Owning and running a business fluently might be a big headache for some business owners, requiring filling out multiple forms every year. One of the most confusing and complicated forms, Form 5472, is equally essential to all businesses in filing and avoiding additional headaches of IRS penalties.

In this article, we’ll learn everything about Form 5472, who files the form, its importance, the documents to prepare, the process of filing, and more.

What is Form 5472?

IRS Form 5472 is a document that is mainly targeted to foreign entities or business owners who own a company in the United States.

Form 5472 also known as the Information Return of 25% Foreign-Owned U.S. Corporation reports transactions within the fiscal years including share sales, leases, assets sales, stock purchases, etc between the corporation and the foreign shareholders.

If a foreign shareholder has more than a 25% individual stake in the business, you’ll need to file multiple forms.

Who files form 5472?

Foreign entities or business owners with 25% or more ownership who own a business or trade in the United States are required to file the form.

Form 5472 shall be filled out separately by each of the foreign owners. Likewise, the situations when you would have to file form 5472 are:

- When a company is equally owned by three owners, two U.S. citizens and one foreign citizen.

- When a company is owned by a U.S. citizen but a foreign shareholder has over 25% of the stock share.

- When a company is a U.S. LLC owned by a foreign national and treated as a disregarded entity for U.S. tax purposes.

Documents to prepare for Form 5472

Before filing the form, you need to gather all essential documents and information such as:

- Identifying information about the reporting entity and related parties.

- Financial statements and records throughout the fiscal year including invoices, contracts, loan agreements, and ledger entries.

How to file form 5472? Instructions

Form 5472 as already told one of the most confusing and complicated IRS forms has three pages with nine different sections.

