A Limited Liability Company (LLC) in South Carolina is one of the most popular types of business entities among budding entrepreneurs and small business owners who wish to have a formalized structure to their business without losing flexibility and at the same time want liability protection.

The most appealing feature of having an LLC is limited liability for the owner which, in simple words means, your assets are usually secured from the debts and liabilities of the business. Setting up an LLC in South Carolina is easy due to its favorable business climate and growing economy.

The goal of this article is to take you step by step on how to set up an LLC in South Carolina by selecting an appropriate name, applying, getting an EIN, and other requirements of the state, so you can set up your business and begin operating legally in South Carolina.

Why Form an LLC in South Carolina LLC

Limited Liability

South Carolina LLC members (or owners) have personal liability protection which means that his/her personal property, such as homes, cars, or bank assets are more or less secured from business debts and liabilities under their name or legal action against the LLC.

One of the strongest advocates for the LLC structure of doing business is the protective separation between personal assets and business assets.

Pass-Through Taxation

South Carolina LLCs do not pay taxes on their own but rather all profits and losses are reported by members of the LLC.

This principle is desirable because it prevents the unnecessary tax burden that often falls on corporations and their shareholders. It is a cost-effective strategy because tax declarations are easier and total tax payables may be lower.

Flexible Management Structure

There are two options: member-managed or manager-managed, making their LLC depending on the circumstances Members in small businesses often provide their management while bigger LLCs sometimes prefer to engage other hired managers.

This gives LLCs the chance to change their original management structure as the growth of the business occurs, enhancing the firm’s competitiveness.

Enhanced Credibility

LLCs enhance the credibility of the business and as such they will attract customers, investors, and possible partners.

A lot of customers and suppliers tend to trust a registered LLC more compared to a sole proprietor business that is not as stable or furnished with the same liability by law and structure.

No Annual Report Requirement

South Carolina stands out as one of the states that require LLCs to file an annual report. This simplifies the compliance process and reduces annual filing costs.

Those LLCs that opt to be taxed as corporations might incur reporting responsibilities, but those who do not wish to change their status can benefit from reduced paperwork.

Steps of Forming an LLC in South Carolina

Step 1: Select a Distinctive Name for Your LLC

Naming Requirements: Your LLC should not be confused with any other business that is registered with the Secretary of State in South Carolina. Moreover, it should contain the words ‘Limited Liability Company, LLC, or L.L.C.,’ showing that the company limited liability.

Name Availability: Checking availability status can be done through the South Carolina Secretary of State’s business databases. This makes sure that the names that you have in mind are not already accounted for or are very similar to those of some other business registered in South Carolina.

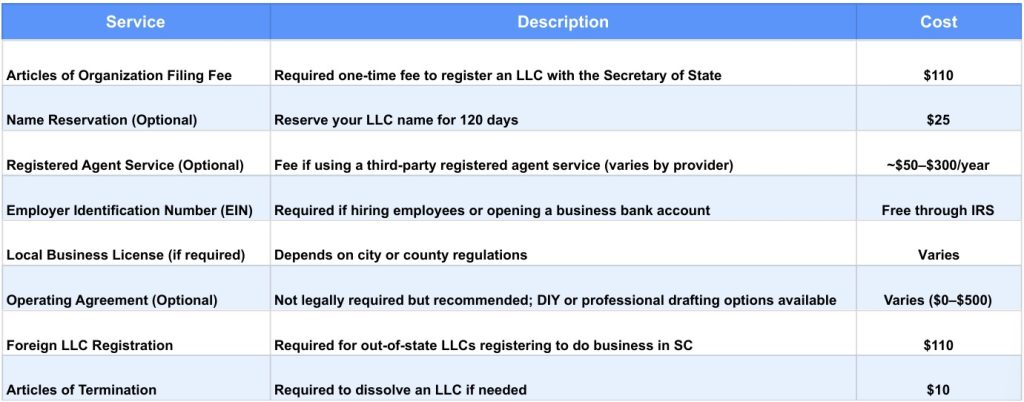

Name Reservation: If you find an unused name and are sure that you want to use it when filling out further documents, you may file an Application to Reserve a Name form, also called Form 4 for the amount of $25. It’s good for 120 days, which is plenty of time for you to have completed your filing.

Step 2: Appoint a Registered Agent

Role of the Registered Agent: A registered agent stands as a point of contact for your LLC and accepts court documents, compromising a lawsuit and any documents provided by the state on your LLC’s behalf. Such individuals should be located in the office from 9 AM to 5 PM and provide these services without challenge.

Eligibility Requirements: A person who is a resident of South Carolina or a corporation in good standing and licensed to do business in the state may serve as the agent. If you employ an agency providing registered agent services, they can provide such assurance and take care of paperwork.

Choosing an Agent: Most companies seek out professional registered agent services because these agents provide a company’s peace of mind and stability, especially in cases when the company does not maintain a physical location or is out of town too often.

Step 3: File the Articles of Organization

Filing Requirements: A registered LLC can only be obtained after submission of the properly completed Articles of Organization to the Secretary of State for South Carolina. This document has very basic particulars of the business such as the business’ registered name, registered agent, and registered office address of the business.

How to File: The Secretary of State can also receive the form through conventional mail or you can file it online. It should also be noted that the filing fee is $110 in both of the cases. For regular filings though, the fee is typically the same at $110, however, this option for filings is normally faster.

