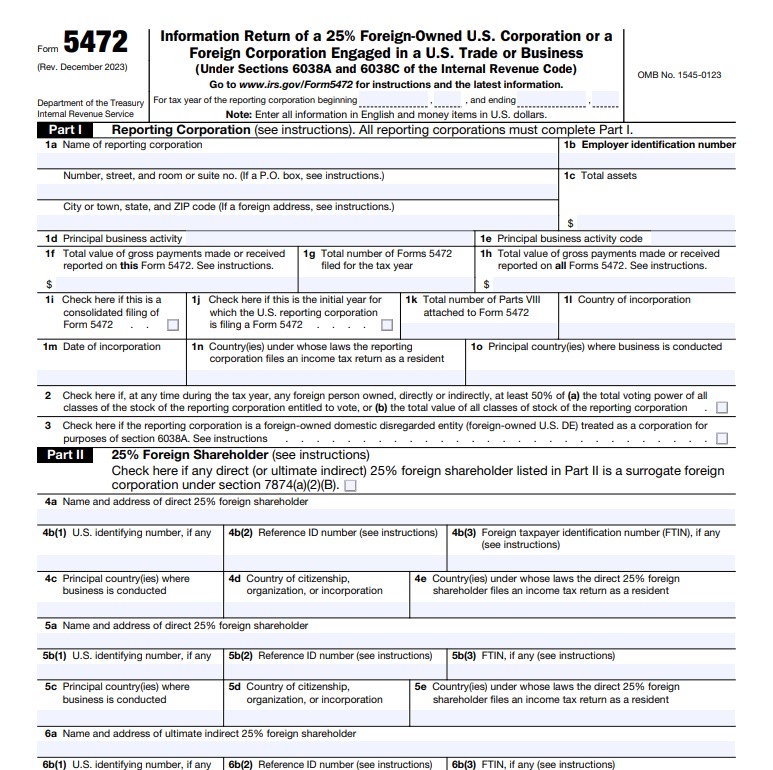

Form 5472, or the Information return of a 25% foreign-controlled domestic corporate entity or foreign engaging in U.S. trade or business, is another significant and unavoidable document for foreign corporations owning a business in America.

Completing this form is important for the foreign ownership of U.S. corporations as each regulated transaction that is necessary in this form serves a reporting purpose to the IRS.

This guide will highlight the outline of the Form 5472 process, the determination of who is eligible to file, etc., typical filing instructions, and filing deadlines.

Eligibility: Who Must File Form 5472?

Form 5472 is one of the very vital mandates the IRS imposes on particular bodies, particularly foreign-based. As such, two broad types of entities are subjected to filing Form 5472:

U.S. Corporations with 25% or More Foreign Ownership: Should a foreign National earn 25% or more of the share of any portion of the stock of a corporation for the entire tax year with direct or indirect control, Form 5472 shall be filed for that corporation. This requirement deals on corporations which have high foreign ownership wanting to enhance accountability and transparency.

Foreign Corporations that Conduct Business in the U.S. Earned Income Tax: This form is required of foreign corporations that have a U.S. trade or business if they undertake related party reportable transactions. Reportable transactions include, but are not limited to, sales and purchases, royalty payments, and management fee payments.

Typical situations when a business is likely to require filing include:

- Technology businesses that have a lot of foreign investment, mostly through the idea of venture capital or other foreign investments being put into the business.

- Subsidiaries of non-US corporations, with cross-border supply chains or service provision interactions.

- Real estate investment firms based abroad and operating in the U.S. buy, sell, and develop real estate.

- U.S.-based Companies that have operations as international advisory service firms, may offer strategic or other specialized services across borders.

Step-by-Step Instructions for Completing Form 5472

The task of filing Form 5472 may not have been very straightforward, but pitching it in such a way assisted in clearing the hurdles. The following includes everything in detail:

1. Identifying Information

- Fill in the corporate title, postal address, and the employer’s identification number. This since it is basic information to be able to locate the concerned party by IRS.

- Specify the tax year for which you will be filing. It is important to comply with the precise schedule as it establishes the extent of transactions that may be reported.

- Indicate the total number of Forms 5472 being filed for that tax year, especially if multiple entities or complex structures are involved.

