In the United States tax system, Form 1099 plays a vital role as it allows taxpayers to report income from sources other than employment.

Completing this set of IRS tax forms is helpful in ensuring every taxpayer has reported their income appropriately and both the taxpayer and the IRS have access to track non-employment-based income.

It is necessary for both individuals and corporations to have a proper understanding of the form to ensure compliance with US taxation laws, tax reporting obligations, etc.

What is Form 1099?

This is formally referred to as an income non-taxable return and is also termed the IRS form 1099. The IRS form is used to report unearned income other than employment wages or salary.

The W-2 reports the earnings of an employee, Form 1099, on the other hand, is issued for several other payments. This is for payments to self-employed persons, contractors, freelancers, and non-employees.

However, the form does not determine due taxes directly but helps with crucial information necessary for a taxpayer when making the income tax return period ends.

Considering all the above, you see that, and through the reporting of this information, the IRS can make sure that all the different forms of income of citizens are taken into account and taxed.

Types of Income Reported on Form 1099

Whoever submitted income on form 1099 has held different ones and these have been filled by different individuals and this as in regards to form 1099 has got different kinds of income:

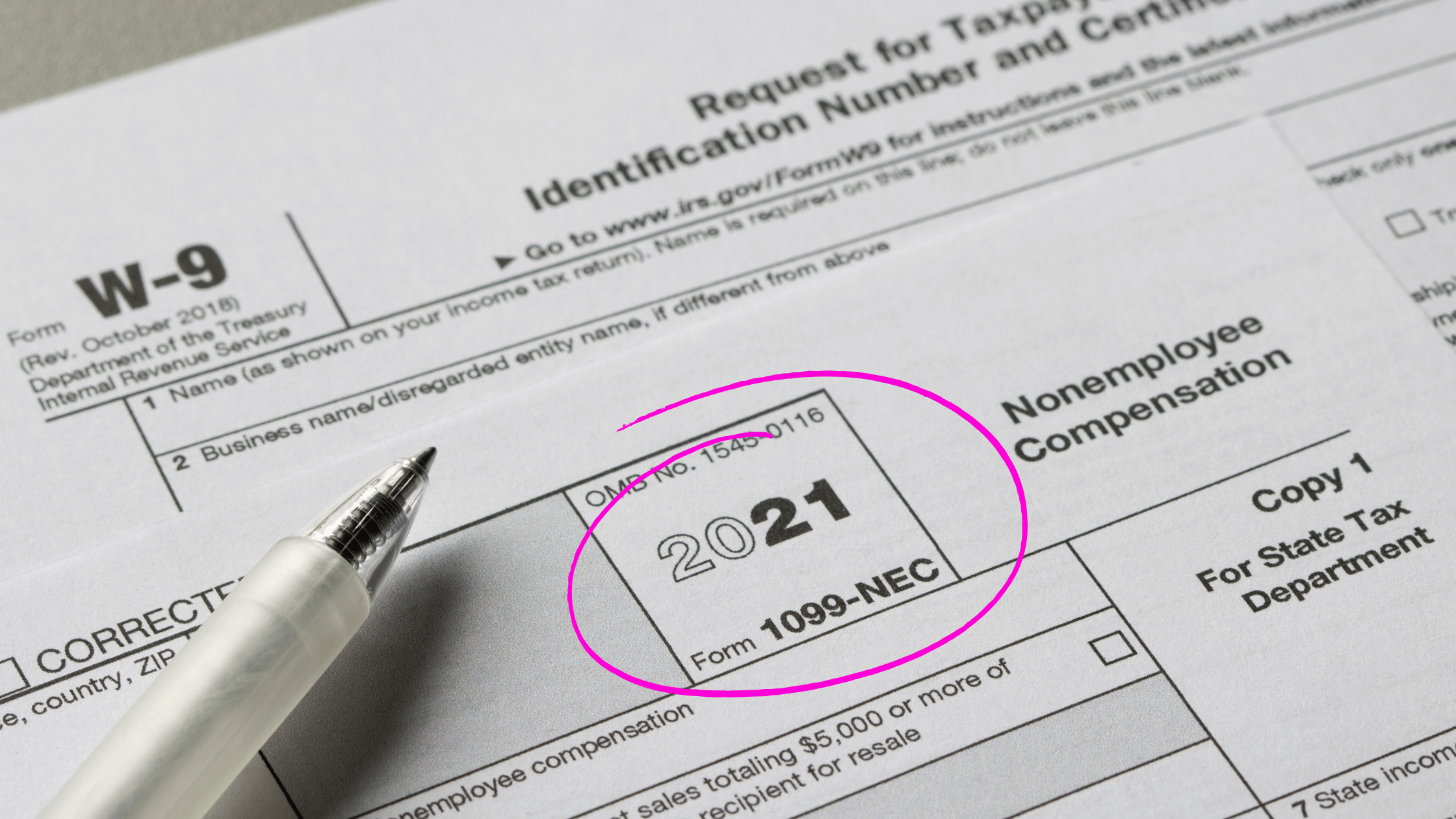

Nonemployee Compensation:

This is filed on Form 1099-NEC and involves freelancers, independent contractors along self-employed individuals especially in situations where they are paid in the line of duty.

