Creating a Limited Liability Company (LLC) in 2024 is a beautiful alternative for many entrepreneurs and small business owners. An LLC combines the flexibility of a partnership with the liability protection found in corporations, which makes it appealing to different businesses.

It is, however, key that one understands the cost of starting an LLC, plans appropriately for its finances, and ensures that it starts on the right footing. The financial aspects of establishing an LLC can be intricate and numerous, from state-specific fees to ongoing administrative expenses.

This article will explore the cost to start an LLC in 2024. We will delve into state filing fees, potential ongoing costs, and all other details individually for you to understand them better. Whether you have never owned a business before or would like to convert an existing company, this knowledge will enable you to proceed with confidence through the process of forming an LLC.

Cost to start an LLC in 2024

State Filing Fees ($50 to $500)

The most significant expense at start-up is usually the state filing fee, but this varies tremendously from one jurisdiction to another. This charge is made by the government officials at your state’s office against your LLC registration document, thus making your existence legal. In 2024, filing fees will vary from around $50 up to $500, depending on the particular state where your company is registered.

You need to therefore closely examine what your specific region requires, as this may significantly add to the original startup resources that are needed for operating changes initiated by new organizations since these rates must be paid before any further step is taken.

Name Reservation Fee ($10 to $50)

It might also be important for you before actually submitting documents establishing your limited liability company (LLC), to hold on to its name until all matters are clarified. Some states have an optional name reservation service that costs between $10 and $50 in most cases.

This may not be a compulsory procedure, but it is advisable, especially where the applicant has come up with a unique or very catchy name for such purposes. It reserves the name of your choice for some time, while you can now go ahead with other formalities without fear that someone else will take it.

Registered Agent Fees ($50 to $300)

A registered agent is chosen to receive legal papers for your LLC. Most states require LLCs to have a registered agent. You can serve as your registered agent, but many business owners prefer hiring professional services. Registered agents’ charges generally range from $100 to $300 annually, depending on the entity or individual providing the service and their level of assistance.

Among other benefits, an expert registered agent ensures that important legal documents are received on time and, more so, helps you protect your privacy since personal addresses do not appear anywhere in public directories or records.

Legal Costs ($500 – $2500)

Operating agreements are not required in all states but are recommended. Such a document outlines both the ownership and management structure of your LLC as well as the rights and responsibilities that members have among themselves. It usually costs between $500-$2500 to draw up an operating agreement legally; drafting one yourself could save you money though if you are comfortable doing so.

A well-drafted operating agreement prevents member misunderstanding by clearly delineating roles, and procedures for decision-making, profit sharing, and dispute resolution. Investing in a properly prepared operating agreement may protect your business from potential legal disputes in the future.

Business Licenses And Permits

Business licenses or permits may need to be obtained depending on industry type and location. Understanding how much these licenses or permits would cost is crucial, ranging from $50 to several hundred dollars. Researching requirements specific to your company type within its locality will help avoid future legal issues.

For instance, a restaurant may require health department permits while trade licenses may be needed for construction businesses. Compliance with these requirements ensures the legitimacy of your enterprise while also enhancing credibility with customers & partners.

Franchise Taxes And Annual Fees

Many states charge annual franchise tax/fee for LLCs which is different from state income tax. This fee is often a flat rate, but in some cases, it can be based on the revenue or profit of the LLC for the year. Annual franchise taxes and fees generally range between $50 and $800.

To tender the good standing of your LLC, you must remain compliant with these annual obligations. Disregarding such tax payments may attract penalties, interest rates, or even liquidation of an LLC. It is important to plan for these ongoing expenses and set up reminders to ensure that your business remains in good standing with the state.

Additional Administrative Costs

Other than the main costs discussed above, there may be additional administrative expenses. Some of them are EIN application fees at the IRS, business insurance premiums, or professional service charges like accounting and legal consultations. These extra expenditures add up fast so it’s crucial to budget accordingly.

For example, while obtaining an EIN from the IRS is free; you might have to pay a service that helps you fill out the necessary forms. Also, business insurance protects an LLC against different risks whereas professional services would make sure all legal and financial regulations are met.