2. Foreign Shareholder Information

- This chapter identifies the 25% of foreign shareholders or foreign corporations that engage in trade or business in the United States. Such transparency also scans a foreign stake in domestic business operations.

- List the name, address, country of incorporation or residence, percentage of stock owned, tax ID number if applicable, and any other identifying information.

3. Related Party Transactions

- All reportable transactions related to the financial year should be itemized and the related parties involved specified. This includes any such foreign persons or entities who have engaged in significant establishment in business.

- Identify the names, addresses, and the nature of any related party or parties for documentation purposes to all transactions reported, regardless of the amount.

4. Monetary Transactions

- Disclose all movements of funds with foreign-related persons or entities such as sales, purchasing, renting, royalty receipts, interest, and any other source of income. Proper bookkeeping prevents ambiguity about international transactions.

5. Non-Monetary Transactions

- Disclose instances with regards to non-monetary transactions or the monetary amount on transactions made is not equivalent to the actual worth of goods or services. Elements hired out and then given back without charge will also be covered.

6. Additional Information

- Provide answers to questions on cost sharing and distribution of intangible assets. These sections are very important and require quite a lot of attention as they relate to financial and legal aspects that can be complicated.

Filing Timeline

The important aspect while filing Form 5472 is to look for the appropriate time to file:

Standard Deadlines:

- In the case of calendar year corporations (Forms 1120): March 15

- In the case of fiscal year filers: The 15th day of 3rd month following the year-end of the taxpayer

- Income tax returns by individuals mandatory form i.e. (Form 1040): 15th April

Extensions: There is a 6-month extension for filing for both the Corporation and individuals but it does not extend any payment deadlines for tax payments that are due. Strategizing these deadlines is not just effective but can also save a lot of time and money as it helps avoid some serious penalties.

Importance of Filing Form 5472

Completing and filing Form 5472 with accuracy and compliance is important for several reasons:

IRS Requirements: To monitor the cross-border transactions of all foreign-owned US corporations engaged in international operations to ensure that they follow US tax laws.

Consequences for Not Complying: $25,000 per form each year is the charge for the infringement of that very obligation and such revenue may be significant for businesses, especially in small ones.

Business Regulation: Good and correct filings enable businesses to carry out operations without fear of regulation or correct scrutiny from the government.

Increased Compliance: More compliance would mean that financial dealings and subsequent investments would be more comfortable enabling a more sustainable mode of growth.

Avoiding Flagging by Authorities: Wrong submissions or variations in client records lead to a higher risk of being audited which may result in more problems and possible litigation.

Tips for Timely Filing

To avoid additional costs:

- Prepare necessary documents well ahead of the deadline. It’s better to have every relevant document prepared to limit putting things off till the last minute.

- You may opt to e-file to save time and reduce errors. Digital submits are usually easier to deal with the IRS.

- Set date reminders to prevent forgetting important deadlines.

- Account for other possible issues regarding preparation okay. Documentation that was assumed to be on file some proxy beforehand to a named shareholder may no longer be the case.

Understanding Reportable Transactions

For this section reportable transaction refers to any transaction made by the reporting corporation either monetary or non-monetary with other related entities. These include the following:

- Transactions on the sale and purchase of goods especially on cross-border trading.

- Leases for buildings or facilities used for business purposes.

- Repayment of some loans or other forms of financing offered by some offshore company.

- Utilization of patents or technology which entails royalty payments.

- Service charges for management of related parties or management services offered by related parties.

To decide whether a transaction has to be reported, ask yourself if the transaction involved a related party whether foreign or domestic as suggested by IRS regulations on related party transactions. Knowing these limits very well increases the possibility of adherence and lowers risk.

Mastering Form 5472: Key Takeaways

As for Form 5472, it is necessary for foreign-owned U.S. corporations and foreign corporations doing business in the U.S. territory. Fines can run into millions for non-compliance within the stipulated time frame hence the need to appreciate time limits and keep good records cannot be overemphasized.

Remember to look at IRS resources frequently to follow any new rules related to Form 5472 instructions before filing a tax return. Book a free consultation today with Easyfiling to learn more about Form 5472 and how to file it without any issues or complications.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now