When it comes to business incorporation, the two prevailing platforms are Stripe Atlas and EasyFiling. While both services have their merits, EasyFiling emerges as the superior choice for several compelling reasons.

EasyFiling offers a streamlined, intuitive, and user-friendly interface. With a core focus on Non-Residnet and their specific needs, EasyFiling guides users through every step of setting up their corporation or LLC. This makes the process less intimidating, even for those unfamiliar with the legal and financial complexities involved.

Secondly, EasyFiling provides a robust customer support service to answer queries promptly, ensuring that no question from their clients goes unanswered. This level of support is invaluable when dealing with complex documentation and state-specific laws.

Lastly, EasyFiling offers more affordable pricing plans without compromising the quality of service. They also offer a range of additional services, such as EIN procurement and Registered Agent service, often at a fraction of the cost charged by other providers, including Stripe Atlas.

Stripe Atlas vs EasyFiling

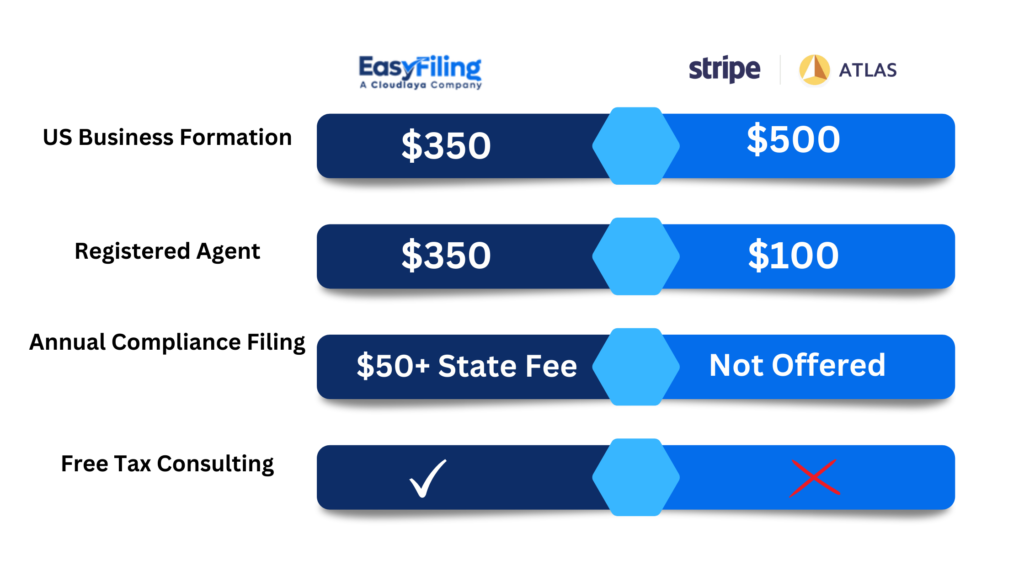

To elaborate on the comparison, EasyFiling offers US business formation at a cost of $350, while Stripe Atlas charges $500 for the same service. For the provision of a registered agent, which is a mandate for most businesses, EasyFiling charges only $50, whereas Stripe Atlas doubles this cost at $100. Moreover, EasyFiling supports annual compliance filing, a fundamental requirement for businesses, while Stripe Atlas does not mention this offering.

One significant advantage of EasyFiling is their offer of free tax consulting, a service not offered by Stripe Atlas. Support for non-residents and local expert aid are two critical factors for those starting a business in a foreign country.

In both these aspects, EasyFiling outperforms Stripe Atlas, indicating their commitment to comprehensive and supportive service. EasyFiling’s more affordable and inclusive offerings make it a preferred choice for entrepreneurs looking to incorporate their business in the US.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now