Are you considering forming an LLC in Rhode Island? Should you be a small business owner or an entrepreneur intending to grow a limited liability company in the Ocean State, there are various advantages worth considering.

Rhode Island is suitable for start-ups and established firms given the conducive business environment and fair regulations.

This article addresses almost all the things that are involved in the process of creating an LLC in the state of Rhode Island starting from how to register and even how to comply with all the requirements so that your journey towards running a successful business is as easy as possible.

Benefits of Forming an LLC in Rhode Island

Limited Liability Protection: Probably the most appealing attribute that forming an LLC brings to the table is the limited liability protection that comes along with it. Owners (members) are not personally responsible for the debts and liabilities of the LLC, and thus, members are shielded from losing personal properties such as their homes, cars, and savings in the event of litigation or internal business disputes.

Pass-Through Taxation: Having its taxation affords no LLCs, this means that the LLC is not taxed beyond the single rate as a unit. The income and losses generated are included in the members’ tax returns thus avoiding dual taxation and making the whole tax process less complex.

Flexible Management Structure: In Rhode Island, LLCs also have enhanced flexibility when it comes to management. An LLC may be run by its members (the owners) or by managers appointed to operate the business, establishing a management structure that meets their needs. This is encouraging especially for family-owned or small businesses.

Ease of Formation and Maintenance: Rhode Island also has easy filing requirements and subtly low annual fees and this makes it relatively easy and cheap to form and maintain an LLC in Rhode Island. In addition, the state’s Annual Report filing fee is quite low compared to some other states which allows the process to be quick with easy online filing facilities.

No Residency Requirement for Members: The law in Rhode Island also does not make it mandatory for LLC members or managers to be residents of the state and this is especially appealing to non-residents wishing to register an LLC in the US. This factor of travel may indeed make Rhode Island a favorable option for international investors.

Steps to Form an LLC in Rhode Island

Step 1: Select a Unique LLC Name

Name Requirements: The first step of forming an LLC is to come up with an appropriate business name. LLC names in Rhode Island must contain Limited Liability Company, LLC, or L.L.C.

Name Distinction: Your selected name must be somewhat different from the names of other licensed business entities in the state. Almost identical names, their abbreviations spelling, or phonetics will be disallowed as well.

Name Availability Check: Check the business name database maintained by the Secretary of State of Rhode Island to see if your selected name is available. To ensure the uniqueness of names will minimize delays to the process of registration.

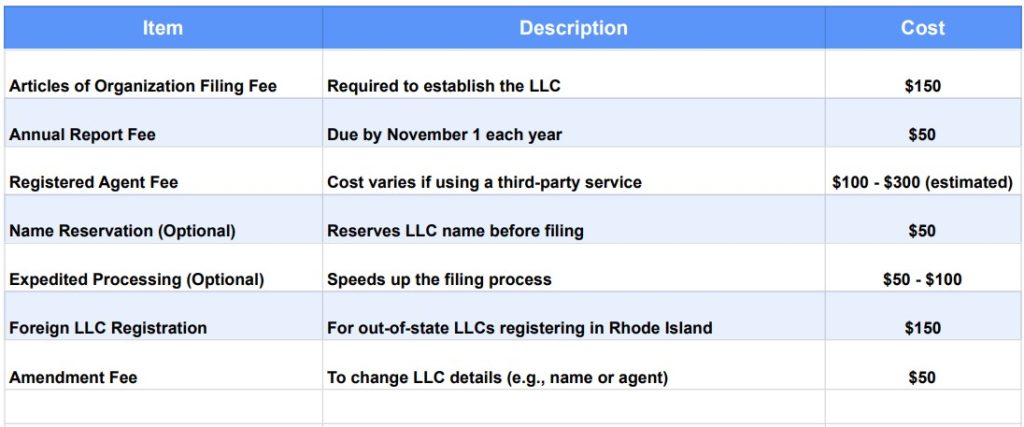

Optional Name Reservation: If you prefer not to submit the Articles of Organization but would like to use the name, Rhode Island permits reserving a name for 120 days. There are $50 fees for name reservations.

Step 2: Designate a Registered Agent

Definition and Role: Every LLC based in Rhode Island is to select a registered agent. The individual or business entity plays the role of receiving legal and tax papers of your LLC and also controls all interactions with the government on behalf of your LLC.

Qualifications: As in some jurisdictions, every registered agent designated for an LLC based in Rhode Island shall have a physical street address within the boundaries of the state (P.O. Box is not acceptable) and shall be in the state during business hours to accept legal documents.

Options for Registered Agent: In the case of an LLC, you can be your registered agent, another member of the LLC, or a registered agent service. Out-of-state members of LLC are advised to use the registered agent service for privacy and compliance purposes.

Step 3: File the Articles of Organization

Purpose of the Articles: The Articles of Organization are the documents that shape your LLC for the first time in the state of Rhode Island. The information contained in this document is crucial to the state about the business, and hence it is filed with the Secretary of State.

Required Information:

- The LLC name, and principal address of the LLC.

- Name and physical address of the registered agent.

- Management of the company: Explain if the LLC will be managed by members, or managers will be appointed.

- Members’ or managers’ names and addresses.

Filing Options and Fees: The Articles of Organization can be filed online or via mail. A filing fee of $150 is applicable. Additional fees may be charged if one opts for expedited filing.

Processing Time: The standard processing will go through within a timeframe of 5-10 business days however, there are expedited options available at an extra cost if someone is in a rush for processing.

