Establishing a Limited Liability Company (LLC) in Oregon is certainly more advantageous for a business owner or an investor who wants to secure their funds against unforeseen circumstances while enjoying the flexibility and the favorable tax structure offered by an LLC.

The favorable atmosphere of doing business, no state sales tax, and easy registration procedures are a few of the things that attract a lot of start-ups to Oregon.

It does not matter if you are a beginner in the business or if you are already well established, knowing how you can legally form an LLC in Oregon will help you have an advantage in the foreseeable future.

We would like to make a special endeavor in this manual to assist you in accomplishing your objectives, beginning with the selection of a name and ending with the accomplishment of all the paperwork required for starting a business.

Key Benefits of Forming an LLC in Oregon:

Limited Liability Protection: As an investor, you do not have to worry about the debts and legal obligations owed by the LLC to protect your assets such as your house or savings.

Pass-Through Taxation: Since the profits and losses are reported on the individual tax returns for members, LLCs are not subject to double taxation, and hence LLCs simplify the tax process for business owners.

No State Sales Tax: The fact that Oregon does not impose sales tax means a lower burden for all businesses, particularly for retail and service sectors.

Flexible Management Structure: LLCs may be owned and operated by members themselves or by managers so there is good leeway offered on how the business will be managed.

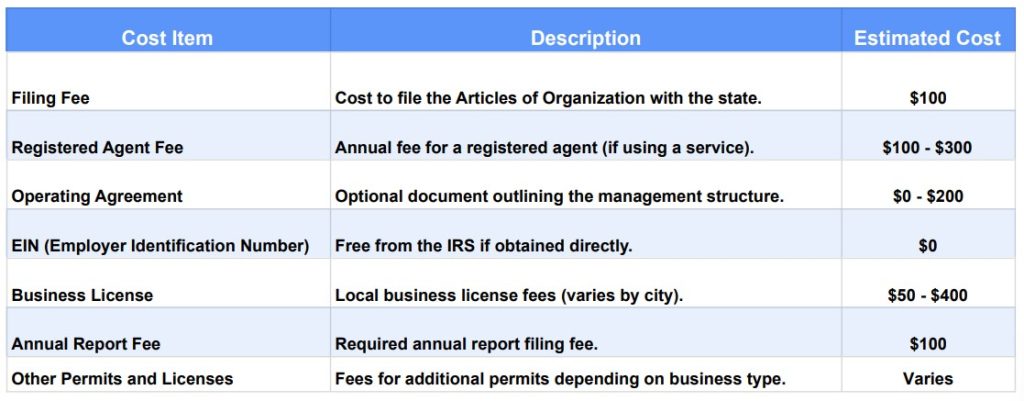

Relatively Low Formation Fees: The Articles of Organization and the Annual Report, both of which cost $100, mean that Oregon has relatively low formation fees in comparison to other states.

Ability to adhere to requirements: The Oregon legal framework is straightforward and has little documentation making it simple to survive the compliance requirements of the law.

Steps to form an LLC in Oregon

Step 1: Select the name that you would like to be called an LLC

Existence of Distinct Name: If you plan to register in Oregon, one of the requirements that you need to fulfill is the need for your LLC to have a name that is not in any way similar to any of the business names that are registered in the state. This ensures that your business occupies its own unique space. The name must include “Limited Liability Company” or its abbreviation ‘LLC’ or ‘L.L.C. The name must not however suggest that the LLC is a corporation which prohibits terms such as ‘corporation’ or ‘incorporated.’

Search for Name Availability: To determine whether the name you wish your LLC to have is not already in use, search for it on the Oregon Business Name Search tool which is available on the Secretary of State’s website.

Reservation of the Name (Optional): When you would like a name for your LLC and you have not completed all the steps to gaining the LLC, you can file a Name Reservation form and pay a $100 fee that helps in reserving your desired name for a maximum period of 120 days.

Step 2: Include a Registered Agent

Definition: A Registered agent is an individual or a business entity who accepts legal documents and receives tax notices and other official communication for your LLC upon receipt to the said individual. The registered agent has to possess a physical location or address in Oregon (P.O. Boxes are not permitted).

Who can do it: The registered agent can either be the member of the LLC, the employee, or the professional registered agent service. Most of the time, if you do not reside in Oregon, you are required to hire a commercial registered agent service.

