Starting a small business is exciting. You’ve got an idea, the drive, and the vision to make it work. But before you can move forward, you need to register your business. This step might not be the most fun part of the process, but it’s one of the most important.

Many first-time owners don’t realize how easy it is to make mistakes during registration. These mistakes can lead to delays, unexpected costs, or even legal problems later on. The good news is that you can avoid most of them if you know what to look out for. Let’s go over the most common registration mistakes and how you can steer clear of them.

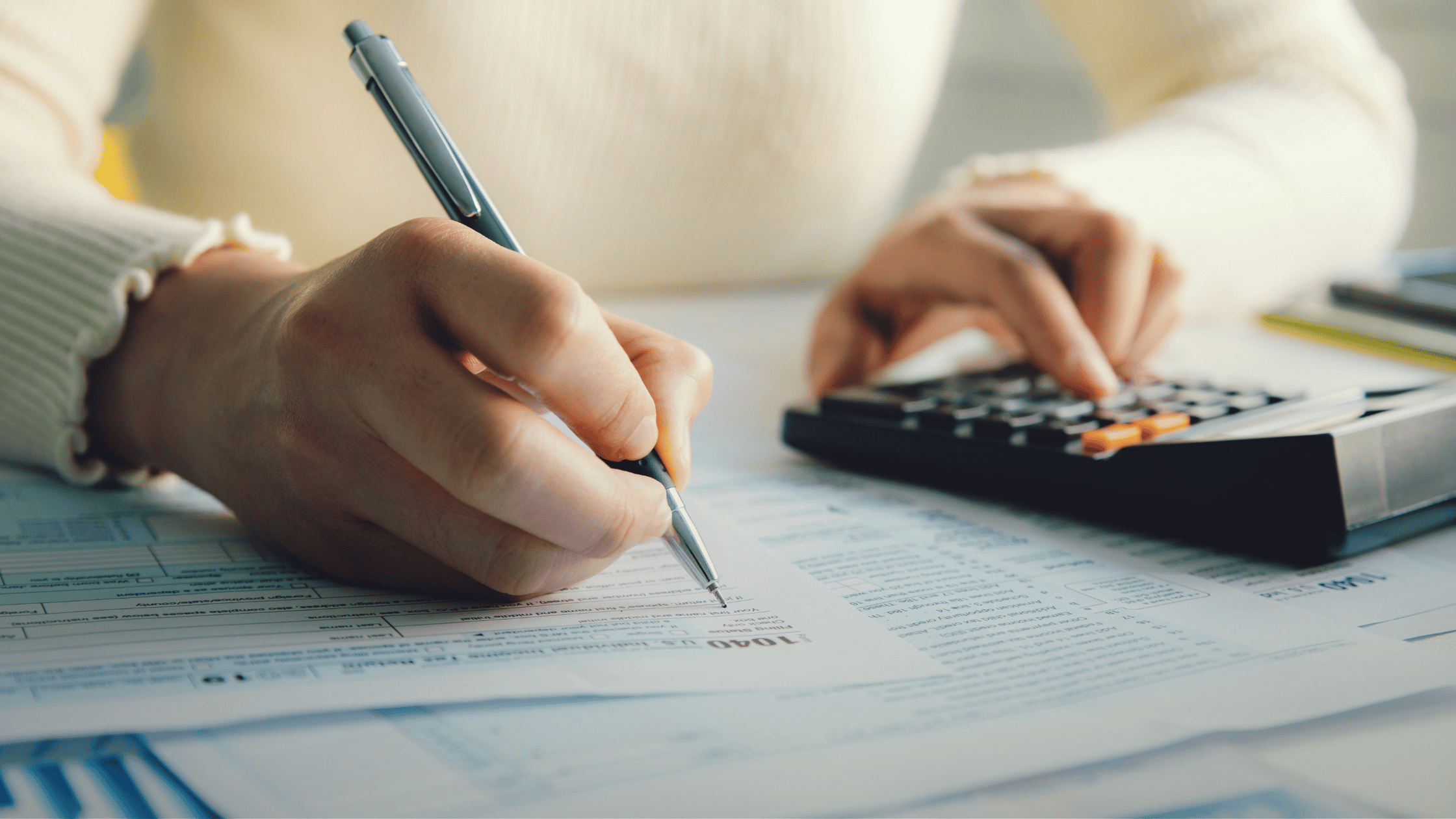

1. Not Reviewing Your Personal Finances First

One of the biggest mistakes new business owners make is ignoring their personal finances. It may feel like your personal money doesn’t matter once you’re starting a business, but that’s not true. In the beginning, your personal financial health can impact how lenders or banks view you.