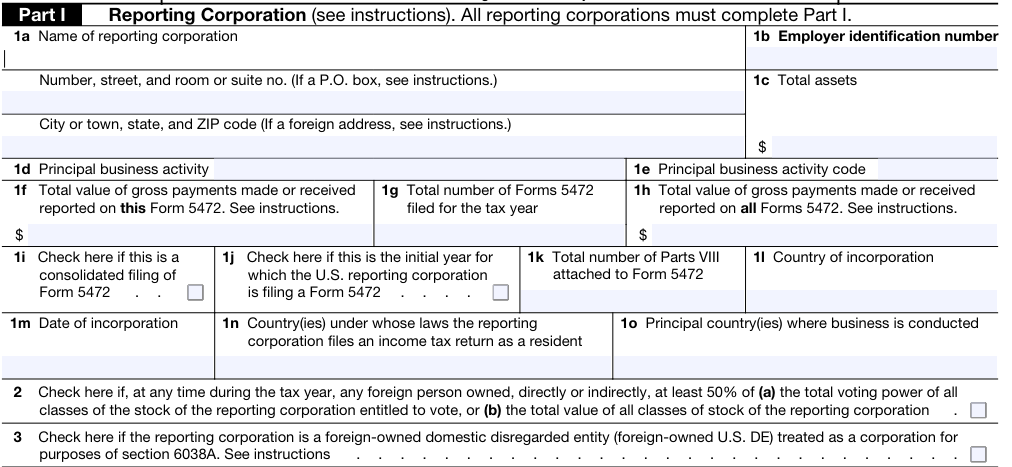

Part I: Reporting Corporation

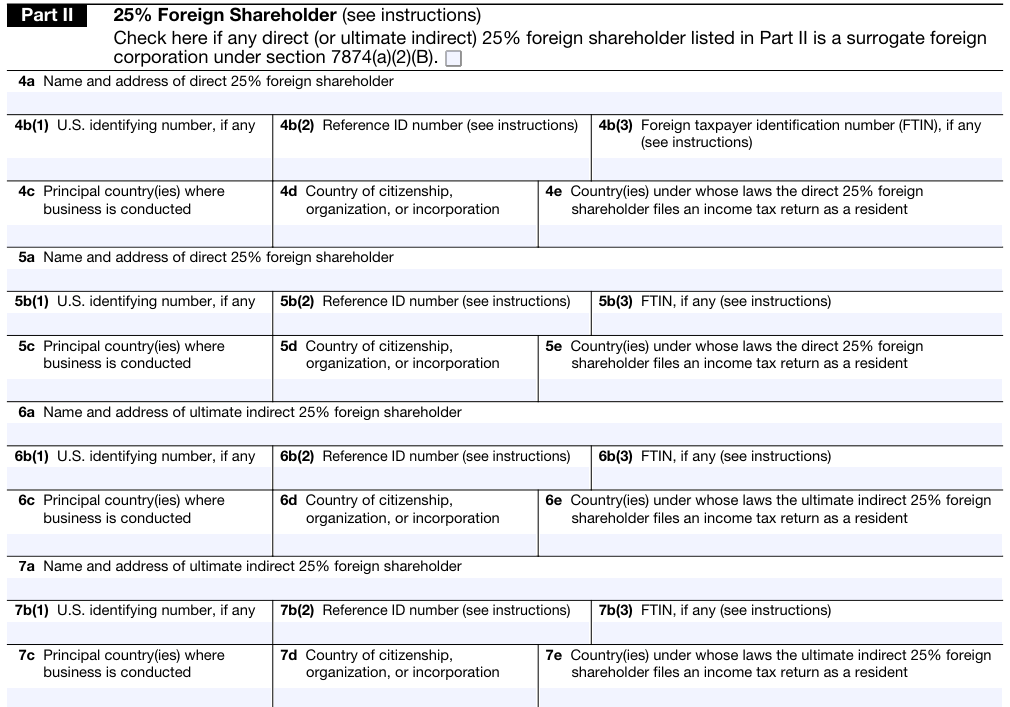

Part II: 25% Foreign Shareholder

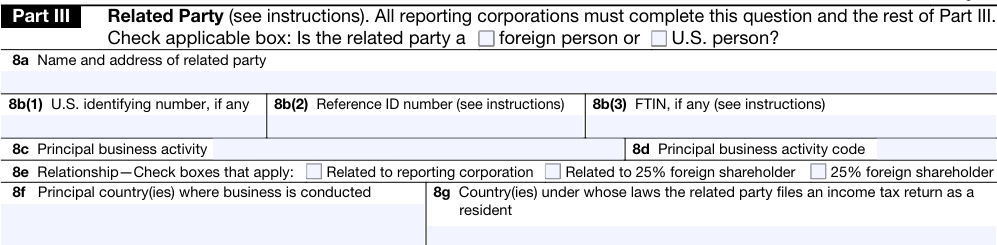

Part III: Related Party

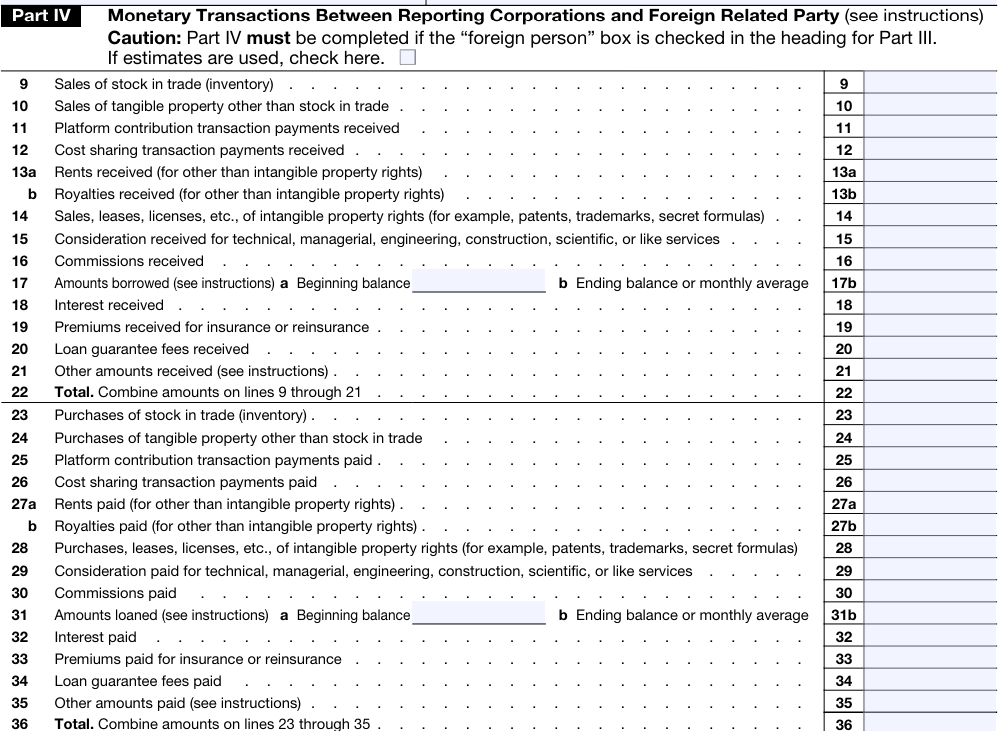

Part IV: Monetary Transactions Between Reporting Corporations and Foreign-Related Party

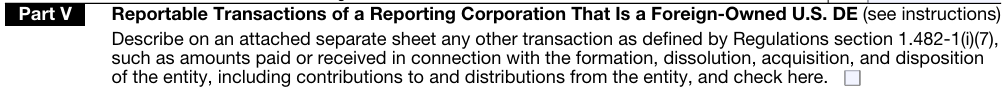

Part V: Reportable Transactions of a Reporting Corporation That Is a Foreign-Owned U.S. DE

Part VI: Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and the Foreign-Related Party

