Entrepreneurs seeking flexibility, legal protection, and ease of operation prefer to form a Limited Liability Company (LLC) in Oklahoma.

On the other hand, given its business-friendly environment, Oklahoma also provides an easy process of forming an LLC, allowing both new and seasoned business owners to minimize their risks while making the most of the flexible management that the structure affords.

Starting a small local business or venturing into the US market, the nitty-gritty to form an LLC in Oklahoma is vital to success for any business.

We are going to take you step by step so you will be able to efficiently carry out every task necessary in starting your business.

Why Form an LLC in Oklahoma?

Limited Liability Protection

Shielding Personal Assets: An LLC has been designed graphically to perform legal protection, which makes it possible for the owner’s assets, for example, a house or car not to be used to compensate business debts, or misused in case the business is imposed with a lawsuit. So, in the event of lawsuits or financial struggles for the business, most assets owned by the person remain unaffected.

Pass-Through Taxation

Avoiding Double Taxation: It is a means to escape two types of taxation: LLCs are known as pass-through entities, meaning that they do not have a tax liability at the entity level tax. Rather the profits and losses are passed through and accounted for in the owner’s tax returns. So, this can save us costs that, corporate firms incur due to double taxation.

Flexibility in Management

Simplified Structure: Unlike corporations, LLCs do not have a complex management structure since they do not have to appoint a board of directors and conduct corporate sessions. This makes them more manageable.

Perpetual Existence

Long-Term Business: Flexible LLC management allows the potential for the existence of power even if a shift in ownership occurs. This enhances the security and continuity of operations in one business.

Ease of Formation and Operation.

Simple Process: Normally, the process of forming an LLC in Oklahoma is expected to be simple due to the standard paperwork’s requirements and complexity being less in comparison to other business types.

Potential for Tax Benefits

Tax Credits and Incentives: There may be some Oklahoma-specific tax credits or incentives available for businesses including, LLCs. These can be financial and promote the economy.

Steps to Form an LLC in Oklahoma

Step 1: Choose a Name for Your LLC

Naming Guidelines: Choose the name of your LLC that conforms to the legal naming requirements in Oklahoma where the name has to have as a suffix the phrase ‘Limited Liability Company’ ‘LLC,’ or ‘L.L.C’ to indicate that this is an LLC entity.

Uniqueness: The name of your LLC has to be different from the names of other recorded enterprises in the archives of the Oklahoma Secretary of State. You can perform this research using the Oklahoma Business Entity Search tool available on the Secretary of State’s website.

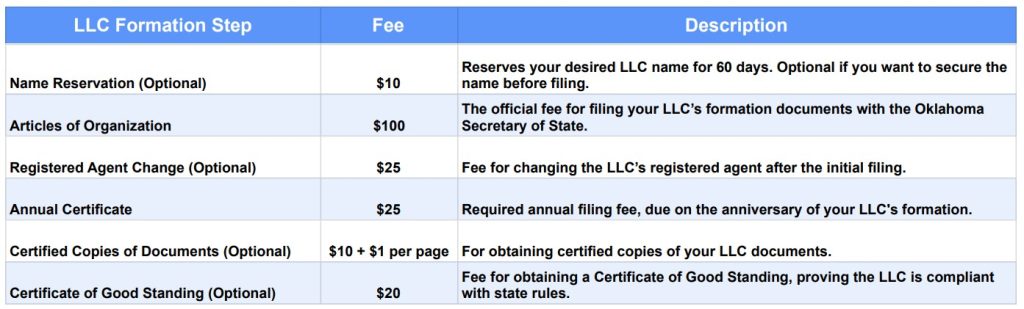

Reservation: If you do not wish to register your LLC but would like to have the name for your LLC, you may submit a Name Reservation Application to the Secretary of State which will reserve the name for 60 days. It costs $10 to file for a reserved name.

Step 2: Appoint a Registered Agent

Role of the Registered Agent: A registered agent has the authority to accept legal papers such as service of process, government correspondence, and tax documents for the LLC. They should be present during standard office hours.

Requirements: The registered agent may be any person (including yourself) or a business entity authorized to do business in Oklahoma. The agent must have a physical street address in Oklahoma (not a P.O. Box).

