Forming an LLC in South Dakota might be one of the best options, especially for small business owners who want the business form to be uncomplicated and flexible.

In South Dakota, there is no corporate tax and no personal income tax which would appeal to people who want to lower their tax responsibilities.

In this article, we explain in detail the main steps to help you understand what you need to do, including, how to choose a name for your LLC, how to pick a registered agent, and how to file all necessary documents while remaining compliant.

If you are starting a business or are converting an existing one and wish to form an LLC in South Dakota, we hope that this door opener will be useful to you on your LLC journey.

Benefits of forming an LLC in South Dakota

No State Income Tax

Businesses and individuals living in South Dakota do not pay corporate tax or income tax which is among the lowest in the USA in terms of taxation of business income and personal income. This would be a very strong point for owners of LLCs who want to maximize their profits.

Limited Liability Aspects

The assets of the owners/ members of the LLC, such as a house, personal savings, etc, are immune from the risks in the business including pursuing debts or claims against the business. Such separation of business assets/ liabilities and personal assets/ liabilities offers the owners considerable tranquility.

Multiple Tax Choices

In South Dakota, it has been to the advantage of many LLCs to determine how they want to be burdened with taxes. For instance, single-member LLCs are regarded as sole proprietorships, while multi-member LLCs are regarded as partnerships by law.

An LLC is also permitted to choose to be taxed as S-Corp or C-Corp to help the business achieve its objectives.

Good Protection for Privacy

South Dakota permits LLCs to have ‘confidential’ owners, which implies, that the names of members do not appear in the public records. This is advantageous for business owners who want a lot of privacy and very limited public disclosure.

Fluid Management Structure

The members of the LLCs in South Dakota shall run the managers of the LLCs, enabling the owners to tailor the structure of the business toward their needs and functions.

Such flexibility enables LLC members to decide how much or how little involvement they will have in the daily activities of the business.

Steps to Establish an LLC in South Dakota

Step 1: Pick a Name for Your LLC

Name Regulation: It should be noted that the name of the LLC must be unique and different from the names of other businesses registered in the State of South Dakota, and the name of the business must have the words ‘Limited Liability Company’, or the abbreviations ‘LLC’ or ‘L.L.C.’ To identify the business form and avoid a breach of state law, it is a requirement to include this.

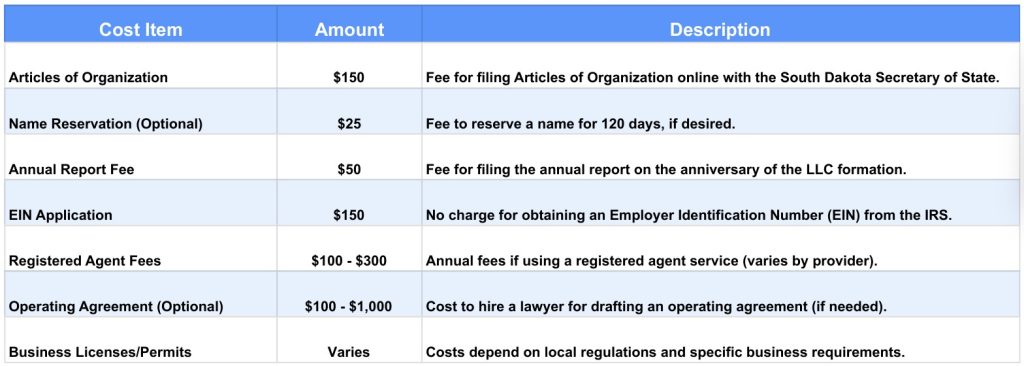

Availability of NAME: You can verify the name with the business name search tool of the South Dakota Secretary of State’s Office. Again, it is optional to reserve a name. However, one may file an Application for Reservation of Name and pay the fee of twenty-five dollars to reserve a name for a period of one hundred and twenty days if he wishes to do so.

Step 2: Choose Your Registered Agent

What is a Registered Agent: One of the requirements for forming an LLC in South Dakota is that such an entity needs to have a registered agent with a physical address to be used as the contact for official mail and legal documents. This makes sure that if and when required, the business can be contacted, especially for service of process.

Who can be an Agent: A resident of South Dakota or a business entity permitted to do business in South Dakota can be the agent. They must possess a physical address (not a post office box) in South Dakota and be present in that place during business hours.

Choosing an Agent: As a registered agent, you are allowed to represent yourself but if you need confidentiality, it is better to seek a registered agent service provider, especially when one does not operate during normal working hours.

Step 3: Submit the Articles of Organization

Filing Requirements: To effectively create your LLC, you need to file Articles of Organization with the South Dakota Secretary of State. This document comprises of the following basic details:

- Name of the LLC

- Address of the principal office

- Details of the registered agent

- Details of management structure (whether it’s member-managed or manager-managed)

- Date of effectiveness (it’s possible to provide an effective date that comes after the date of filing)

Filing Fees: Online filings will attract a fee of $150 while postal filings will cost $165.

Submission Options: One can complete the filing online through the Secretary of State’s website or postal mail. Online filings are usually quicker than postal filings which may take several days.

