A 147c letter serves as a crucial official document, which is issued by the Internal Revenue Service (IRS), a key agency of the United States federal government responsible for tax collection and tax law enforcement.

The primary purpose of this letter is to verify a business’s Employer Identification Number (EIN), a unique nine-digit number assigned by the IRS to businesses operating within the United States for the purposes of identification.

This letter is particularly important as it confirms the correct legal name of the business that is associated with the given EIN, ensuring that there are no discrepancies in official records.

Why do you need a 147C letter?

1. Opening a Bank Account

Financial institutions often require a 147C letter to confirm your EIN before you can open a business bank account. This helps the bank verify that your business is legitimate and ensures that all financial activities are tracked appropriately.

2. Business Loans and Credit

When applying for business loans or lines of credit, lenders need to verify your EIN to assess your business’s creditworthiness. This letter serves as official proof of your EIN, which is crucial for the application process.

3. Licensing and Permits

Many states and local governments require a 147C letter to issue business licenses and permits. This verification helps ensure that your business is registered correctly and complies with all relevant regulations.

4. Tax Filings

Accurate tax filings are essential for maintaining good standing with the IRS. A 147C letter ensures that your EIN is correctly reported on all federal and state tax documents, helping to avoid discrepancies and potential penalties.

5. Contractual Agreements

When entering into contracts with other businesses or government entities, a 147C letter may be required to verify your EIN. This ensures that all parties involved are dealing with a legitimate entity, fostering trust and transparency.

6. Vendor and Supplier Relationships

Suppliers and vendors may request the letter to verify your EIN before extending credit or establishing a business relationship. This helps them confirm that they are dealing with a legitimate and registered business.

How to Obtain a 147c Letter

Step 1: Gather Necessary Information

Before you contact the IRS, make sure you have the following information readily available:

- Your business’s legal name.

- Your business’s EIN.

- The address associated with your EIN.

- The reason you are requesting the letter.

Step 2: Contact the IRS

You will need to call the IRS Business & Specialty Tax Line to request your 147c letter. The phone number to reach them is 1-800-829-4933. The line is open Monday through Friday from 7:00 AM to 7:00 PM local time.

Step 3: Verify Your Identity

When you call, you will need to verify your identity and your authority to request the 147c letter. Be prepared to provide:

- Your name and title within the business.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Any other identifying information requested by the IRS representative.

Step 4: Request the Letter

Once your identity is verified, inform the IRS representative that you need a letter to verify your EIN. They will process your request and can send the letter in one of two ways:

- Fax: If you need the letter urgently, you can request that it be sent via fax. Be sure to provide a secure fax number where you can receive the document.

- Mail: If you do not have access to a fax machine, the IRS can mail the letter to the address on file for your business. This method may take several days to a few weeks, depending on postal service times.

Step 5: Confirm Receipt

After making the request, confirm that you have received the 147c letter via your chosen method. Ensure that all the information on the letter is correct and keep it in a secure place for future reference.

Who might request for a 147c letter?

- Business Owners: Individuals who own a business and need to verify their Employer Identification Number (EIN) with the IRS can request a 147c letter. This is crucial for tax reporting and compliance purposes.

- Authorized Representatives: A person who has been given legal authority to act on behalf of the business, such as a lawyer or an accountant, can request the letter. They must have proper documentation proving their authorization.

- Third-party Designees: With the business owner’s permission, a third party, like a payroll service, may request the 147c letter. This is often necessary when handling financial transactions or tax-related matters for the business.

Why is a 147c letter Important?

A 147c letter is crucial for several reasons, particularly for businesses and individuals dealing with tax-related issues. Issued by the IRS, this letter is an official document that verifies the Taxpayer Identification Number (TIN) or Employer Identification Number (EIN) of a business.

