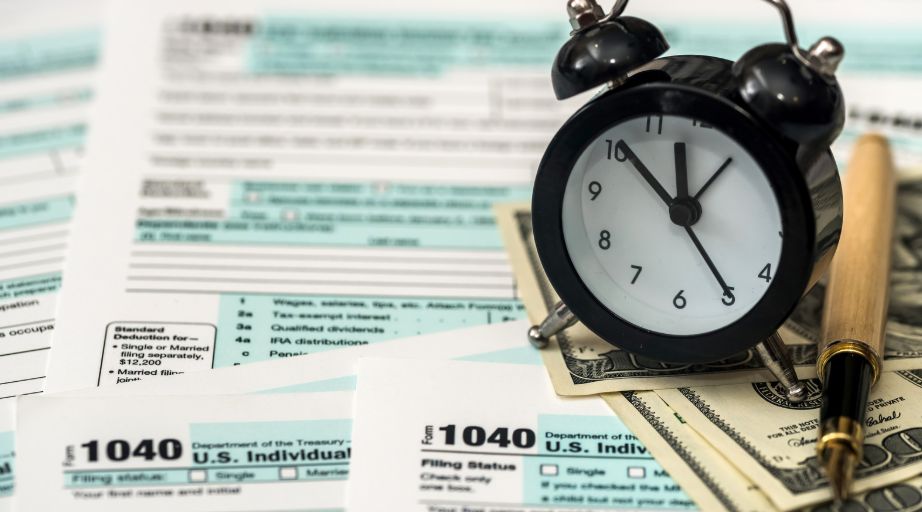

If you own a Limited Liability Company (LLC) in Oregon, it is essential to understand your tax filing obligations with the IRS.

Your tax responsibilities largely depend on how your LLC is organized: either a single-member LLC (SMLLC), a multi-member LLC, or an LLC that has elected to be taxed as a corporation.

In this article, we will discuss the process of IRS tax return filing for Oregon LLC, focusing on classifying the taxes, reporting the taxes, deadlines, and other relevant details.

Federal Tax Filing Requirements for Oregon LLCs

Single-Member LLC

As SMLLC is taxed as a sole proprietorship, the IRS considers it a disregarded entity. This means that your LLC’s profits and losses are reported on the owner’s return via Schedule C. In your case, it is part of your Form 1040.

Important Tax Documents:

- Form 1040 (U.S. Individual Income Tax Return)

- Schedule C (Profit or Loss from Business)

- Schedule SE (Self-Employment Tax) if applicable

- Form 1099-NEC (if applicable for freelancers)

All single-member LLCs have to pay self-employment taxes which cover social security and Medicare. These taxes are reported on the SE Schedule and they have to be paid with the tax return.

Multi-Member LLC

A Multi-Member LLC is treated as an ordinary partnership unless an election is made for corporate taxation. It does not pay federal income taxes and instead, profits and losses “pass-through” to its members, who report these amounts on their personal tax returns.

Key Forms to File:

- Form 1065 (U.S. Return of Partnership Income)

- Schedule K-1 (Partner’s Share of Income, Deductions, Credits, etc.)

- Each member’s income in their Form 1040 and applicable schedules

In addition, each member of the partnership must also pay self-employment taxes, as each member is treated as individually self-employed, based on the member’s share of the LLC’s net income. The IRS also requires that these multi-member LLCs maintain adequate records of their income distributions to members.

LLCs Electing Corporate Taxation

An Oregon limited liability company (LLC) that opts to be taxed like an S or C Corporation has additional IRS tax filing obligations.

C-Corporation:

- Form 1120 (U.S. Corporation Income Tax Return)

- The LLC pays corporate income tax directly at the federal level.

- If dividends are paid out, there is payment of tax at the shareholder level.

S-Corporation:

- Form 1120-S (U.S. Income Tax Return for an S-Corporation)

- Shareholders receive Schedule K-1.

- Shareholders declare distribution as profits through Form 1040.

- It is possible to save some self-employment tax by reasonable salary distribution.

Oregon State Tax Filing Requirements

Apart from federal taxes, Oregon LLCs have state-level tax filing obligations, which include:

Oregon Corporate Activity Tax (CAT): This tax is for LLCs whose commercial activity in Oregon exceeds $1 million.

Oregon State Income Tax: If the LLC conducts business within Oregon, it is subject to filing/ payment of personal/ corporate income tax. Oregon state income tax is progressive, with a range of 4.75% to 9.9%.

Oregon Employer Taxes: These taxes are mandatory for LLCs with employees (as employers), including payroll tax.

Oregon Transit Tax: This tax is automatically withheld from the employee’s wages by the employer.

Self-Employment Taxes for Oregon LLC Owners

Owners of single-member LLCs or fully owned multi-member LLCs are obligated to pay self-employment taxes to cover their Social Security and Medicare contributions.

- Self-employment tax is automatically 15.3% of net income.

