Establishing a business necessitates making several choices, one of the most vital being understanding the method of business taxation.

Taxation is an important aspect of profitability and a business’s financial position, so comprehending concepts such as double taxation is essential.

Although double taxation sounds scary to most people, there’s plenty of knowledge available that can help you structure your business to minimize these tax repercussions.

In this article, we will discuss what is double taxation in detail, its causes, and whether the formation of a company limited by shares is a viable solution to this problem.

After reading this guide, you will have a much better understanding of how you will go about addressing the structure of taxation applicable to your business.

What Is Double Taxation?

When a person earns an income, it can be subjected to two different taxes. For example, let’s say a $100 income is taxed before it’s received and also taxed as a part of an investment. This is termed double taxation, and the scenarios where it applies are two-fold:

Corporate Double Taxation:

When companies file taxes they first file corporate taxes, let’s assume it’s a flat 21% tax. This means if a business earned a total of $100,000, they would pay $21,000 in taxes leaving them with $79,000. If this profit is later paid out as a dividend to an investor, they in turn are required to file taxes as well, and that leads to double taxation which is also why many investors decide to skip dividend stocks and choose to reinvest.

International Double Taxation:

The second situation is when international income is earned. If it’s conducted in America, and the business is abroad, then both governments will seek to earn a tax on the income, unless there’s a treaty between the two countries. For example, an American entrepreneur attempting to do business abroad will have to first pay tax in America, alongside paying tax in the country the business is being conducted in.

Do LLCs Face Double Taxation?

An LLC is a tax-efficient business structure because it does not incur double taxation. LLCs are referred to as “pass-through entities,” which means they do not pay federal income taxes as an entity. Instead, profits and losses are allocated to the owners or members and are reported at the individual level. Let’s analyze this further:

1. Taxation of Single-Member LLCs

By default, an LLC that has one member is treated as a sole proprietorship for tax purposes. In this case, the loss or income generated by LLC is reported in the personal tax return of the owner via Schedule C. This kind of structure ensures that there is no double taxation, as the sole owner’s income gets only paid once.

