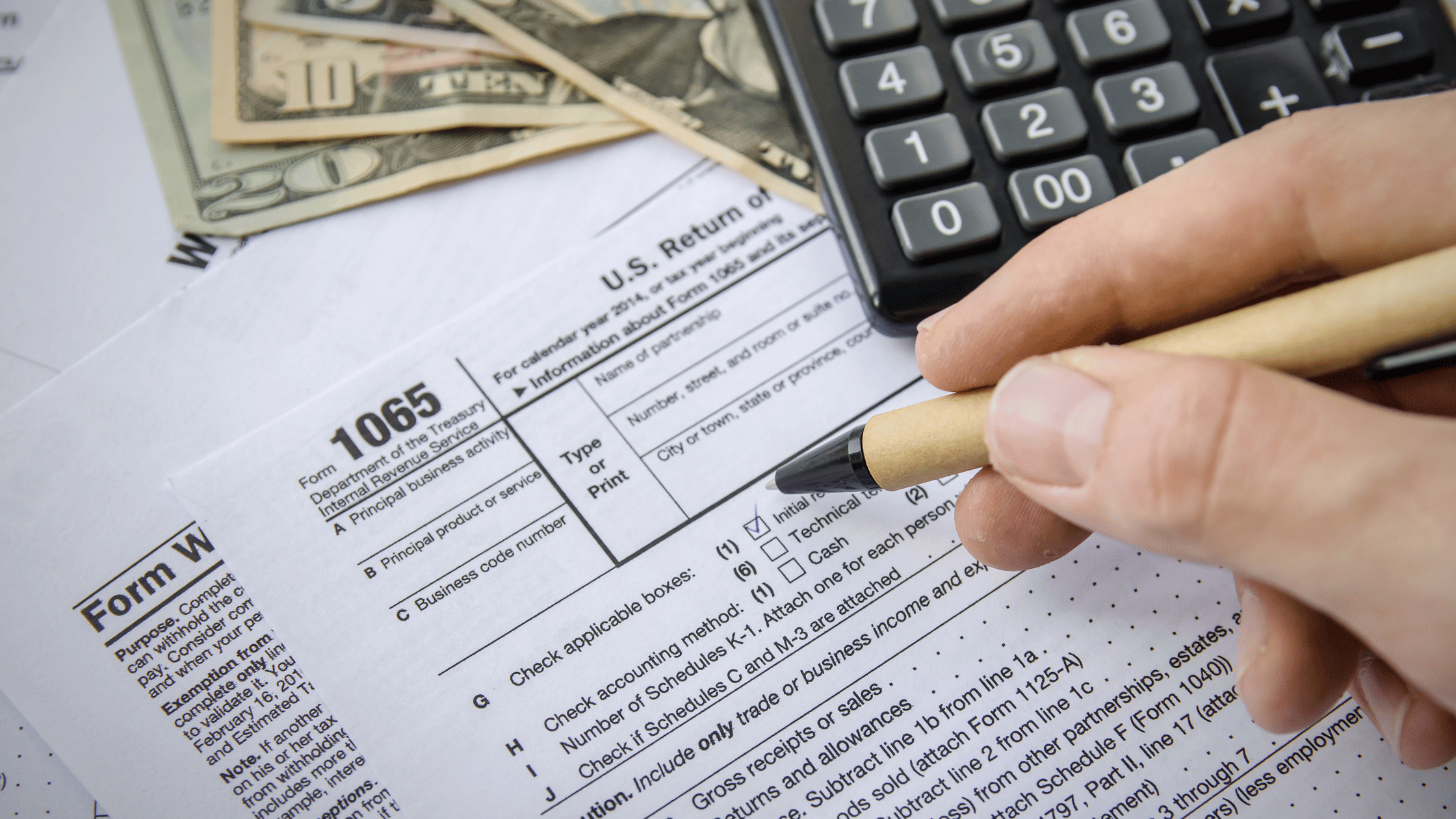

Form 1065 also publicly known as the U.S. Return of Partnership Income, is a tax form that is filled up by partnerships to report their incomes, deductions, gains, losses, and other relevant information.

Partnerships are regarded as pass-through entities in the US context. Thus, partners do not pay income taxes as such instead profits and losses are reported by the individual partners on their returns which are reported by the partnership partners themselves on their individual returns.

In this guide, the readers will learn about Form 1065, its filling requirements, and determination factors.

Who Needs to File Form 1065?

Form 1065 applies to all businesses that are represented as a partnership according to the IRS, which covers the following forms of partnerships, only for the US:

General Partnerships: This is a type of business where two or more persons or entities combine their efforts or skin in the game to carry out a business activity. All the partners share in the profits and or losses and other obligations within the business. General partnerships are the simplest form of partnership structure.

Limited Partnerships (LPs): These consist of one or more general partners that run the business and have unlimited liability and one or more limited partners who can only lose their investment and have no say in how the business is run.

Limited Liability Partnerships (LLPPs): An LLP can be termed as a partnership firm that has more than one partner while the other partners’ liability is restricted to the extent of their contribution which makes it a bit better than general partnerships. This type of structure is common in professional firms like law or accounting firms.

Limited Liability Company (LLC): LLCs with two or more members can elect to be treated as partnerships for tax purposes. This allows the LLC to enjoy pass-through taxation while providing liability protection to its members.

