Have you decided to start a business and settle in the state of Ohio? Forming a Limited Liability Company is essential as it is not only easy but important because it comes with personal liability and tax benefits.

This is where the consultant goes over the area of forming a Limited Liability Company (LLC) in Ohio, how to do it, and everything there is to know within this process starting from what name to file.

Even if it is your one day, this article includes both beginners and those already familiar with the business, making it a perfect starting point for everyone who wishes to register their ‘Ohio LLC’.

Why form an LLC in Ohio?

Personal Liability Protection: Protection between the personal assets and business liabilities provided by LLCs. This implies that if one’s business goes bankrupt, their home or car will usually be protected from creditors because it is personal property.

Tax Flexibility: Tax structure-wise, LLCs are flexible. You can choose to be taxed as a sole proprietor, a partnership, or a corporation. This flexibility allows one to better optimize their tax situations to those specific surrounding circumstances.

Simplified Management: Corporations can be a lot of work requiring a lot of paperwork during both the formation and the lifetime. LLCs are considered simpler in the way of requiring less formalities in the original and administrative burden.

Credibility: If you own an LLC, it automatically makes your business more trustworthy and professional as it shows peripheral belief in the business. It will also help you entice customers and partners because it will make your desire worthy.

Steps to Form an LLC in Ohio

Step 1: Select a Name For Your Ohio LLC

As you form your business, picking an appropriate name for your LLC is among the essential steps. An Ohio law contains guidelines that govern the name of your LLC:

Name Distinction Degree: As Ohio law stipulates, the name must not be used by any other business, which can be registered in this state, as a corporation, LLC, or reserved business name. You may go to the Ohio Secretary of State Business Search Tool to see if another legal entity is already using your preferred name.

Has The Term LLC: This term has to come before or after a company name in any case: “Limited Liability Company” or the designator “LLC” and “L.L.C.” is used. This also serves to inform others that the business is a limited liability company and thus there is no individual accountability for business debts and obligations.

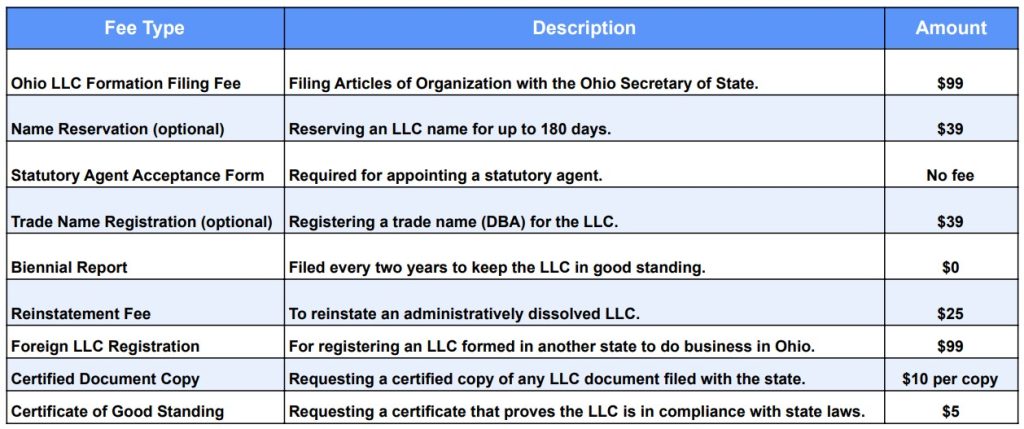

Reservation of Business Name (Optional): In case you would like to reserve a name pending registration of the Articles of Organization duly signed, you have the option of filing Form 534B (Name Reservation Form) to the Ohio Secretary of State. It will cost $39 for reserving the name for 180 days.

Step 2: Choose a Registered Agent

Along with many formalities, Ohio requires every LLC it registers to have a registered agent as well. A registered agent is an individual or business that will be willing to accept service of process, such as lawsuits or communication from the state, for the LLC. The registered agent must:

- Be an actual street address in Ohio; they cannot be PO boxes.

- Have the ability to receive pertinent documents during normal business hours.

You are allowed to appoint:

- Someone who lives in the state of Ohio, such as yourself, a friend, or a relative.

- Registered Agent Services: Many businesses use registered agent professional services because they know that the documents will be taken care of. This is particularly beneficial for someone who does not live in Ohio.