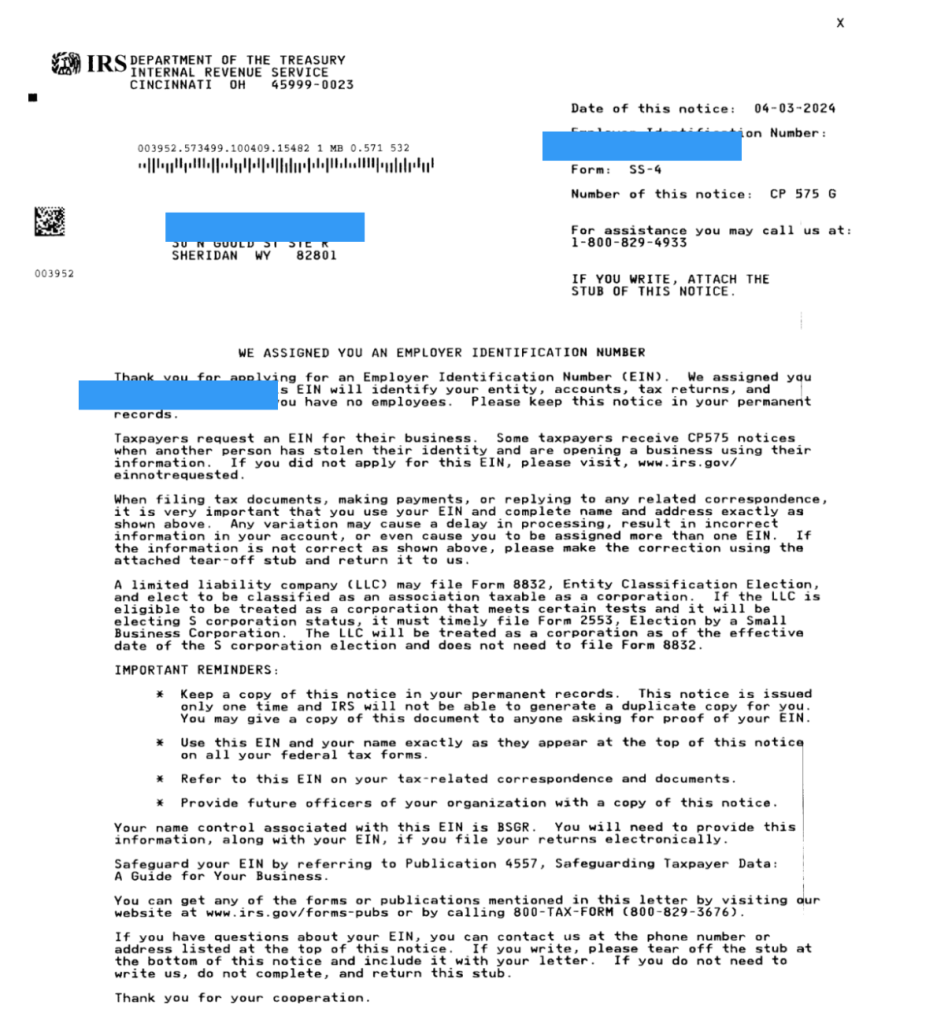

This becomes particularly important in situations where the original EIN confirmation letter (CP 575) is lost or misplaced. The 147c letter serves as a replacement for the CP 575, ensuring that businesses can confirm their EIN to banks, and financial institutions, or when required for tax-related documentation.

Having access to a 147c letter allows businesses to maintain compliance with IRS regulations and avoid potential tax-related complications. It is essential for completing various administrative tasks, such as opening business bank accounts, applying for business licenses, and filing tax returns. Without this letter, businesses might face delays, financial discrepancies, or issues with legal documentation, potentially hindering their operations.

Moreover, the 147c letter reassures other parties (like vendors, clients, or financial institutions) of the business’s legitimacy and its compliance with tax laws. This can be particularly beneficial in establishing trust and credibility in business transactions.

Overall, the 147c letter plays a vital role in smoothing the path for various business operations, ensuring that companies can demonstrate their tax identity, comply with legal requirements, and avoid unnecessary hurdles.

How does the IRS send the 147c letter?

The IRS sends the 147c letter through the following process:

- Identification: The IRS identifies a need to confirm an entity’s Employer Identification Number (EIN) information.

- Request: The entity or their representative requests the 147c letter, usually via phone, as the IRS does not initiate this process.

- Verification: The IRS verifies the identity of the requester to ensure confidentiality and security.

- Preparation: The IRS prepares the 147c letter, confirming the EIN and associated business name.

- Mailing: The letter is sent directly to the requester’s address on file, usually within a few days.

- Receipt: The requester receives the 147c letter, which doesn’t replace the EIN confirmation letter but serves as official verification.

Conclusion

In summary, a 147c Letter is an essential document provided by the IRS that verifies a business’s Employer Identification Number (EIN). This letter is crucial for maintaining accurate tax records and ensuring smooth interactions with financial institutions and other entities that require EIN verification.

Understanding the importance and the process of obtaining a 147c Letter can help businesses avoid potential complications and keep their operations running smoothly. If you ever find yourself in need of EIN verification, don’t hesitate to request a 147c Letter from the IRS to ensure your business remains compliant and well-documented.

Frequently Asked Questions (FAQs)

How long does it take to receive a 147c Letter?

Once requested, the IRS typically processes and mails the letter within 7 to 10 business days. However, delivery times may vary depending on your location and the efficiency of the postal service.

Is there a fee for obtaining a 147c Letter?

No, the IRS does not charge any fees for issuing a letter. It is a free service provided to businesses needing to verify their EIN.

What information is included in a 147c Letter?

A 147c letter includes your business’s legal name, and the corresponding Employer Identification Number (EIN), and may include the business address on record with the IRS. It confirms the accuracy of the EIN associated with your business.

What should I do if I lose my 147c Letter?

If you lose your letter, you can request a new one by calling the IRS Business & Specialty Tax Line at 1-800-829-4933. The IRS will issue a new letter with the same information as the original.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now