Step 4: Prepare an Operating Agreement

Benefits of the Operating Agreement: This document may not be considered by Rhode Island law as a requirement but it is very important to have this document for your LLC. It provides guidance to all the members of the LLC by specifying their rights, obligations, and the extent to which they will share profits and losses.

Key Components:

Ownership Structure: Characteristics of each member’s share of power and control

Management Structure: Characteristics of each member’s inclusiveness in the affairs of the LLC and the extent of his powers in decision-making

Financial Guidelines: How the benefits and losses will be weighted

Dispute Resolution: Members will resolve any differences between them appropriately and peacefully.

Exit Strategy: Guidelines about the circumstances in which one of the members of the LLC may wish to exit or for the common termination of the business itself.

Benefits of an Operating Agreement: An Operating Agreement can weaken paid provide in case an LLC only consists of One Member as well as provide an official recognition of the business and defend its liabilities. In the case of Multi Member LLC, this will rule out disagreements among the members.

Step 5: Obtain an EIN (Employer Identification Number)

What is an EIN? An Employer Identification Number (EIN) is a unique nine-digit number that the Internal Revenue Service assigns to your Limited Liability Company (LLC). This number serves as a Social Security number for your business and is necessary for tax reporting purposes.

When operating your business, here are situations that force you to obtain an EIN:

- You will need one if your LLC is member-managed.

- You will need one when you hire employees.

- You cannot operate a business without it.

How to Apply: You can make your EIN application either online, via the IRS website, through mail, or by fax. If you make your application online, a fully completed application is free of charge.

Step 6: File an Annual Report

Annual Reporting Requirements: All the LLCs registered in Rhode Island are obliged to submit an Annual Report through the Secretary of State. This report works to provide current information regarding the contact and structural details of your LLC.

Due Date and Fee: The Report should be submitted with the relevant operating license each year by 1st November and this entails the payment of a fee amounting to 50 dollars. If you fail to meet this deadline, there are penalties or an Administrative Dissolution procedure against you.

What do I include in the report?: The report mainly requires information on the address of the LLC’s principal office, that of the registered agent, and other changes in the structure of the management of the LLC.

Step 7: Observe the Permits and License Requirements of Rhode Island Business

License Requirements: It is possible to require certain state or local licenses or permits. A business may not secure these permits for several reasons including ignorance or plain disregard for the rules. License violations can bring about fines amounting to thousands and sometimes even a closure for an indefinite period may be recommended, to the business owner.

Industry-Specific Licenses: Certain industries like food service, real estate, or construction require practicum or professional certification which are above the general licensing. It is advisable to seek information from the Rhode Island Department of Business Regulation on whether your LLC will need special licensing.

City and County Permits: Legal requirements may, however, exist at local levels in as much as the county may have run into a stipulated license. Appointment to your city or county clerk’s office may provide adequate knowledge of what permits you may require in your locality.

Costs of Forming an LLC in Rhode Island

More Tips on How to Manage Your LLC in Rhode Island

Open a Business Bank Account: It is critical to ensure the business bank account is opened in legal requirements from limited liability legal status steps in taking out personal liability on business debt.

Rhode Island Tax Requirements: Rhode Island will impose increased tax requirements based on the classification of your company, and possibly based on sales tax, employment taxes, or state income tax where it fits. Register with the Rhode Island Division of Taxation as it may be necessary.

Monitor Changes in State Requirements: Since compliance requirements can be revised, it is prudent to have an alert on risk areas that may affect the operations of a Wisconsin-based LLC. For the Rhode Island Secretary of State’s newsletters and other March 22, 1979 tools for you to keep your business in the right position.

Conclusion

If you abide by these steps, you will be able to set up the company as an LLC in Rhode Island which is legally compliant. Your LLC must be properly set up and registered, conduct its affairs in a manner that is compliant and has identifiable business and personal finances to take full advantage of limited liability status whilst conducting business in the state.

Book a free consultation for clear guidance on how to set up a Rhode Island Limited Liability Company and any other services that you may need.

Frequently Asked Questions (FAQs)

Is an Operating Agreement required in Rhode Island?

There is no state provision for the LLCs to provide an Operating Agreement for the company. In any case, it is good practice to draw one up since it clarifies assignments, rights, and duties of the members, as well as the LLC organizational chart in terms of managerial aspects.

How long does it take to form an LLC in Rhode Island?

To file for an LLC in the state of Rhode Island, the requirement takes several days to even several weeks depending on the filing procedure which the state offices and their current workload. You can also expedite it but you may have to pay an extra fee.

Does the state of Rhode Island require an LLC to submit an annual report?

Indeed, LLCs within Rhode Island must file an annual report which lacks a fixed date but restricts submission to the 1st of November. Most annual report filings are accompanied by a filing fee charge of roughly 50 dollars. Those who fail to submit are subject to mandatory punishments or the complete deregistration of the LLC in question.

Is there anything stopping a foreign LLC from operating in Rhode Island?

Yes, if an LLC formed in another state wants to conduct business in Rhode Island, it must register as a foreign LLC with the Rhode Island Department of State. This calls for registering by way of submitting an Application for Registration, as well as designating a Registered Agent in Rhode Island.

What about creating a single-member LLC in Rhode Island?

As far as a single-member organization is concerned, such organizations can be formed in the state of Rhode Island. Such is built in with similar liabilities to that offered by a multi-member LLC and assists the single owner to be able to contain personal liabilities while owning a business.

If my LLC already has a name or a Registered Agent, can I change them sometime later?

Yes, you can amend your LLCs up-to-date information like registered name or registered agent by submitting an amendment to the Rhode Island Department of State. There may be extra payments.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now