2. Taxation of Multi-Member LLCs

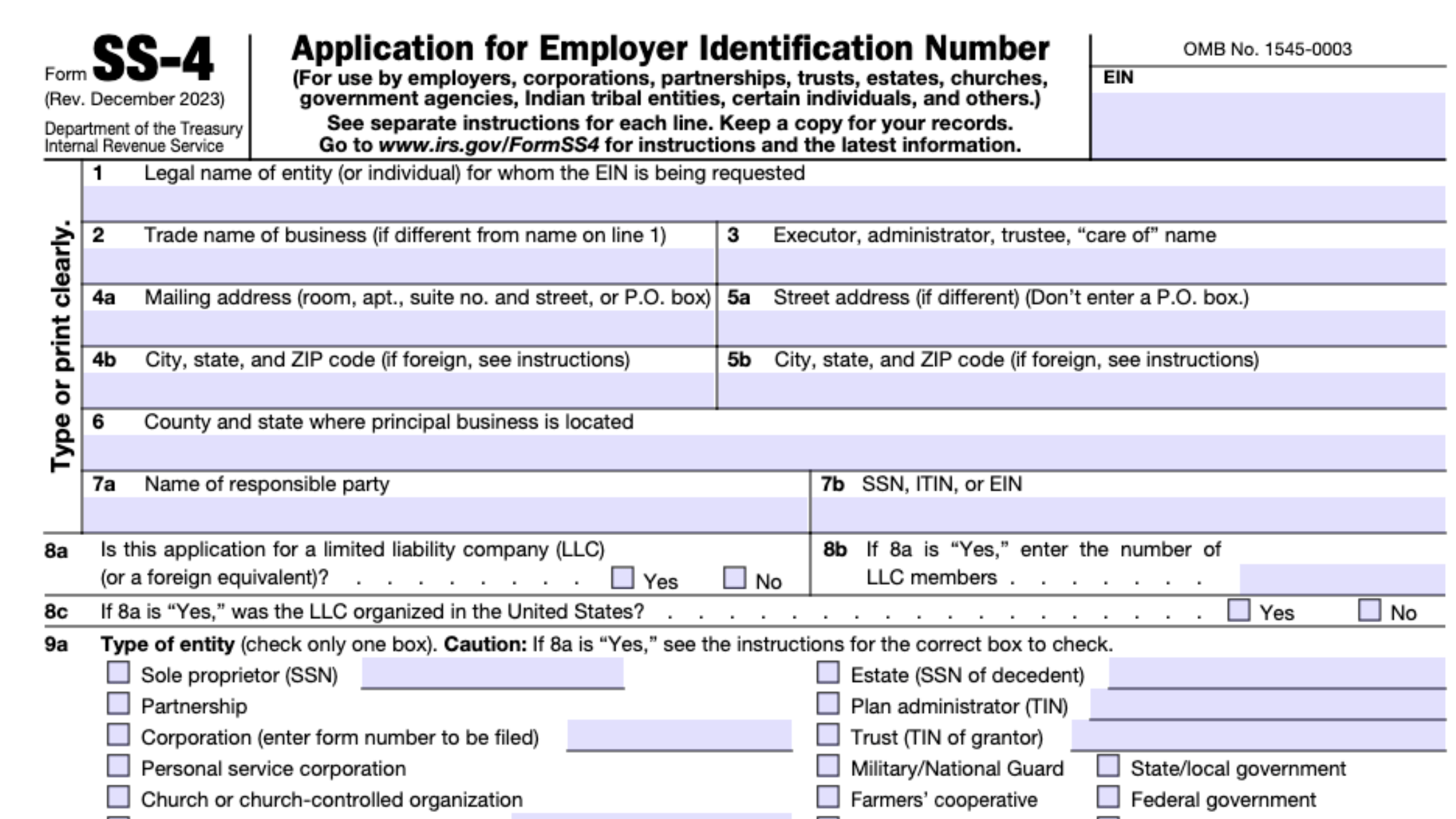

By default a multi-member LLC is treated as a limited liability company, for taxes under the IRS, it files as a partnership. The business completes Form 1065, which is an informational return, and does not pay entity-level taxes.

Firstly, the individual members do not pay taxes on the business’s income, rather they receive Schedule K-1 which proportionally quotes their income share. As such, they go on to declare this in their tax returns, thus, resulting in no double taxation.

3. Election to Be Taxed as a Corporation

LLCs can choose the S option or the C option and file the required forms with the IRS. Here’s how each option affects taxation:

C Corporation: An LLC that makes an S election may be subject to a corporate level of taxation and also a member level taxation whenever dividends are issued. The C corporation tax applies here.

S Corporation: Under this election, the self-employment taxes are minimal for the members as the election does not repeal the pass-through taxation feature of the LLC. Furthermore, an S corporation does not also result in double taxation.

Advantages of Avoiding Double Taxation with an LLC

1. Tax Efficiency

LLCs are very easy and tax-effective. Automatically, the members of an LLC do not face double taxation as shareholders of corporations do, therefore the members can keep more of the income generated from the business. It is beneficial for many small businesses and startups who wish to reinvest the profits back into the business.

2. Flexibility in Tax Elections

LLCs have taken the election decision to get taxed in a certain manner. Although not many LLCs elect pass-through taxation some may find it beneficial at times to access facilities such as lower rates of taxation at the corporate level and profits being reinvested rather than shared as dividends among the people.

3. Eligibility for Deductions

LLC issues can be moved to the members and this includes however not limiting covering the member’s all income liability and in addition paying out travel and equipment expenses which are in a way business expenses. LLC members are also availed under section 199A of the Internal Baritone Income Code a 20% Qualified Business Income Median to minimize the taxable figure they come up with.

4. Simplified Compliance

There is no statutory requirement for LLC hence there will be a reduced level of stress and costs used for compliance. It all tends to reduce administrative work as well. This simplicity makes LLCs an attractive option for starters in the business.

Why Understanding Taxation Matters

Paying taxes will no doubt affect the profits of my business, and in this case, the structure will actively promulgate not only from the perspective of management or liability but rather as making sure you do not have substantially large amounts to pay in tax.

As some countries have such laws as double taxation knowing such concepts can assist easily in paying with ease bronze and the rest to the finger and the country in which they belong.

Key Takeaways

- The term “double taxation” describes the taxation of a given income on two different occasions, such as on the corporate and individual platforms.

- LLCs, by default, avoid double taxation due to their pass-through taxation structure.

- LLCs can elect to be taxed as a C Corporation, which may result in double taxation, or as an S Corporation to maintain pass-through taxation.

- The structure and taxation benefits provided by LLCs are always an appealing factor for an investor and a small business owner.

- It’s very important to get in touch with a tax professional to make sure the business is structured in the right way from the outset.

In case you’re acquainted with the taxation laws, and laws of your jurisdiction, and properly structure your business, you may as well maximize profits coming from business activities. The pass-through structure along with the flexible operational maneuvers makes it easy for many business owners to incorporate LLCs.

Let EasyFiling Help You Form Your LLC

If you’re looking to get your LLC set up and begin enjoying the various benefits, then EasyFiling is your best bet. Our solution was designed to provide you with an easy-to-navigate platform and the best support available within the space ensuring that your LLC is formed in no time, cheaply, and effectively.

Allow EasyFiling to make the numerous procedures and requirements of starting a business easy for you so you can work towards developing your business.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now