Changing Registered Agents: If your registered agent changes after registration, please note that a Change of Registered Agent/Office Form should be submitted to the Secretary of State’s office together with the relevant fees.

Step 3: Submit Articles of Organization

What are Articles of Organization?: Articles of Organization is a document of legal importance regarding registering an LLC’s establishment within Oklahoma. They may be submitted electronically on the website of the Secretary of State or via the use of a paper form submitted by post.

Information Needed:

- The LLC’s official name.

- The name and address of the registered agent.

- The principal address of the LLC.

- Whether the LLC will be managed by members or managers.

- The duration of the LLC (most LLCs are set up to exist indefinitely, but you can specify an end date if desired).

- The filing date or a delayed effective date if you do not want the LLC to be active immediately.

Filing Fee: About Units in a Limited Liability Company, in Oklahoma, filing Articles of Organization costs $100 per 1 unit. Generally, you get better and faster service if registered online.

Step 4: Prepare an Operating Agreement

The scope of the Operating Agreement: Though no law requires LLCs to incorporate an Operating Agreement in Oklahoma, it’s an essential purview internal to the business. In broad terms, the document covers ownership issues, functions, distribution of proceeds, and operational matters encompassing the conduct of the LLC among the rest.

Member versus Manager Management: The Operating Agreement will address the management structure of the LLC. This, too, affects the character of the affair daily.

Reducing Conflicts: This agreement can ease conflict by allocating the role, phase, and duties of every member. This is particularly helpful for LLCs with multiple members.

Step 5: Obtain an EIN (Employer Identification Number)

What Is an EIN?: The EIN, or Employer Identification Number, is an IRS-issued number that is similar to the Social Security Number of the LLC. It is important for tax purposes, especially for an LLC with multiple members, employees, or those taxpayers who are expected to remit specific federal taxes.

How to Get an EIN: It’s possible to obtain an EIN at no cost by applying to the IRS site. This is a quick and easy task done entirely online which lasts a couple of minutes and the EIN is issued once the application is finished.

When Is an EIN Required?: Even if you are the only member of the LLC, you will require an EIN when hiring employees or choosing the option of LLC taxation as a corporation. Most banks also need this number to provide an account to operate a business.

Step 6: Adhere to Oklahoma State Tax and Licensing requirements

State tax: you may need to register under the state tax system depending on the nature of your business. For example, if you are selling goods within Oklahoma, it will be necessary to apply for a Sales Tax Permit from the Oklahoma Tax Commission. If you have employees for your business, then again you will be required to register for unemployment insurance and also withhold payroll taxes.

Local licenses and permits: In addition to state, there may be areas that require licensing at the local county or city levels as it relates to the conduct of business. Areas of focus include zoning and other permit requirements specific to certain industries or geographic locations.

Franchise tax: Unlike most states, Oklahoma does not apply a franchise tax for LLCs. Some industries like alcohol distributorships, however, might encounter certain taxes and fees applicable to the specific industry.

Step 7: Submit the Annual Certificate of a company

What is an Annual Certificate? As a requirement in Oklahoma, LLCs annually file with the Secretary of State an Annual Certificate to comply with the good standing of the company. This is a notification form to the state that communicates any changes in contact addresses for the LLC.

Due date and penalty: The due date for the Annual Certificate falls on the anniversary of the date the LLC was incorporated. The filing fee for the Annual Certificate is 25 dollars.

Penalties associated with Non-Compliance: Being late in submitting the Annual Certificate may make your LLC lose its good standing status, and there may be other penalties or administrative dissolution.

Step 8: Obey the law

Business Bank Account: When your LLC is created, it is critical to open a business or corporate account to keep personal and business expenses separate. A Tax Identification Number and a copy of the Articles of Organization are some of the documents that the majority of banks will require.

Ongoing Record Keeping: Indeed, Oklahoma does not impose any periodic reporting requirements on LLCs however it is good practice to keep proper and current financial records, minutes of meetings, and major events to remain within the law in terms of taxation.

Costs of Forming an LLC in Oklahoma

In this manner, the formation of an LLC and its active status can be achieved in Oklahoma state. Also crucial is the management of the business to the federal and the state requirements to escape fines and in the end ensure the long-term viability of the business.

Book a free consultation for clear guidance on how to set up an Oklahoma Limited Liability Company and any other services that you may need.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now