Owning and running a business is more than only providing business services to your customers. The harder part is to take responsibility for your business documents mainly financial documents i.e., the 1120 Tax Form.

Maintaining your financial records and paying corporate taxes is essential to running a business. If you are new to owning a business then, the 1120 Tax form is a new thing that shall be filed each year in paying your annual business tax.

What is an 1120 Tax Form?

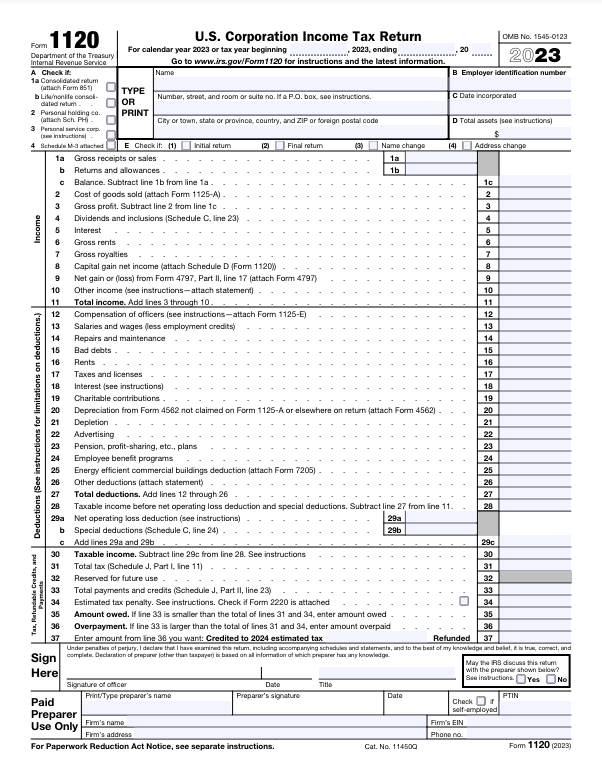

An 1120 tax form is an IRS form that a business corporation uses to find out how much tax they owe to the government. It is also known as the U.S. Corporation Income Tax Return.

Likewise, US corporations use this form to report their income, gains, losses deductions, and credits to the Internal Revenue Service (IRS).

Within 1120 Tax form, there are several types with its own features and purposes:

- 1120 C: Tax Return for Cooperative Associations

- 1120 F: Tax Return for Foreign Corporation

- 1120 H: Tax Return for Homeowners Association

- 1120 L: Tax Return for Life Insurance Companies

- 1120 POL: Tax Return for Political Organizations

- 1120 S: Tax Return for an S Corporation

Who files the 1120 Tax Form?

All the business corporations must file the 1120 Tax Form except for those business that lies under section 501. Even if the corporation doesn’t have taxable income or is under bankruptcy, form 1120 must be filled.

The following business entities must file the 1120 Tax Form:

- Limited Liability Companies (LLCs)

- Entities electing to be taxed as corporations

- Corporations engaged in Farming

- Foreign-owned domestic disregarded entities

- Ownership interest in a Financial Asset Securitization Investment Trust (FASIT)

The following business organizations with tax-exempt:

- Charitable organizations

- Social welfare organizations

- Social clubs

- Trade associations

- Labor organizations

- Veteran’s organizations

- Political organizations

These types of organizations shall instead file Form 990, Form 990-EZ, and Form 990-PF for the return of information to the business.

How To File Form 1120: Step-by-Step Instructions

Form 1120 is quite complicated for the first-timer as it is of six pages with several sections. However, following the steps below will guide you in filing Form 1120.

Step 1: Gather all the details

Before filling out the form, you need to prepare yourself with:

- Employer Identification Number (EIN)

- Business incorporated date

- Total assets of the corporation

- Total Income

- Dividends earned

- Gross receipts

- Interest earned

- Royalties earned

- Tax deductions

Step 2: Build your tax team

Building a tax team that includes a corporate tax professional and corporate tax filing software will make your filing process faster without any complications or issues.

Also, to file the form, the business owner has to use software like TurboTax, which has options for C Corporations. The owners cannot use a self-employment tax software program.

