Although forming a Limited Liability Company (LLC) in Colorado is very simple and important, there are a lot of benefits that come with it. These benefits include protection from debts, protecting one’s resources and properties from debts and lawsuits about the business, as well as different management features that allow the operational frameworks to be customized.

Here’s a detailed step-by-step guide to help you navigate the process of establishing your LLC.

Why Register an LLC in Colorado?

The state receives attention because it has a favorable environment for business with a lower corporate tax rate and a competent labor force. You will enjoy many advantages of an LLC for your business such as:

Limited Liability: A limited liability company (LLC) protects your assets from business debts or liabilities because they are also members of the LLC.

Flexibility: A member, manager, or majority owner can all run the LLC, along with the member’s owner Manager

Tax Benefits: Limited liability companies can be regarded as sole proprietorships, partnerships, or corporations for taxation purposes to advantage the business entity on taxation.

Pass-Through Taxation: Mostly, LLCs are regarded as pass-through entities which indicates that all the income and losses are reported on the tax forms of the members. This might help reduce your tax expenses.

Steps to Register an LLC in Colorado

Step 1: Select a Business Name

The name of your LLC is crucial because it defines your identity as a brand and has to be unique among all other business names registered in Colorado. Also, state naming rules should be maintained while clarity and legality is ensured in such instances:

Representation Clause As a rule, the word L.L.C must be followed by one of the following: “Limited Liability Company,” “Ltd. Liability Company,” “Limited Liability Co.,” “Ltd. Liability Co.,” “Limited,” “L.L.C.,” “LLC,” “L.C.,” or “LC.” This requirement helps inform the public about the nature of your business structure.

Government Agencies Such as these cannot be used in the name of your LLC such as; FBI, Treasury, State Department, etc. This helps avoid any misrepresentation or confusion among consumers.

Check Availability: If you have a name in mind use the business name search feature provided by the Colorado Secretary of State to check if the name is available. This step is crucial to prevent you from encountering any legal impediments in the future.

Reservation of Your Name (optional): In case you would not like to file your LLC immediately, you are allowed to hold your selected name for a certain number of days (120) by submitting a Statement of Reservation of Name for a fee. This allows you to secure your business name while you conclude other activities about the creation of your LLC.

Step 2: Select a Resident Agent

Typically, every LLC has its registered agent which is the official contact address for the particular LLC regarding any legal services as well as receiving all legal notices. As for Colorado’s registered agent, it must:

- Be either a natural person residing in Colorado or a legal business entity registered to conduct business in Colorado. This ensures that someone reliable is available to accept important documents.

- On this space, the registered agent shall provide a real street address located geographically in the state of Colorado (post office box number is not acceptable). This requirement is in place to make sure that there is openness and reliability in communication.

Step 3: File Articles of Organization

The only choice you have if you wish to legalize the existence of your LLC is to file articles of organization with the Colorado Secretary of State. This is made very easy by allowing people to do this through the website of the Secretary of State. The form will require you to provide the following information:

- The name under which the LLC is registered

- The physical address of the principal office address

- Name and address of the registered agent

- The management structure of the LLC (whether the LLC in the future will be operated by the members or the managers).

- Specifying for how long the LLC shall exist if not forever (this one is important as it helps to define the lifespan of the business).