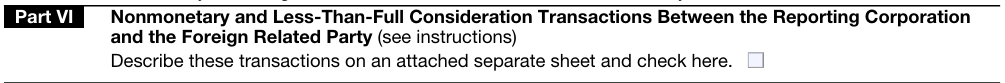

Part VII: Additional Information

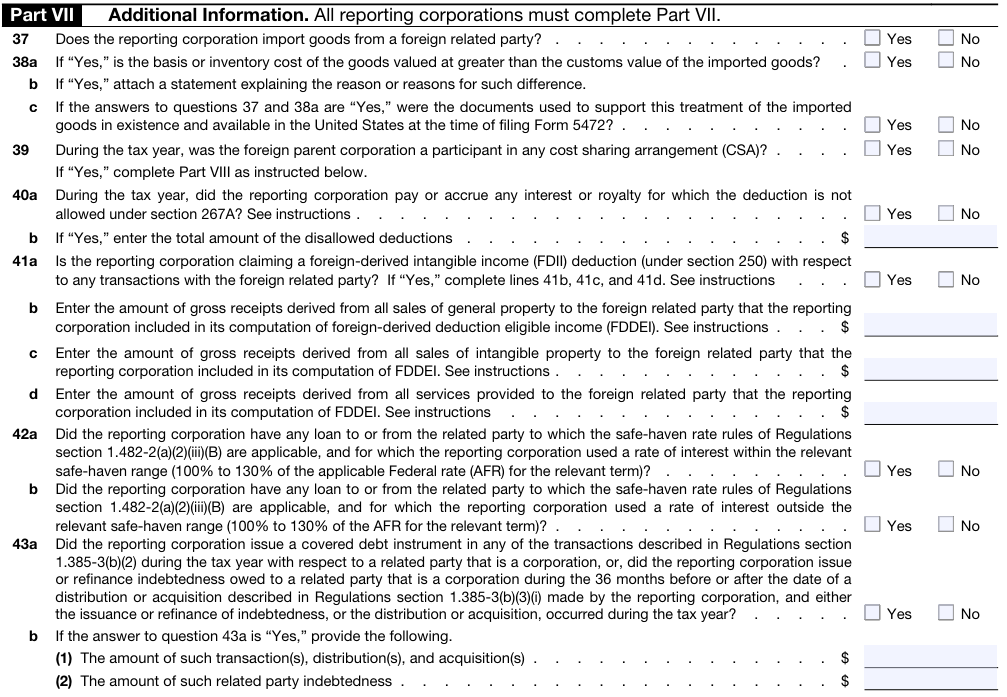

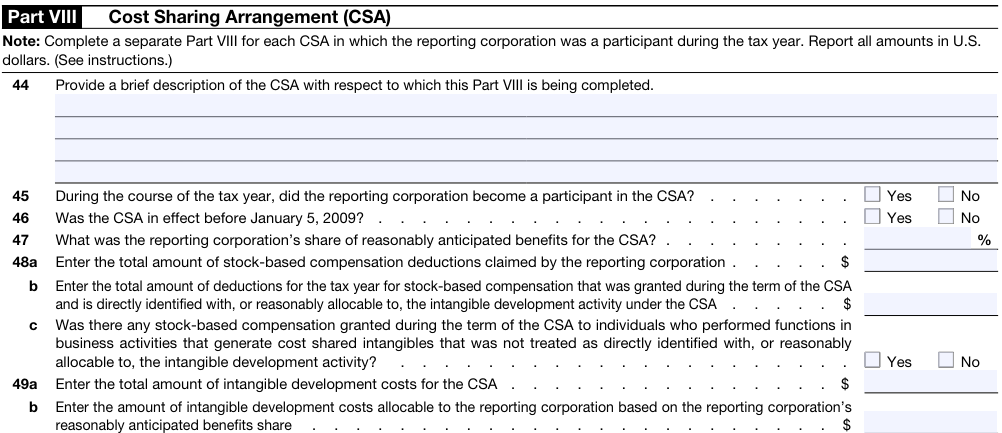

Part VIII: Cost Sharing Arrangements (CSA)

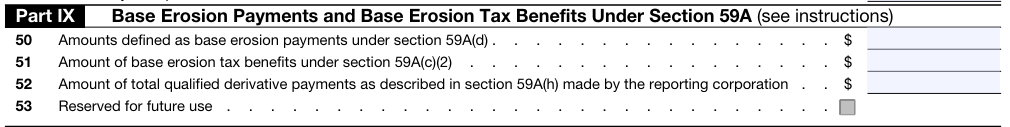

Part IX: Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A

Form 5472 filing deadlines

The deadline for filing Form 5472 is the same as the deadline for filing the corporate income tax return which is, April 15th of the calendar year. However, the deadline extension is available until October 15th of the same calendar year.

Penalties for late filing

If you do not file Form 5472 by the due date, you will be penalized by the Internal Revenue Service (IRS). Initially, you will be fined $25,000 for late filing or not including all the required information in the form.

Similarly, if not filled for a long period, an additional $25,000 is added as a penalty for each 30-day period after IRS notice.

Conclusion

Therefore, if you own a business in the United States and have 25% or more ownership then, Form 5472 is the one that would be in your mind which holds a huge importance in filing as if missing to file, you would be massively penalized. To prevent the penalty and file the form on time, you can always seek support with Easyfiling.

Frequently Asked Questions (FAQs)

Does the LLC need to file Form 5472?

If an LLC is classified as a disregarded entity and is wholly owned by a foreign individual, it is required to file Form 5472 to disclose transactions involving related parties.

What is the penalty for not filing Form 5472?

Before 2018, not filing Form 5472 could incur a $10,000 penalty. However, from 2018 onwards, the penalty was raised to $25,000 per failure to file.

Does foreign ownership of a corporation require Form 5472?

Any U.S. company with at least 25% foreign ownership must file Form 5472 for reportable transactions with a related party, foreign or domestic.

File Your LLC Today

25$ off with a coupon

Lock in EasyFiling's transparent rates and get lifetime compliance support at no extra cost.

Get Started Now