For example, if you need a loan to get your business off the ground, the lender will likely check your personal history. That means your credit score may play a role in whether you get approved. It’s smart to take a quick look at where you stand before applying for funding. Some people hesitate and ask, “Do I really need to check my credit score before applying?” The short answer is yes. It helps to check your credit score early, since lenders often look at it when deciding on financing.

By reviewing your finances early, you can also decide how much you’re comfortable investing in your business. It gives you a clear picture of what you can handle without overextending yourself.

2. Choosing the Wrong Business Structure

The type of business structure you choose affects almost everything—taxes, liability, and even how easy it is to raise money. A sole proprietorship is simple, but it leaves your personal assets at risk. An LLC offers more protection, while a corporation can make sense if you plan to seek investors.

Many new owners rush through this decision without understanding the long-term impact. If you choose the wrong structure, changing it later can be complicated and costly. It’s better to take the time now to learn about the options. Think about your goals, your risk level, and how you want to grow. Talking with an accountant or legal professional can also help you choose wisely.

3. Skipping Name Searches and Trademark Checks

Another common mistake is registering a name without making sure it’s available. Just because you came up with a great name doesn’t mean no one else is using it. If your name is already taken, you could face legal disputes or be forced to rebrand. Both can be expensive and stressful.

Before you file any paperwork, search your state’s business registry. You should also check the U.S. Patent and Trademark Office database to see if your name is trademarked. Don’t forget to look online to see if the matching domain name is available. Taking these extra steps helps protect your brand and saves you from headaches later.

4. Forgetting to Register for an EIN

An Employer Identification Number, or EIN, is like a Social Security number for your business. Many first-time owners forget to apply for one, but it’s often required. Without an EIN, opening a business bank account, handling tax filings, or bringing on employees may not be possible.

The good news is that applying for an EIN is quick and free through the IRS website. Once you have it, keep it stored safely with your other important business documents. Obtaining this number early on helps you establish the rest of your business with fewer obstacles.

5. Overlooking Local and State Requirements

Registering your business at the federal level is not always enough. Each state has its own rules, and some cities or counties add extra requirements. For example, you might need a business license, zoning permits, or industry-specific certifications.

Skipping these steps can lead to fines or even being forced to stop operations until you comply. This is one mistake that’s easy to avoid if you do your research upfront. Visit your state’s business website and check with your local government offices. Write down everything you need and make a checklist so nothing gets overlooked.

6. Not Keeping Paperwork Organized

Business registration involves a significant amount of paperwork. You’ll have forms, applications, confirmation letters, and licenses to keep track of. Many new owners make the mistake of tossing these into a pile or leaving them scattered across emails.

Losing track of paperwork can cause delays when you need to prove compliance. It can also make renewals or tax season more stressful than it needs to be. To avoid this, set up a system from day one. Keep both digital copies and printed files in a safe spot. Label everything clearly so you can find it quickly when you need it.

7. Ignoring Post-Registration Obligations

Some owners think registering the business is the final step. In reality, it’s just the beginning. Once your business is registered, you’ll have ongoing responsibilities. Depending on your state, you may need to file annual reports, renew licenses, or pay specific fees.

Missing these obligations can result in penalties or even the suspension of your business status. To stay on top of things, mark important dates on your calendar and set reminders. Building these habits early makes it easier to stay compliant and focused on growing your business.

Registering a small business doesn’t have to feel overwhelming, but you do need to pay attention to the details. Many of the mistakes covered here—like skipping name checks, ignoring paperwork, or overlooking local rules—are completely avoidable with a little planning.

Taking the time to review your finances, choose the right structure, and stay on top of ongoing requirements will set you up for success. Each step you take now builds a stronger foundation for your future.

Your business deserves a solid start. Avoid these common mistakes, stay organized, and move forward with confidence. With the right approach, you’ll be ready to focus on what really matters—growing your dream into a lasting success.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now