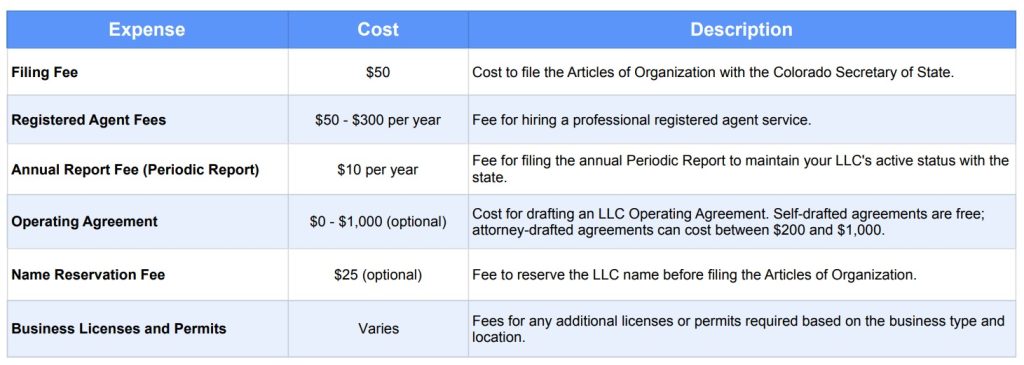

Filing Fee

A sum of $50 is to be paid as a filing fee for the Articles of Organization. This is rather on the low side when you consider the gains you are likely to get after forming an LLC.

Step 4: Create an Operating Agreement.

Beginning with an operating agreement is not a formal requirement of the law in the State of Colorado. However, there are advantages to coming up with one. This document clarifies the ownership structure and the management of activities within your LLC. Some of the crucial things to include would be:

- The functions performed by each of the members are referred to as member roles and responsibilities.

- The ability to vote and make decisions includes the fair voting system which ensures that all members are informed of the decision-making process.

- Profit and loss sharing, which factors in how the members will share among themselves any profits that may be generated.

- Meeting procedures and voting guidelines that provide a methodology for policymaking and communication.

- Membership rules and regulation procedures including rotation policies focus on dealing with ownership transitions.

Step 5 Complete Obtaining an EIN

An EIN is needed for tax purposes, for employing staff, and for setting up the business’s bank account. Additionally, applying for an EIN with the IRS via the Internet is without charge. It also expounds simplistically on tax requirements and compliance.

Step 6 Adhere to State and Federal Laws

With the nature of your organization, you might:

- Obtain appropriate business licenses and permits from the county and/or the state of Colorado. This step guarantees that the entity functions legally with the concern of local laws.

- Register for state taxes under the Colorado Department of Revenue. Once done, this is the right step towards working towards paying your taxes and being in good standing.

- Support your entrepreneurial activities by complying with relevant employment, health and safety, and other federal laws.

Step 7: Submit Periodic Reports

Depending on the state in which the LLC is registered, Colorado LLC has filed periodic reports to maintain its up-to-date business information. The report is filed every year and it can be done online from the website of the Colorado Secretary of State. The filing fee is ten dollars. Meeting this condition helps keep the good standing of your company LLC and therefore enjoy the limited liability benefits.

Costs to Register an LLC in Colorado

Conclusion

There are several details to this process of registering an LLC in Colorado, however, it is not an overly complicated one assuming you have the requisite support and materials. After I have filed it, I can take pleasure in the enjoyment that comes with limited liability, as well as the willful management of my business. Not only does this arrangement protect your assets in the event of a lawsuit, but it also makes your target of expanding the business very feasible.

Reach out for assistance or if you have any inquiries please consider arranging a meeting with Easyfiling who will provide information that is relevant to your circumstances.

That’s it! You have completed everything and you are now all set to commence the process of forming an LLC in Colorado. Should you find this guide useful, kindly pass it on to people who will also appreciate it. All the best with your new business!

Frequently Asked Questions (FAQs)

What are the tax requirements for LLCs in Colorado?

Generally, all members of an LLC are considered, for Federal law tax purposes, a pass-through tax entity by default. Thus, the profits or losses of the LLC are reported on the personal returns of the members. However, these types of companies can opt for the taxation of a corporation by completing and submitting the required documents to the IRS.

Can I file an LLC in Colorado online?

Yes, you can easily register an LLC online through the website of the Colorado Secretary of State.

Is it possible to change my business structure to an LLC in Colorado?

Yes. You can change your current business structure into an LLC in Colorado. This procedure is referred to as conversion or domestication.

To convert your business entity to an LLC form, submit Articles of Conversion to the Colorado Secretary of State. The articles shall provide the name and kind of the business entity where you currently are and the proposed LLC type.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now