Step 3: Fill out most of Page 1

The first page of form 1120 requires the basic information about your business such as EIN number, date incorporated, total assets, and more.

Step 4: Fill out the Form 1120 Schedules

Take the support of professionals to file the details from page two onwards.

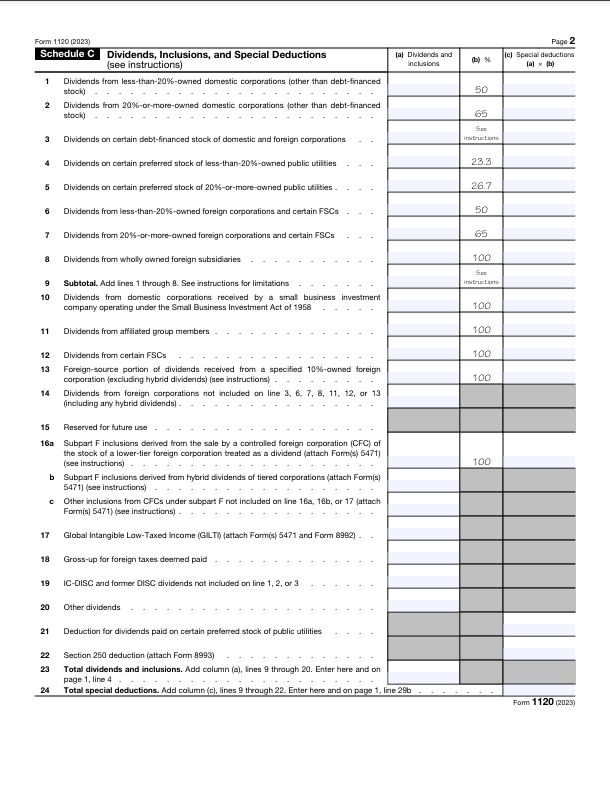

- Schedule C: Dividends, Inclusions, and Special Deductions

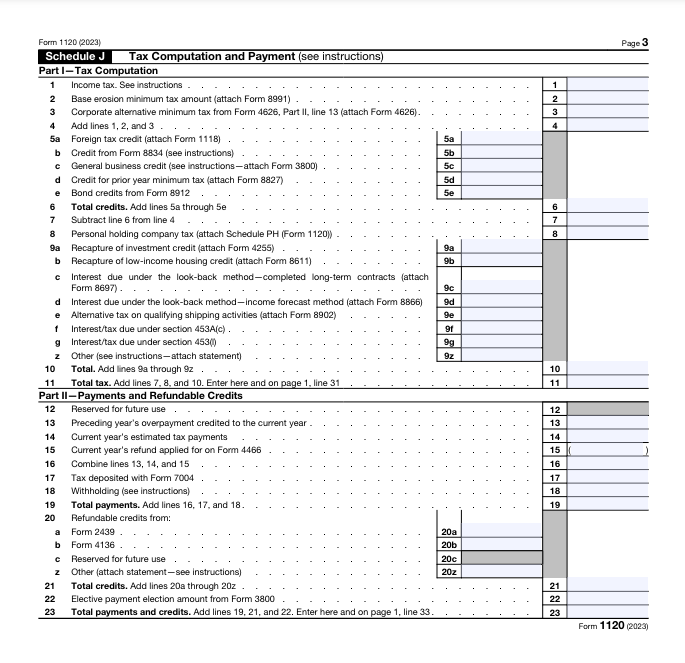

- Schedule J: Tax Computation and Payment

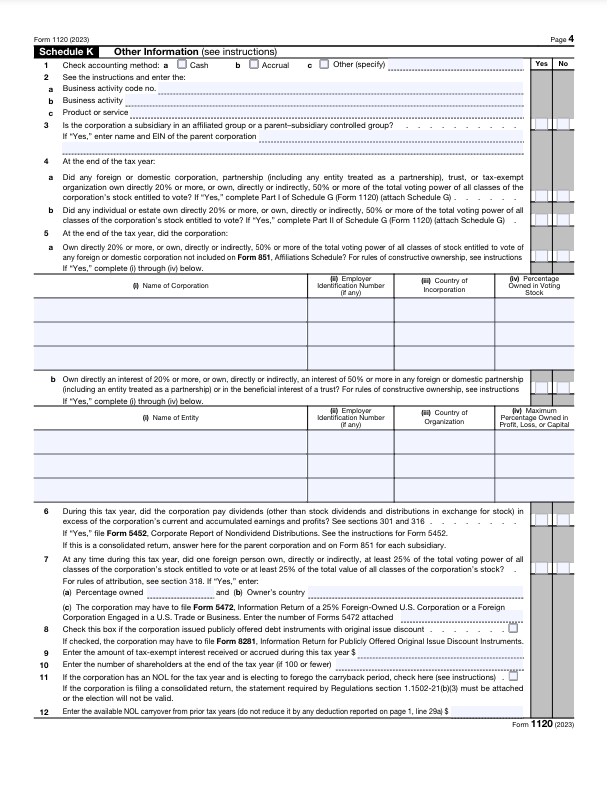

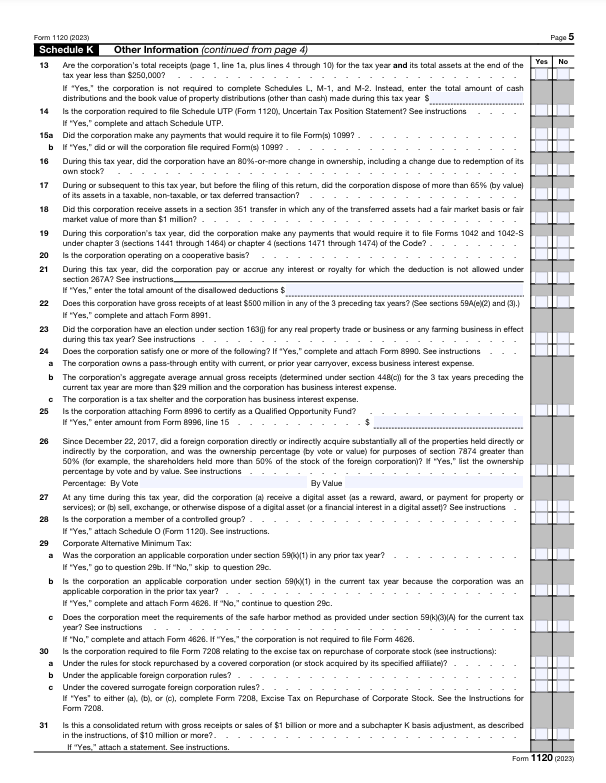

- Schedule K: Additional details on owner and companies

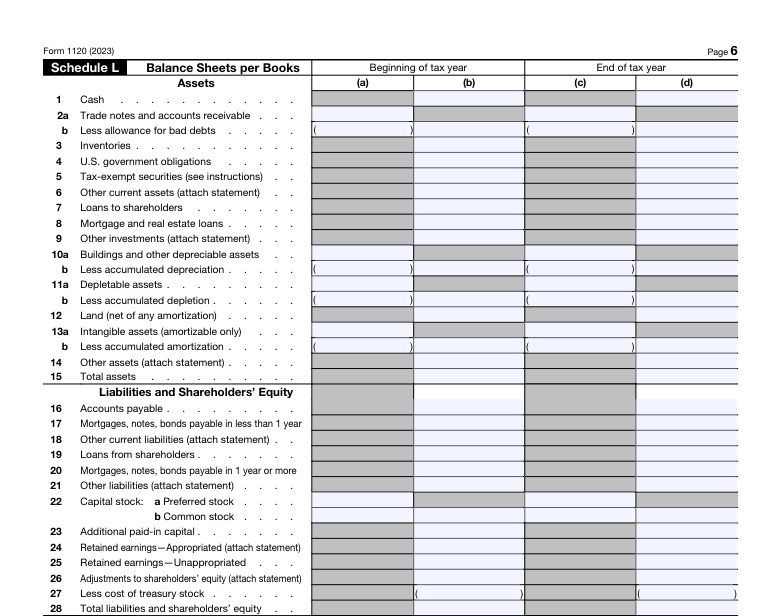

- Schedule L: Balance Sheets per Books

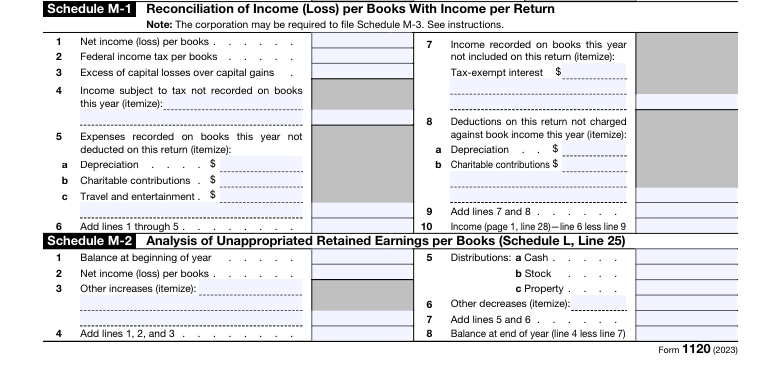

- Schedule M-1 and M-2: Reconciliation of Income (Loss) per Books with Income per Return (M1) and Analysis of Unappropriated Retained Earnings per Books (M2)

Step 5: File more Forms as per your Corporation’s requirements

Not every corporation files the same form, depending on the business activities, the forms required to fill are different as well. Here are a few types of forms as per the companies:

- Form 1125-A: Companies with a cost of goods sold

- Form 1125-E: Compensations with gross receipts of $500,000 or more

- Form 4797: For the sale of any business property

- Form 4563: For calculating depreciation and amortization

- Schedule D: For capital gains and losses

When Do I File an 1120 Tax Form?

Filing the 1120 Tax Form is due by the 15th day of the 4th month (April 15th) after the end of its tax year.

In contrast, a company whose fiscal tax year concludes on June 30 is required to submit its filing by the 15th day of the third month following the end of its fiscal year. Similarly, a company with a short tax year ending in June will be considered to have ended on June 30 and must file by the 15th day of the third month after the end of its fiscal year.

In case of late filing or return, a corporation may be penalized 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax.

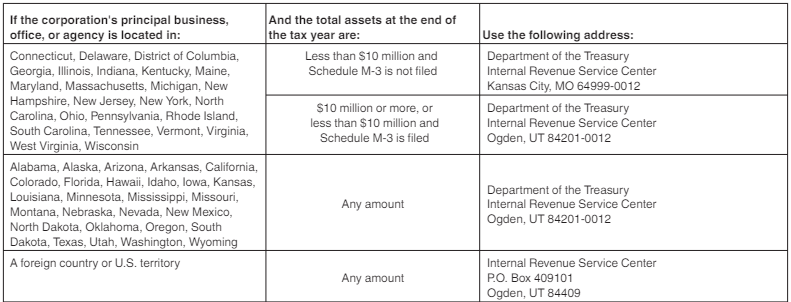

Where Do I File an 1120 Tax Form?

1120 Tax Form shall be filed in the Department of the Treasury Internal Revenue Service Center of the particular state where the corporation is formed.

Conclusion

Tax filing and reporting might be a burdening task to every corporation which if failed to file would be penalized by the Internal Revenue Service (IRS). Therefore, during your time of filing form 1120, you can seek the support of professionals (EasyFiling) to be safe from IRS penalties and complete the tax filing process with ease.

Frequently Asked Questions (FAQs)

What is the difference between Form 1120 and Form 1040?

Form 1120 represents the corporate entity (S Corp) while Form 1040 represents personal taxes as an individual. However, to file your personal taxes, you first have to file your S Corp tax return. Both personal taxes and business taxes have to be filed separately.

Can I file Form 1120 myself?

Yes, you can file form 1120 yourself online or by mail using IRS free file or tax software. Otherwise, you can hire a professional to file the form.

What is the deadline to file Form 1120?

The deadline to file Form 1120 is April 15th of the business year. Similarly, if your business uses a fiscal year, you need to file your tax return by the 15th day of the third month following the close of your tax year.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now