Do you think LLCs will have tax obligations? A question most entrepreneurs and small business owners tend to ask themselves is the amount of taxes they might be required to pay after establishing their Limited Liability Company (LLC). It is critical to remember that, unlike corporations, LLCs do not have a certain tax rate. Instead, a few important circumstances determine the total of their tax obligation.

Therefore, let’s investigate LLC taxation in detail and explain the tax brackets, self-employment taxes as well as tax implications of pass-through entities.

Understanding LLC Tax Rate Classification

An LLC is a rather unusual type of business as it combines the limited responsibility of a shareholder in a corporation with the tax reliefs and management autonomy characteristic of a partnership. Typically, pass-through taxation applies to LLCs which allows owners to avoid paying federal income taxes at the level of the company as the company does not pay taxes on the profits and losses “pass-through” to the owners’ income tax returns.

LLCs (Limited Liability Companies) provide the flexibility to determine how to be treated for taxation purposes. The taxation of an LLC depends on the number of members (owners) and the tax classification selected.

That said, there are a few options to consider:

1. Single-Member LLC (Disregarded Entity)

Taxation Method: Based on this method, the organizer of the LLC will file the business loss and revenue of the LLC in the business section of their tax return (Form 1040 schedule C).

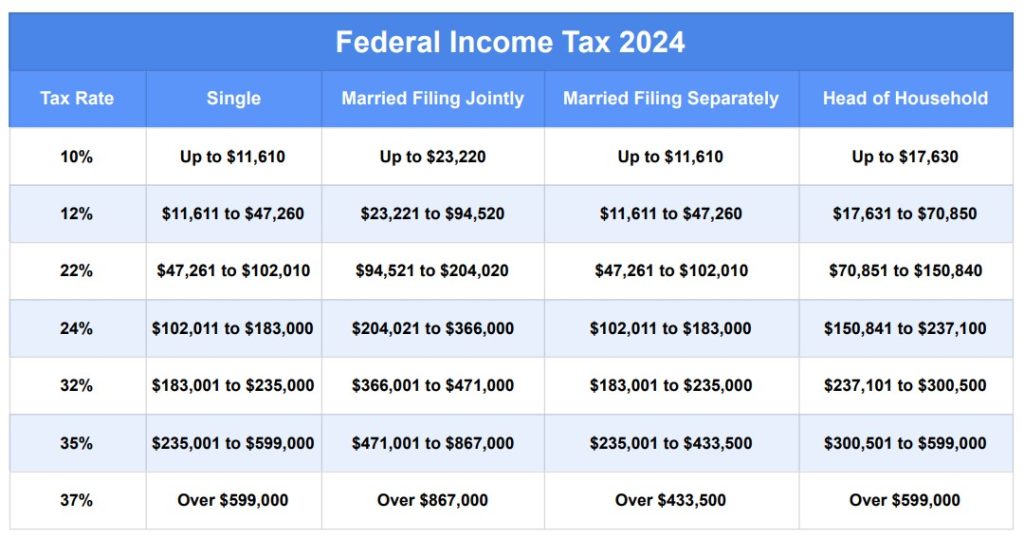

Tax Rate: The owner is considered an individual taxpayer and is taxed according to federal income tax rates for the year 2024 which are:

- 10% rate apply to an amount of $11,610 and below

- 12% rate apply to an amount between $11,611 and $47,260

- 22% rate apply to an amount between $47,261 and $102,010

- 24% rate apply to an amount between $102,011 and $183,000

- 32% rate apply to an amount between $183,001 and $235,000

- 35% rate apply to an amount between $235,001 and $599,000

- 37% rate apply for an income above $599,000.

Self-Employment Tax: The proprietor also, besides income taxation, pays self-employment taxes (Social Security and Medicare) on net income equal to 15.3% for Social Security and only on net income up to $160,200 for the year of 2024, and 2.9% for Medicare on all net income.

2. Multi-Member LLC (Partnership)

Taxation Method: On the personal tax return along with individual taxpayers there is a Schedule K-1 prepared allocating shares of profit to every member of the LLC according to percentage holding.

Tax Rate: A single member of an LLC is also taxed on income earned at the individual federal marginal rate tax above

Self-Employment Tax: Each member is allocated a percentage of self-employment tax equal to 15.3% of the first $160,200 net earnings, 2.9% Medicare tax is on any net earnings.

3. LLC Taxed as an S Corporation

Taxation Method: In simpler terms, because the LLC has elected S Corporation tax status, it also features “pass-through” taxation.

Salary Component: For working owners of the LLC who wish to receive salaries, there is a cap on how much they can earn which is taxed through the payroll.

- Tax of Employees: Employers and employees each pay a combined FICA of 7.65% (Social Security on income up to $160,200 and Medicare on all incomes earned).

- Self-employment taxes are not levied on any excess earnings, other than that which is taken out as salary.

Tax on Profits: The taxes on the residual dividends that are allotted On shares to the shareholders are on off-tax rates; i.e., self-employment taxes don’t apply.

4. LLC Taxed as a C Corporation

Taxation Method: Limited Liability Company declared taxes at the federal level as a corporate payment system and tax on dividends earned by shareholders.

Income Tax Rate: Corporate and personal income tax. Tax relates directly to the c477.060 for the year’s February tax forms to tax proportionate to net earnings of the LLC corporation and taxes passed.

Tax Treatment: Distributions are cumulative, preventing taxation at a corporate entity level, whilst taxation on dividends occurs individually.

- Long-Term Capital Gains Rates (LTCG): lastly, these are defined as ordinary taxation of dividends received or assets followed for more than 60 days: LT background 0%, 15%, or 20% relatively versus income levels.