- Paid through Schedule SE form linked to a Form 1040

- Can be paid every three months with Form 1040-ES

Some owners pick an S-Corp election to lower their self-employment taxes. This allows them to designate a reasonable salary, while also taking net income as distributions that are not liable for self-employment taxes.

Annual Reporting and Compliance for Oregon LLCs

Alongside other LLCs, Oregon-based LLCs have additional obligations to fulfill annually such as:

Oregon Annual Report: This should be sent to the Secretary of State who will charge $100 for locally based LLCs.

Quarterly estimated tax payments: 1040-ES needs to be filled out by anyone who is currently owing $1000 or more in federal taxes.

Business License Requirements: Several municipalities and districts are known to issue permits or registrations for other businesses in Oregon.

Not submitting an annual report can lead to fines and can even get your LLC terminated by the state.

IRS Tax Filing Deadlines for Oregon LLCs

March 15: Multi-member LLCs and S-Corporation fill deadline for Form 1065 or Form 1120-S

April 15: Single-member LLCs and C-Corporate fill Form 1040 or 1120 deadline

Estimated Quarterly Payments for Taxes: April 15, June 15, September 15, and January 15.

Filing taxes late can result in penalties and interest charges, making it crucial to stay ahead of deadlines.

Penalties for Late Filing and Non-Compliance

You can suffer negative consequences through debt if you don’t comply with tax law and fill on time. In corresponding IRS regulations:

Filing Delay Penalty: In most cases, not filing on time results in 5% of unpaid taxes, a maximum of 25%.

Payment Delay Penalty: Not paying taxes within a specific timeline may lead to a 0.5% penalty per month.

Lack of Filing Form 1065: This can lead to a penalty of $220 per partner, every month.

Interest Charges: The IRS charges interest on unpaid taxes, which continue to accumulate until the balance is paid.

Steps to File Your IRS Tax Return for an Oregon LLC

Choose Your Tax Classification: Check if your LLC is a single-member or multi-member, or if you have elected for corporate taxation.

Obtain Financial Documentation: Assemble income, expenses, payroll, and any other relevant records.

Prepare Required Business Taxes Forms: Complete the IRS forms applicable to your business structure.

Estimate Self-Employment Taxes Along With Payroll Taxes: Calculate your liabilities, both self-employment and employment taxes.

Pay Estimated Taxes Quarterly: If applicable, make quarterly estimated payments on Form 1040-ES.

Complete State Tax Filings: Ensure filing compliance with Oregon tax requirements.

Submit Your Federal Tax Return On Time: File before the relevant IRS deadlines to avoid penalties.

How EasyFiling Can Help Oregon LLC Owners

Filing taxes can be complex, but EasyFiling simplifies the process for Oregon LLC owners. Our team provides LLC formation services, bookkeeping, and tax filing assistance, ensuring that you remain compliant with IRS and state tax requirements.

Why Choose EasyFiling?

- Consultation regarding LLC tax liabilities and compliance issues

- Assistance in filing for federal and state taxes

- Help in IRS paperwork and bookkeeping

- Guidance provided for tax savings and write-offs

Start Today

Reach out to EasyFiling’s specialists at any time for help with tax compliance and strategies for LLCs because you shouldn’t have to wait until tax season to get your finances in order.

Final Thoughts

An LLC owner in Oregon will be compliant and reap the tax benefits by understanding some of these tax liabilities.

Make EasyFiling your number one choice today! Federal fillings or state taxes, we are with you to help you always.

Count on our professional staff will help you avoid expensive deductable tax errors and provide you with good financial cover.

Call us today and relax while we deal with your tax filings so you can concentrate on expanding your business.

Frequently Asked Questions (FAQs)

When does an LLC in Oregon file its taxes?

The federal tax deadline is April 15, the same as it is for other states. However, state taxes for Oregon may have different deadlines. You should ask the Oregon Department of Revenue for their specific date.

Do LLCs in Oregon have to file taxes at the federal and state level?

Yes, LLCs are subject to IRS compliance and regulations under the state of Oregon. Federal filings vary based on tax classification, state filings include possible income taxes and the Corporate Activity Tax (CAT) for qualifying businesses.

Can self-employment taxes be avoided with an LLC in Oregon?

Taking S-Corp elections enables LLC members to receive a salary while allowing the remainder of the profits to be distributed as dividends, thus reducing overall self-employment tax expenses. A tax advisor can assist with this evaluation.

What are the consequences of not filing taxes for an LLC in Oregon?

Not accurately filing taxes can lead to various ramifications, including penalties from the IRS, state fines from Oregon, and in some circumstances, losing good standing with the state which could lead to dissolution of the LLC.

Is there a yearly tax for an LLC in Oregon?

Oregon does not have a franchise tax; however, businesses with revenues exceeding $1 million are subject to the Corporate Activity Tax (CAT). Other taxes may apply based on business activities.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now