Step 4: Prepare an LLC Operating Agreement

Reason for an Operating Agreement: Though an operating agreement is not legally required in South Dakota, having one is very beneficial. This document specifies:

- The percentage of ownership for each member

- The proportional sharing of profits and losses

- Members and managers’ duties and responsibilities

- The voting rights and decision making

- Processes related to the introduction and expulsion of members and the termination of the LLC

Safeguard: It also assists in avoiding misunderstanding among its members and reinforcing the LLC. If any lawsuits arise, then a proper operating shall prove that the LLC is a distinct business.

Step 5: Get an EIN from the IRS.

What is an EIN?: An Employer Identification Number (EIN) is a number that the IRS gives for tax purposes. EIN is required to:

- Remit federal and state tax

- Set up a bank account for the business

- Employ staff when needed

How to Apply: Apply for an EIN free of charge by visiting the IRS forum. If you apply online, it often takes about a few minutes.

Tax Implications: When it comes to single-member LLCs, the IRS treats the LLC as a disregarded entity for tax purposes and the taxes are reported on the individual’s return. Tiered taxation as partnerships is what multi-member LLCs are subject to by default.

Step 6: Open a Business Bank Account

Separation of Finances: It fosters clearer demarcation of personal and business finances which is very important for liability.

Required Documentation: In general, you will need to provide these documents when setting up the account:

- The EIN of the LLC

- The LLC’s Articles of Organization

- Operating Agreement (if any)

Banking Options: A lot of banks have these additional features for LLC accounts like LLC-specific accounts, online banking, options for business credit, expense tools, etc.

Step 7: File an Annual Report

Annual Report Requirements: South Dakota law provides that an annual report shall be filed with the Secretary of State by every LLC on the anniversary of the date of its formation. It enables you to notify the state if there are any changes to the information about the business and serves as verification that the LLC is active.

Filing Fee: 50 dollars is what is charged as the filing fee for the annual report.

Late Fees and Penalties: There may be late fees accompanying these submissions or risk of the LLC being administratively dissolved as a result of non-filing. You must file your returns promptly so that you do not have any issues about good standing.

Step 8: Obtain Licenses and Permits That May Be Necessary

State and Local Permits: Depending on what your LLC is doing, additional licenses or permits may be necessary, including locations within counties that may be zoned as business districts, professional licenses, and health department permits. Check with city and county authorities for the regulations applicable.

Sales Tax Permit: In case any products are offered for sale by the LLC, a sales tax permit in South Dakota will have to be applied for and obtained.

Step 9: Know What You Are Required to Do Regularly

Taxes: LLC owners can breathe easy since there are no state corporate or personal income taxes in South Dakota. Some taxes are worth mentioning: federal income taxes may apply to your LLC; especially in case it has employees or has elected for corporate income taxation.

Record-Keeping: It is important to keep these documents at hand formation and change of the LLC, tax returns, the operating agreement, and sometimes even executed contracts. Good management of records will also assist in the preparation of tax returns and financial statements since accurate records are kept.

Costs to Form an LLC in South Dakota

Conclusion

There are many reasons why one should go ahead and form an LLC in South Dakota. The state offers tax benefits, legal protection, and privacy. With its easy requirements and tax incentives for entrepreneurs, South Dakota is a wonderful state to start a business or officialize an existing business.

Additionally, it is important for any LLC to not only be set up correctly but also remain compliant with the annual reports and any permits or licenses that may be needed. This will help safeguard the business from great exposure to liability while enabling the owner to concentrate on growing the business in the favorable atmosphere of South Dakota.

Book a free consultation for clear guidance on how to set up a South Dakota Limited Liability Company and any other services that you may need.

Frequently Asked Questions (FAQs)

Am I permitted to act as my registered agent in South Dakota and if so, what are the requirements?

Of course! However, this is possible only if you are physically present in South Dakota and are available during business hours. Most owners of LLCs, however, hire a professional registered agent service for security reasons.

Do LLCs in South Dakota need an Operating Agreement to be effective?

It is not required in South Dakota, however, it is worth noting such a document exists. An Operating Agreement describes how the LLC operates, its members, and the sharing of any profits. This document can reduce disputes and provide an element of legal protection because it demonstrates that the LLC is an independent body.

Should an LLC in South Dakota file state income tax?

South Dakota, unlike other states, does not have an income tax for individuals and business entities alike, thus making life easy for all LLC owners aiming to minimize tax costs. Nonetheless, their obligations towards federal taxes and filings should be confirmed by the LLCs as well.

What’s the composition of an LLC in South Dakota, can it have only one member?

South Dakota does allow single-member LLCs. Single-member LLCs have the same guaranteed liability as multi-member LLCs and in normal cases are considered to be taxed based on sole proprietary ship.

Is it possible to reserve a name for an LLC in South Dakota?

Yes, According to the Secretary of State of South Dakota, a name retained for an LLC can be reserved for not more than 120 days through the filing of the Application for Reservation of Name and the payment of the reservation fee of $25.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now