Any business organization that pays out about $600 to an individual who is not an employee must file this form by the end of the tax year.

Income from Interests:

This income is reported on Form 1099-INT, and it arises from interest received from a savings bank, certificates of deposits, and other similar financial services.

This type of income is usually reported by and paid by authorized financial institutions like banks, credit unions, and some other financial bodies.

Income from Dividends:

Income from Dividends is filed on Form 1099-DIV which is mainly filed on submission of dividends in invested stocks or mutual funds.

This specific form also appertains to and includes reports on the capital gains distributions.

Income from Rent:

In as much as Form 1099MISC reports the payments received for rental properties such payments could depend on the context of the transactions in specifics.

It is very important to do so in particular to landlords and the other persons who own property the total income earned from such activities suitably reflected.

Miscellaneous Income:

Filed on Form 1099 MISC, this form is the winner in the larger categories for any other payments like prizes and awards, royalties, and even legal settlements with other payments in between.

And in other instances, it can include some of the payments for the services rendered.

If a business or a corporate entity makes a payment of more than $600 in a tax year to an individual or an entity, they are required to file a Form 1099 with the IRS. Those who do not timely submit or file these forms properly may be liable to suffer penalties as payers.

Importance of Form 1099 in the Tax System

Form 1099 is crucial for the overall workings of the tax system in the USA. It facilitates making reports of all taxable income so there is no negative possibility of people intentionally underreporting or evading paying taxes.

For taxpayers, a Form 1099 acts as a motivator to portray in their tax returns every income perhaps from more than one source. Other than the people, these forms are also good for the IRS as they provide a strong means of meticulous income data cross-checking and compliance verification.

Filing Requirements for Non-resident Owners of Disregarded LLCs

Americans tax their non-resident owners of disregarded Limited Liability Companies (LLCs) differently than most other non-Americans. A single-member LLC that has opted not to elect the corporate option for tax purposes qualifies as a disregarded entity.

Given that LLCs do not have a federal tax obligation to pay, their non-resident owners must discharge certain responsibilities.

Required Forms

Owners of disregarded LLCs who are not residents of the US have to meet the following form filing obligation:

Form 5472:

This form requirement exists if there are reportable transactions that occur between the LLC and its foreign owner in a given tax year.

In its essence, this form is an informational return without any tax liability accruing to the LLC. Its purpose is to provide information about financial transactions.

Form 1120:

A non-resident owner of disregarded LLCs is obliged to submit this for 1120 together with form 5472. While Form 1120 is meant to be completed as a corporate income tax return, it is acting in this instance as an information return.

Additional Considerations for Non-resident Owners

Obtaining an EIN:

There is a requirement for only non-resident owners of an LLC to acquire an EIN which is a tax obligation identification number for the business.

Effectively Connect Income- ECI

This means that if an LLC lacks ECI with respect to any trade or business carried out within the US then they may not be liable to pay taxes in the US even in the presence of a 1099 Form. However, it is essential again to file relevant forms of information properly.

Use of Form W-8BEN

Non-resident owners are required to fill out Form W-8BEN when making transactions wherein the U.S. payer is involved. This document explains their non-U.S. foreign status and thwarts a U.S. taxpayer’s identification from being mistakenly assigned to them.

Reporting Deadlines

Non-resident owners of an LLC are to be subjected to strict timelines when it comes to filing Form 5472 and Form 1120. Penalties are incurred patently if such a timeline is exceeded. These fines include a staggering $25,000 incurred for filing such forms.

Common Scenarios for Non-resident LLC Owners

Receiving Payments from U.S. Entities:

Non-resident LLC owners are likely to be issued a 1099-NEC or a 1099-MISC who avail services of US-based clients or other entities. Even in the instance where the owner isn’t eligible to pay for US tax, these payments are still to be reported without fail.

No Reportable Transactions

In the scenario where Form 5472 was not needed as there were no reportable transactions made between the LLC and its foreign owner, this was only applicable. Nevertheless, always better to seek advice from tax professionals when in doubt.

Running Without ECI:

In the event, the LLC does not take part in the activities that create ECI, the tax liabilities only appear to be limited. The non-resident owners should keep irrefutable evidence of this status.

Conclusion

Non-employment income is required to be reported to the IRS for a variety of reasons and Form 1099 is one such Means through which income is reported. Getting the details of the business accurately reported is essential since penalties can follow noncompliance in issuing 1099 forms to such businesses.

Getting acquainted with the different types of 1099 forms other than 1099-misc is important for individuals in order to get their tax returns filed correctly.

For foreign owners of a disregarded LLC, filing taxes in the USA has some extra layers of complexity. Among other forms that are more general in substance instruction requirements, one of them is on how to file a tax return when revoked with tax Law Forms 5472 and 1120.

However, getting an EIN, the concept of ECI, how to fill w 8ben for better clarity on tax status, and so forth, might be able to simplify the procedure and avert careless mistakes that might lead to very costly consequences.

Not only do these provide taxpayers with accurate information but they also assist the IRS in determining correct income for taxation purposes and maintaining the tax system’s integrity. Non-resident LLC owners are strongly encouraged to obtain proper U.S. tax advice to comply with U.S. tax law requirements.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now