Step 3: Ohio Secretary of State Articles of Organization

The Articles of Organization must be filed and is the action that forms your LLC in the state of Ohio. It contains essential information regarding your LLC and other operating details.

When filing the Articles of Organization, please ensure you do the following:

Fill and sign Form 533A (Articles of Organization for a Domestic LLC). Don’t forget the signed one works best.

Provide the following information: The name you want to be inscribed in your LLC.

- The full name, title, and physical address of your appointed representative.

- A brief note advising if the business will be run based on managers or members and so on.

- Signature of the chartered member of the LLC.

- A statement about the LLC’s activity commencing at a specific date, and this is optional.

The Articles of Organization may be submitted electronically or via mail as follows;

- Online Filing: Navigate to the website of the Ohio Secretary of State and follow the guidelines until completion.

- Mail Filing: Mail in Form 533A along with a $99 check to the Secretary of State of Ohio

P.O. Box 670

Columbus, OH 43216

A stamped and approved version of the documents is provided to you after your LLC is officially created after receiving approval of the Articles of Organization.

Step 4: Draft an Operating Agreement

This document is not required for forming an LLC in Ohio. Nevertheless, you should draft an Operating Agreement to avoid any issues in the future. The Operating Agreement specifies:

Ownership Structure: The percentage of the LLC owned by each of its members.

Roles and Responsibilities: The tasks allocated to each member or manager.

Voting Rights: How agreements will be reached and votes cast.

Profit Distribution: The distribution of profits (as at one point in time it will be more than losses) among its members.

Management: Indicating whether members of the LLC or other managers will run the company.

Exit Strategy: The procedure for leaving out one of the members from the LLC, or ceasing its activities, if necessary.

The effectiveness of this document is that it decreases the likelihood of disputes arising between members by outlining the specific language that governs how the LLC will function. Alternatively, it can serve as intra-corporate document outlining the interrelationships of the members within the LLC.

Step 5: Apply for an EIN (Employer Identification Number)

The IRS issues an Employer Identification Number (EIN), which is also known as a Federal Tax Identification Number and is unique to your LLC. It is similar to a Social Security number that identifies individuals. An EIN is necessary for:

- Business bank account opening.

- Tax returns (in the case of an LLC having several members).

- Hiring employees (where it is applicable).

To apply for EIN, you will need to fill out IRS Form SS-4. This form is available on the IRS website and there is no fee to apply for EIN. The steps are few and once the application is completed, you can expect to receive your EIN right away.

Step 6: Open a Business Bank Account

It’s likely that upon the official formation of your LLC and receipt of your EIN, you will go ahead to open a business bank account. Keeping a business bank account is important for:

- Keeping your personal and business finances separate, is critical for maintaining the limited liability protection of your LLC.

- Simplified accounting and filing of tax returns.

To open a business bank account, you will be required to provide:

- Articles of Organization for your LLC.

- EIN for your LLC.

- Incorporated Companies If the bank uses such reference terms in the LLC’s Operating Agreement as participation.

The most pressing issues are business bank accounts. Any personal and company assets must be separated since any interlinking will help you avoid cases that may be distressing.

Step 7: Compliance with the Other Permits and Local Licenses

Certain types of businesses often require various licenses. It may differ significantly according to your business’s place and, to a certain degree, its type. This can include:

- Local Business Licenses: Of the city or county in which your LLC operates.

- Professional Licenses: Certain occupations (like those in the legal, medical, or finance profession) may require certain licenses for those practicing.

- Zoning Permits: If setting up physical premises for the business, such a location should be approved by the relevant zoning authority for proper zoning rules.

If the licensing requirements are not met, then the owner may be subject to penalties or closure of the business taking place.

Step 8: File Biennial Reports

Every two years, LLCs based in Ohio should submit a Biennial Report that provides the state with information about, among other things, the primary contact persons, active business, and ownership of the entity. Failure to file the report on time results in a $25 fee. Filing reports promptly is critical in avoiding penalties and ensuring the continued good standing of the LLC.

Additional Considerations for Foreign LLCs

- File Form 533B (Registration of Foreign Limited Liability Company) with the Ohio Secretary of State.

- Pay a filing fee of 99 US dollars. It is also a requirement for foreign LLCs to have a resident agent with a physical address in Ohio.

Costs of Forming an LLC in Ohio

Conclusion

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now