- Source of investment’s net tax due To hover close to this, certain earning brackets of up to 3.8% net investment target tax income doubly taxation applies.

Additional Considerations:

State Taxes: Many states typically impose taxes on LLCs in the form of corporate income tax, corporation franchise tax, or other statutory assessments that may be quite different from the normal business tax.

QBI Deduction: LLC members qualify for a beneficial taxation incorporation into the legal framework of the members known as a payment in practice called the QBI deduction whereby qualified business income is reduced by up to 20% depending on specified caps and limitations.

Here is a table showing the 2024 federal income tax brackets for different filing statuses: Single, Married Filing Jointly, Married Filing Separately, and Head of Household.

LLC Tax Rates for 2024 in every state

The LLC tax rates for 2024 vary by state, with some states imposing specific fees or taxes on LLCs. Below is a summary of the LLC tax rates and notable requirements across all U.S. states:

| State | LLC Tax Rate/Fees |

| Alabama | $100 annual business privilege tax |

| Alaska | No state income tax |

| Arizona | 4.9% on income |

| Arkansas | 4.8% (top marginal rate) |

| California | $800 minimum franchise tax; gross receipts tax varies |

| Colorado | 4.55% on income |

| Connecticut | 7.5% on income |

| Delaware | No state income tax; annual franchise tax $300 |

| Florida | 5.5% on income |

| Georgia | 5.75% on income |

| Hawaii | 4% on first $25,000, 6.4% thereafter |

| Idaho | 6.5% on income |

| Illinois | 9.5% (includes local taxes) |

| Indiana | 5.25% on income |

| Iowa | 7.1% (top marginal rate) |

| Kansas | 4% on income |

| Kentucky | 5% on income |

| Louisiana | 3.99% on income |

| Maine | 8.93% on income |

| Maryland | 8.25% on income |

| Massachusetts | 8.0% on income |

| Michigan | 6.0% on gross receipts |

| Minnesota | 9.8% on income |

| Mississippi | $250 annual fee; 3% on gross revenue |

| Missouri | $0 to $100 based on revenue |

| Montana | No state sales tax; flat fee of $20 |

| Nebraska | $10 to $20 based on revenue |

| Nevada | No state income tax; annual business license fee varies |

| New Hampshire | No state income tax; annual fee of $100 |

| New Jersey | 9% (top marginal rate) |

| New Mexico | 5.9% on income |

| New York | Varies; generally around 6.5%-8.82% |

| North Carolina | 2.5% on income |

| North Dakota | Varies; generally around 1.41%-4.31% |

| Ohio | Varies by a municipality; generally around 3% |

| Oklahoma | Varies; generally around 6% |

| Oregon | Varies; generally around 6.6%-7.6% |

| Pennsylvania | 8.49% (corporate net income tax) |

| Rhode Island | 7.0% on net income |

| South Carolina | 5.0% on net income |

| South Dakota | No state corporate income tax |

| Tennessee | $300 annual franchise tax |

| Texas | No state corporate income tax |

| Utah | 4.65% (corporate tax) |

| Vermont | Varies from 6%-8.5%, depending on revenue |

| Virginia | Varies; generally around 6% |

| Washington | No state corporate income tax |

| West Virginia | Varies by revenue; generally around 6.5%-7.0% |

| Wisconsin | Varies; generally around 7.9%-11% |

Key Considerations

- Franchise Taxes: Many states impose a minimum franchise tax or annual fee regardless of profit, such as California’s $800 fee.

- Gross Receipts Tax: Some states, like California and Delaware, may impose taxes based on gross receipts rather than net profit.

- No State Income Tax: States like Nevada, Wyoming, and South Dakota do not have a state corporate income tax, which can be advantageous for LLCs.

- Self-Employment Tax: LLC members are typically subject to self-employment taxes unless they elect to be taxed as a corporation.

Conclusion

The likelihood of your LLC being taxed on its income explains why paying attention to tax-related issues is very important to any business owner. The reasonable level of taxation for every LLC is influenced by the number of members and the tax classification that the individual member chooses.

Tax classification, number of members and business activities undertaken by LLC, and state and local tax laws could all affect how much tax your LLC will pay. With the aid of a tax professional (Easyfiling), LLC members can assess their options and ensure the legal aspects of such efforts are adequately addressed.

Frequently Asked Questions (FAQs)

What factors influence the tax amount payable by my LLC?

Tax classification, number of members, business activities, and requirements of the Country or Local tax laws.

If my LLC is a sole proprietorship, how am I taxed?

The LLC’s profit and loss account is not filled in other income-generating vehicles, but it is included on Schedule 416 of your tax return. Thus you will pay self-employment taxes based on the net earnings.

If my LLC is a partnership, how am I taxed?

The partnership allows the sharing of profits and losses for income tax purposes as well, where all income-less expenses are divided among all of the partners and reported on all of their returns. Self-employment is also generally afforded to partners.

What benefits are there of being an S corporation tax classification?

- Profits and losses get reported on individual returns therefore double taxation technique is avoided.

- The earnings received by the shareholders from the businesses they incorporate cannot be taxed for the self-employment taxes.

Can LLCs deduct business expenses?

Yes: LLCs can deduct qualified business expenses from their income, which can reduce their overall tax liability. Examples of deductible expenses include rent, utilities, salaries, and supplies.

How can I reduce my LLC’s tax liability?

- Contribute to retirement accounts: Contributions to retirement accounts like a SEP IRA or Solo 401(k) can reduce taxable income.

- Claim deductions: Maximize deductions for business expenses.

- Consider entity elections: Explore options like S corporation status or disregarded entity status to potentially reduce tax burdens.

- Consult with a tax professional: A tax professional can provide personalized advice on tax strategies.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now