Importance: The registered agent has to be authorized and licensed; this is because, without a registered agent, there are high probability of other parties not receiving important legal notifications which can result in the order of default judgments or administrative dissolution of the company.

Step 3: Go on and Submit The Articles of Organization

Filing Process: The next step is to file your LLC’s Articles of Organization with the Oregon Secretary of State. This document serves to legally form your LLC from the perspective of the state.

Details Required: The Articles of Organization is quite simple as it will require the following information:

- Name of the LLC and its address

- The name and address of the registered agent.

- The period of the LLC ( Quite a lot are lasting, however, a time can be stated)

- The management structure (For instance if the LLC is managed by the members or the managers)

Filing Options: Filing the Articles of Organization can be done online through the Oregon Secretary of State website, by sending it via the mail, or personally. Filing the documents via the Internet is the most practical and quick option.

Filing Fee: The charges of filing the Articles of Organization in Oregon stand at $100 (as of 2024).

Processing Time: Online Filings are normally completed within 5-7 working days from the date of filing, but may fluctuate on busy seasons.

Step 4: Prepare an Operating Agreement

Purpose: Although the state of Oregon does not require LLCs to have an Operating Agreement under law, it is obligatory to prepare one. It is one of the internal documents which depicts the owners, the structure of the management as well as the rules of operations of the LLC.

Contents: A solid Operating Agreement should cover topics like:

- The ownership shares for every member

- The way profits and losses will be shared

- The voting system

- Duties of members

- The methods of admitting or expelling members.

Importance: In the absence of an operating agreement, the LLC default under the laws of Oregon will automatically come into operation in so far as it is the governing law of the company. An operating agreement prepared thoughtfully tends to minimize conflict among the members of the LLC and promote a better functioning of the business.

Step 5: Obtain an EIN (Employer Identification Number)

What is an EIN?: An EIN is a nine-digit number that is unique in the IRS’ Systems and it’s assigned for taxation purposes. The number is synonymous with a social security number, only that it’s for the business as opposed to a social security number.

When You Need an EIN:

- If your LLC comprises of a lot of members (multi-member LLC legally registered)

- Should you wish to have wages for your employees

- On taxations for LLCs that opted for corporate taxation

- Should there be a need for a business banking account

How to Apply: An EIN can also be obtained from the Internal Revenue Service. Registration is free of charge and can be done either through mail, fax, or online. Applications submitted through the web are executed instantly.

Step 6: Follow the Tax Requirements Specific to Oregon

Business Taxes: If your LLC is operational, certain tax obligations may include registering with the Oregon Department of Revenue such as:

Oregon Corporate Activity Tax (CAT): In the case of LLC firms conducting business activities in Oregon and having gross commercial receipts beyond 1 million USD per year, CAT stands applicable.

Payroll Taxes: If employees are employed, payroll taxes and state withholding along with taxes related to unemployment will also be necessary.

Sales Tax: The main state of Oregon does not charge sales tax, which is good for numerous businesses, however, there may be other applicable specific taxes that depend on the sector.

Federal Taxes: For federal tax purposes, LLCs are independently regarded as pass-through entities meaning that profits and losses are reported through the owners’ tax returns. However, employees may also elect to pay themselves as an LLC purely if it best fits the financial strategies.

Step 7: Submit Annual Reports

Requirement: Following the law, every Oregon LLC is mandated to prepare an annual report and submit it to the Secretary of State to ensure the update of any information of the company. This report encompasses a range of information, such as the name of the LLC, the address of the business’s primary office, and the registered agent.

Due Date: Once you form an LLC, an annual report is expected every year on that date. Loss of this date can lead to penalties for delay or administrational dissolution of the LLC.

Filing Fee: Oregon has a filing fee of $100 for the annual report.

Filing Process: The report may be prepared online or mailed. The Secretary of State’s Office will send out a notice to the person once the time comes for the annual report to be submitted.

If these steps are adhered to, then the formation of the LLC and compliance with all the regulations put in place for Oregon will be achieved. An LLC can be registered in Oregon with ease, but subsequent filings, taxes, and compliance requirements must be strictly adhered to, to keep the LLC in good standing.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now