Information to Include:

- LLC’s legal name and statutory office address

- The agent for service of process together with his/her address

- The particulars of LLC members’ or managers’ residence addresses, if any of them are present

Step 4: Execute Operating Agreement

What It Is: An operating agreement is a legal document that details the ownership, management, structure, financial arrangements, and operational lines of the LLC. This is important when determining the percentage of share ownership among members, the activities of each member, and provisions for sharing profits.

Why It’s Needed: Such a document is however not mandatory in South Carolina, still, an operating agreement has a mitigating effect on the risk of discord among members. It outlines how disputes will be handled and how the members will conduct themselves in managing the business.

Key Elements to Include:

- the part of ownership that each of the members will possess

- what rights and responsibilities each member has

- what are the voting power and decision-making powers

- when and how to increase and decrease the number of members

- the procedure to be followed in case of deciding to wind up the LLC, if such a resolution is taken.

Step 5: Apply for EIN (Employer Identification Number)

EIN is short for Employer Identification Number. The same is required to have a social security number, in the instance of an operation for a business. This number is used for tax reporting and becomes necessary when hiring employees, creating a business bank account, or when deposits are being filed.

How to Apply: You can obtain an EIN for free by applying online through the IRS website. The application process is straight forward and you will have your EIN assigned to you after you finish all steps in the form.

When You Need it Most: In most instances, an EIN is required to obtain a business bank account. Also, if the LLC has more than one member, an EIN will also be needed as long as there are no employees and so no payroll.

Step 6: Registration for South Carolina State Taxes

Sales Tax Registration: Where your LLC supplies goods or certain services, they would need to pay sales tax and register with the South Carolina Department of Revenue which can be done online through the department’s MyDORWAY portal.

Employer Taxes: Regrettably, if your LLC has employees, they should register for employer withholding tax and unemployment insurance tax.

Special Industry Requirements: Some sectors like the hospitality industry, alcohol sales health care, etc require certain registration and permits. Verify that your business complies with any industry-specific regulations by contacting South Carolina’s regulatory authorities.

Step 7: Filing the Initial report clear in Form CL-1

What It Is: LLC owners in South Carolina are obliged to submit the initial report copy known as Form CL-1 when submitting the Articles of Organization. This assists the state in monitoring the business entities that are active in South Carolina by providing the owners and the management of the business.

How to File: You can file Form CL-1 online, or if you are mailing the Articles of Organization, you can include it with them. Remember to pay the filing fee ($110) as well.

Required Information:

- Contact and business name

- Shall include the names, and addresses of the managers or members of the LLC.

- Outline of activities engaged by the business.

Step 8: Open a Business Bank Account

Why It’s Necessary: Having separate personal and business accounts is critical as it ensures liability protection and effective bookkeeping. Having only one bank account for business purposes reduces tax liabilities and the risk to personal savings.

Required Documentation: In most cases, opening a bank account will require the following:

- Your copy of the Articles of Organization.

- An EIN was issued by the IRS.

- An LLC operating agreement (if available).

Step 9: Be Aware of the Annual and Other Required Compliance Affidavits

Annual Reports: In South Carolina, members of an LLC are not obliged to file an annual report.” However, if the company elects to be treated as a corporation for tax purposes, it will be required to do so. Regardless, it is important to ensure that all business records with the Secretary of State are current to prevent any suspension of registration or additional penalties.

Franchise Taxes: Franchise taxes are not levied against South Carolina LLCs, however, if the LLC elects taxation status of either an S-corporation or a C-corporation, then applicable provisions would be applied.

Ongoing Documentation: Accurate logs of members’ meetings, decisions, and transactions will be necessary records in case there are any litigations to be engaged in.

Step 10: Observance of Other Business Permits and Licenses

Local Licensing: There are instances when businesses within some cities or counties within South Carolina are required to obtain local business licenses. Check with your city or county government to confirm the specific licensing requirements for your LLC.

Industry-Specific Permits: Other permits or permits may be required based on the type of business you run. For example, permits seem to be standard for firms or providers of health care, and food services, or in abusing construction companies permissions seem to be important

Costs of Forming an LLC in South Carolina

Wrapping Up

In South Carolina, the filing of an LLC requires not only due accuracy but consideration of state-specific regulations. Seeking to compile a comprehensive strategy in this article, step by step.

In that context please inform me whether any other portions should be added, for example, covering ongoing legal matters or tax issues regarding South Carolina LLCs!

Book a free consultation for clear guidance on how to set up a South Carolina Limited Liability Company and any other services that you may need.

Frequently Asked Questions (FAQs)

Can a foreign LLC be registered in South Carolina?

An out-of-state or “foreign” LLC can do business in South Carolina. All that is required is the submission to the Secretary of State of Application for a Certificate of Authority along with the payment of a $110 fee. A house address in South Carolina is also needed for a registered agent.

Can a single-member LLC be established in the state of South Carolina?

Yes. In South Carolina, it is permissible to form a single-member LLC. They, however, become the sole member of the company and hence enjoy limited liability protection and pass-through taxation.

Am I required a South Carolina business license to conduct business in my South Carolina LLC?

Even though South Carolina does not require a general business license, other licensing requirements in place may be observed in other cities or counties within the state. It’s best to contact the relevant local city or county offices to find out if uses or additional permits, for which there may be a fee, are required.

Does my company need a South Carolina address to register my LLC?

The address of an LLC’s registered agent should be in South Carolina and the purpose of such an address is to receive official documents. However, having a business address in South Carolina is unnecessary if a registered agent has an address in South Carolina.

What should I do to close an LLC in South Carolina?

In South Carolina, an LLC may be dissolved by filing Articles of Termination with the Secretary of State or any company obligations including settlement of taxes and business license cancellations.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now