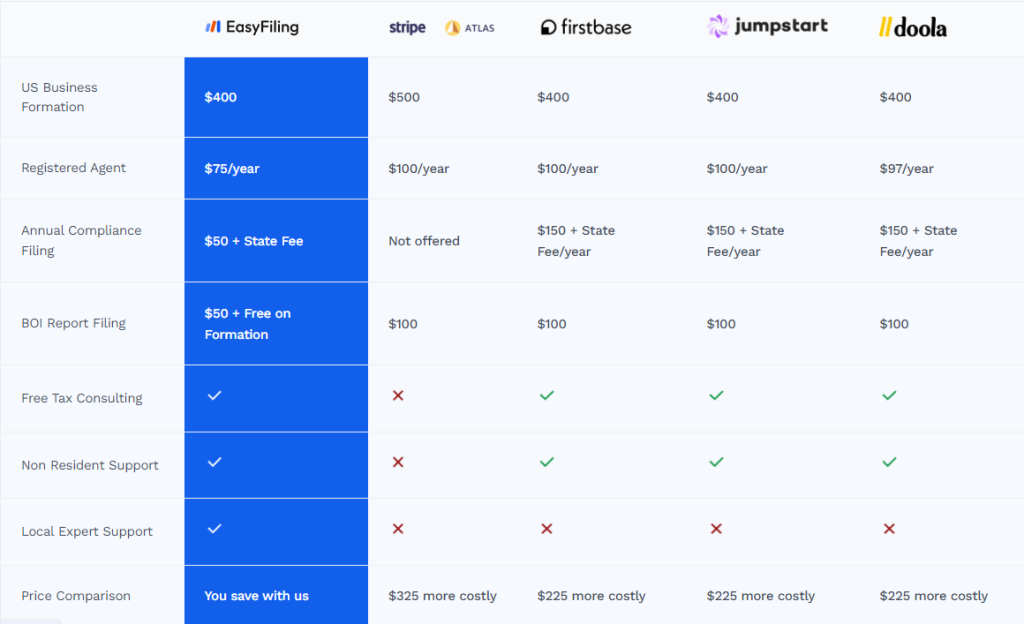

Cost to start an LLC with EasyFiling

Conclusion

Starting up an LLC in 2024 comes with different costs, which are both one-time and recurring. Understanding these expenses and planning for them will make the start of your business smoother and financially stable. We have discussed the main expenses relating to the formation of an LLC in this guide, from state filing fees to other administrative charges. This article has equipped you with all the knowledge needed so that you can easily form an LLC and get it off the ground.

In conclusion, this is a comprehensive overview of what it means financially when someone decides to start an LLC. It is meant to help you avoid any financial surprises as well as make more informed decisions about starting the company. Finally, every step taken during the process of forming your LLC toward its success and stability depends on understanding why it is essential to pay state-specific fees or how valuable a properly drafted operating agreement could be.

Similarly, maintaining awareness about ongoing costs such as franchise taxes or administrative fees ensures the good standing of your LLC and smooth running operations. Taking such steps as managing these costs proactively or seeking professional advice where necessary can minimize financial risks while maximizing growth potential and profitability. In essence, the cost implications associated with starting a Limited Liability Company are integral milestones toward the company’s targets.

Frequently Asked Questions (FAQs)

How much does it cost on average to start an LLC in 2024?

The average cost of setting up a Limited liability Company in 2024 ranges between $500 – $1000 depending on local state requirements, and additional services including legal aid/ professional assistance.

Are there continuous costs associated with the maintenance of my LLC?

Yes, there are continuing charges comprising annual franchise taxes registered agent payments as well as renewals for business licenses/permits, etc., usually costing between $200 – $800 per year.

Can I form an LCC without hiring an attorney?

Just like many others have managed to do successfully; you can establish a limited liability corporation by using online assistance organizations but for sophisticated business requirements or ensuring that all legal documents are properly prepared, it is wise to consult a lawyer.

Do I need an operating agreement for my LLC?

Although it may not be mandatory in every state, having an operating agreement is highly recommended as this document clearly outlines the ownership and operational structure of your LLC hence avoiding conflicts and ensuring smooth management.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now