Exemptions: There are some wholesale businesses without income, expenses, or even any sort of activities for the year such as a single member LLC or a single member corporation which doesn’t need to file form 1065 return. It is always wise to clarify this with a tax adviser.

Key Sections of Form 1065

Form 1065 has several sections, each of which is focused on a specific objective:

Basic Information:

- This includes the Partnership name, address, Employer Identification Number (EIN), and other identifying data about the Partnership. Also required is the nature of the principal business activity, the principal product, where a service is provided, or the form of accounting used (cash, accrual, other).

- Providing background information concerning the IRS assures that the partnership is accurately recognized and the return is expeditiously dealt with.

Income Section

- In this section, the partnership reports its gross receipts or sales, cost of goods sold (COGS), and gross profit. Additional income sources, such as interest, dividends, or rental income, are also reported here.

- Sufficient reporting of all income will reduce the chances of an audit or penalties from the IRS.

Deductions Section

- The deductions portion enables partnerships to claim example, rent, salaries, utilities, advertising, and depreciation as their business expenses. These deductions help in reducing the past taxable income to the partners.

- You must prepare detailed documentation and a reasonable explanation for all deductions to conform to IRS requirements.

Schedule K

- Schedule K analysis summarizes the income of the partnership, its deductions, credits, and additional information on the financial status of the partnership. It is this summary that is used to allocate amounts to the individual partners through the K-1 form.

- The K schedule assists the partners’ tax returns in any required changes and focuses on the distribution of K.

Schedule K-1

- A partnership’s income, deductions, and credits allocated for each advanced partner is that which is shown in the schedule k-1 which is prepared for the respective partner. The returns of each partner are prepared using the information contained in this K-1, which eases their filling out Form 1040.

- The timely and accurate distribution of the K-1 forms is essential for partner compliance.

Other Schedules:

- Schedule L: It shows the Partnership’s assets, liabilities, and balance over which all the partners have control at the beginning and at the end of that tax year.

- Schedule M-1 and M-2: These schedules are used to make income adjustments as well as to explain fluctuations in partners’ capital accounts, explaining differences between book and tax income.

Steps to File Form 1065

Gather Required Information:

- First of all, make sure you have all your financial documents processed including income statements, balance sheets, depreciation schedules, or any expense statement. Also make sure that you have the correct figures for every partner’s input, outtake, and ownership ratio.

- Proper preparation will save a lot of time in the course of filling in the forms as well as save mistakes.

File Form 1065:

- Complete all sections of Form 1065 starting with basic particulars, moving on to income, further wastage, and schedules concerned. If there are additional forms or statements prescribed by the IRS, provide them alone.

- Check the Form thoroughly to make sure that every piece of information provided is accurate.

Prepare Schedule K-1s:

- Form one Schedule K-1 for each of the partners aforestated to enable the partners to report their share of income, deductions a partnership has without such have the required for them to complete their returns.

- Ensure that K-1 is sent on time and ensure that other documents are complied with to avoid delays in partner compliance.

Filling the Form:

- Understand that 1065 can be submitted using an e-file provided by the IRS, or tax professional or you can just get a paper and submit it. Faxing it out is an option as well however make sure that the pages are in-arranged and clear.

- A copy of the documents submitted should always be kept in order for them to be used in the future if needed.

Distributing Schedule K-1s:

- This now means that all partners would receive Schedule K-1 copies, to be able to include their share of the partnership. This is possible when Form 1065 is submitted.

When is Form 1065 Due?

The answer is March 15 for most taxpayers as they would like to wait until the 15th day of the third month when the year’s filing cycle ends for them. And this could be altered in the form of holidays. A yearly partnership would mean a more simple deadline of March 15.

Retaining documents such as profit/loss reports would help you file taxes more easily, given the past document formats you could shift towards net income approaches. A Form 7004 can be filled to enable this and the new deadline will be September 15th. However, this does not cover taxes and any obligations you owe.

Penalties for Late Filing

For not filing Form 1065 by the deadline, the IRS has peculiar penalties. Starting in 2024, the punishment would be a fine amounting to $220 each month for every partner, lasting for up to a year. This is a lot of money, especially for an extended partnership.

The penalties add up when a partner fails to provide Schedule K-1s for partners. Hence it is necessary to submit a timely W-2 that is free of errors.

Tips for Filing Form 1065

Use Accounting Software: Accounting software like TurboTax Business, QuickBooks, or even tax preparers help streamline the attachment and submission of the 1065 form. Most of these programs contain a way to check errors that get done.

Hire a Professional: Going to a CPA or a tax advisor can help ease in guiding the IRS deadlines and ensure that no errors take place which equates to making you spend more than necessary. In addition to that such professionals can help increase the amount you have to write off to the IRS or further credits you have.

Keep Records Organized: All financial and personal data that gets collected throughout the year must be organized. Being organized allows completing Form 1065 and any requests the IRS has.

Double-Check Details: Last but not least, always confirm that all the template codes and partner details are accurate and that the information regarding the partner and income distributions is flawlessly documented, correct, and ready to be submitted.

Partnerships are required to electronically submit Form 1065. They also have a good record of fulfilling their tax obligations and complying with the IRS guidelines.

However, if you are experiencing any difficulty in the process, do not hesitate to contact Easyfiling for assistance. We will help you file an accurate return without any errors.

Book a free consultation today for more guides on Form 1065.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now